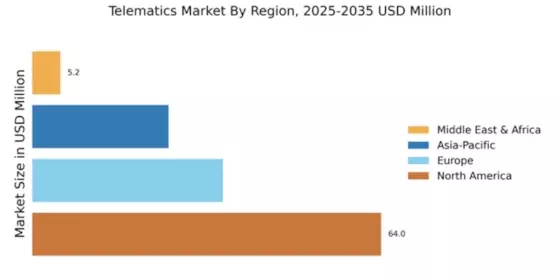

Market Growth Projections

The Global Telematics Market Industry is on a trajectory of remarkable growth, with projections indicating a rise from 129.2 USD Billion in 2024 to 681.8 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 16.33% from 2025 to 2035. Such figures suggest a robust demand for telematics solutions across various sectors, including automotive, logistics, and insurance. The increasing integration of telematics in everyday operations highlights its potential to transform industries by enhancing efficiency, safety, and connectivity. As the market evolves, stakeholders are likely to explore innovative applications and technologies to capitalize on this growth.

Advancements in IoT and Connectivity

The Global Telematics Market Industry is significantly influenced by advancements in Internet of Things (IoT) technologies and connectivity solutions. The proliferation of connected devices facilitates seamless data exchange between vehicles and infrastructure, enhancing the capabilities of telematics systems. For example, smart city initiatives leverage telematics to improve traffic management and reduce congestion. As connectivity becomes more robust, the market is poised for substantial growth, with projections indicating a rise to 681.8 USD Billion by 2035. This evolution suggests that the integration of IoT in telematics will not only enhance user experiences but also drive innovation across various sectors.

Growing Adoption of Electric Vehicles

The Global Telematics Market Industry is significantly impacted by the growing adoption of electric vehicles (EVs). As the automotive landscape shifts towards sustainability, telematics plays a crucial role in managing EV performance and optimizing charging infrastructure. For example, telematics systems can provide real-time data on battery health and charging patterns, enabling users to maximize efficiency. This trend aligns with the broader market growth, as the industry is projected to expand to 681.8 USD Billion by 2035. The integration of telematics in EVs not only enhances user experience but also supports the transition towards greener transportation solutions.

Rising Demand for Fleet Management Solutions

The Global Telematics Market Industry experiences a notable surge in demand for fleet management solutions. Companies increasingly seek to optimize their operations, reduce costs, and enhance safety through telematics technologies. For instance, the integration of GPS tracking and real-time data analytics allows fleet operators to monitor vehicle performance and driver behavior effectively. This trend is reflected in the projected market growth, with the industry expected to reach 129.2 USD Billion in 2024. As businesses recognize the value of telematics in improving efficiency, the adoption of these solutions is likely to accelerate, contributing significantly to the overall market expansion.

Increased Focus on Vehicle Safety and Compliance

The Global Telematics Market Industry is witnessing an increased emphasis on vehicle safety and regulatory compliance. Governments worldwide are implementing stringent regulations to ensure road safety, which drives the adoption of telematics solutions. For instance, telematics systems can monitor driver behavior, providing insights that help reduce accidents and improve compliance with safety standards. This focus on safety is likely to propel the market forward, as organizations invest in technologies that enhance their safety protocols. The anticipated compound annual growth rate of 16.33% from 2025 to 2035 underscores the importance of telematics in meeting these evolving safety requirements.

Emergence of Advanced Driver Assistance Systems (ADAS)

The Global Telematics Market Industry is increasingly shaped by the emergence of Advanced Driver Assistance Systems (ADAS). These systems utilize telematics to enhance vehicle safety and automate driving processes. Features such as lane-keeping assistance, adaptive cruise control, and collision avoidance rely heavily on real-time data provided by telematics solutions. As consumer demand for safer and more automated vehicles rises, the adoption of ADAS is expected to grow, driving the telematics market forward. This trend aligns with the projected market growth, as the industry is anticipated to reach 129.2 USD Billion in 2024, reflecting the critical role of telematics in advancing automotive technology.