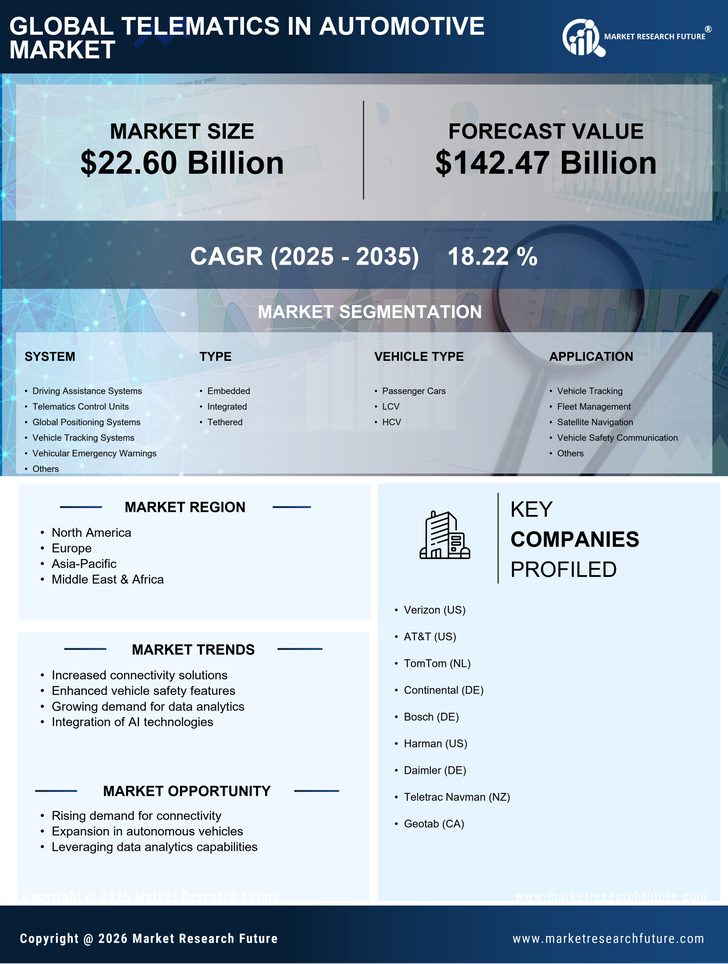

Leading market players are investing heavily in research and development to expand their product lines, which will help telematics in the Automotive market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including several product launches, contractual agreements, mergers and acquisitions, more investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Telematics in the Automotive industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Telematics in the Automotive industry to benefit clients and increase the market sector. in recent years, telematics in the Automotive industry has offered some of the most significant advantages to medicine. Major players in the Automotive Telematics Market include Trimble, inc. (U.S.), Masternaut Limited (France), TomTom international B.V.( Netherlands), Telogis (U.S.), and Visteon Corporation (U.S.).

Continental AG (Germany), Airbiquity, inc. (U.S.), AT&T inc. (U.S.), Delphi Automotive PLC (U.K.), Harman international industries, inc. (U.S.), Robert Bosch GmbH (Germany), Trimble inc. (U.S.), Verizon Communications, inc. (U.S.), and others, are attempting to increase market demand by investing in research and development operations.

Robert Bosch GmbH, also known as Bosch, founded in 1886, located in Gerlingen, Germany, is a German multinational engineering and technology company. It's core operating areas are in four business sectors: hardware & software, consumer goods, industrial technology, and energy & building technology.

in November Bosch introduced Ridecare solutions for fleet managers. Ridecare solutions are specially designed for a fleet of vehicles or ride-sharing services to reduce the skyrocketing maintenance cost due to damage or misuse of the vehicle. Bosch's Rideshare solutions utilize a single sensor box.

This highly sensitive box can detect minor scrapes such as fender scuffs or underbody dings. It can even tell if the occupant has smoked inside the vehicle during the rental period.

Trimble inc., founded in 1978, and located in Westminster, Colorado, US, is an American software, hardware, and services technology company. It supports various industries in building & construction, agriculture, natural resources, utilities, transportation, etc.

in December Trimble announced that it acquired Agile Assets, an asset management software provider to government and private organizations (including state-level transportation agencies and national road authorities in the U.S.). Agile Assets' asset management solutions will offer organizations advanced analytics for real-time decision-making and insights for maintenance operations and efficiency management.

In October 2025, Stellantis’ Mobilisights partnered with Zubie to improve fleet management using embedded telematics data. The collaboration enhances visibility, predictive maintenance, and operational efficiency for commercial fleets. It reflects increasing demand for data-driven fleet intelligence.

In July 2025, Teletrac Navman connected its TN360 telematics platform with leading vehicle manufacturers, expanding data-driven fleet management capabilities. The integration supports real-time tracking, diagnostics, and operational optimization for commercial fleets. It highlights increased industry reliance on IoT and telematics for vehicle operations.