- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

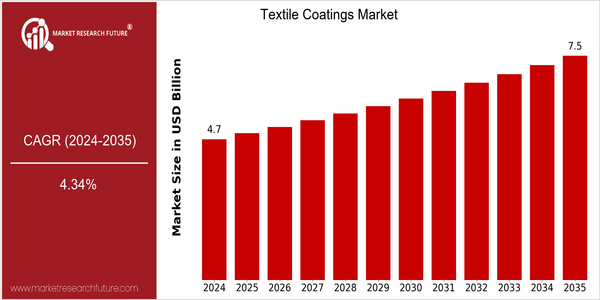

Textile Coatings Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 4.7 Billion |

| 2035 | USD 7.5 Billion |

| CAGR (2025-2035) | 4.34 % |

Note – Market size depicts the revenue generated over the financial year

The textile coatings market is undergoing a significant change and is expected to reach a market size of $ 4.3 billion in 2024, which is expected to reach $ 6.7 billion by 2035. This corresponds to a CAGR of 4.34 % from 2025 to 2035, which shows a steady demand for new textile solutions. This is due to several factors, such as the increasing demand for high-performance textiles in various applications such as the automobile, the industry and the consumer goods industry, and the development of coating technology to increase the lifespan and functionality of the coated textiles. Moreover, the technological development of new coatings and smart textiles that meet the needs of consumers and the industry are driving the market growth. The development is led by companies such as BASF, The Dow Chemical Company and Huntsman. Strategic initiatives, such as strategic collaborations and alliances, are also expected to further increase the development of the market and ensure the development of the market in the coming years.

Regional Deep Dive

The textile coatings market is growing rapidly across the globe, owing to the growing demand for technical textiles in the automobile, medical, and fashion industries. The North American market is characterized by a strong focus on innovation and sustainability. The companies in this region are focusing on developing eco-friendly coating solutions. Europe has a strong regulatory framework that promotes the use of advanced coatings. Asia-Pacific is emerging as a manufacturing hub, owing to the low cost of production and a large population base. The Middle East and Africa are witnessing an increasing demand for protective textiles, owing to the climatic conditions and industrial growth. The Latin American region is gradually adopting advanced textile coatings, owing to the increasing investments in the textile sector.

North America

- The American EPA is regulating the emissions of chemicals, which is pushing companies like DuPont and BASF to develop water-based and low-VOC textile coatings.

- Nanotechnology has recently developed to the point where smart fabrics are possible. NanoTech Coatings is a good example of a company that has been working to put these properties into everyday clothes.

- A growing trend towards sustainable development has led to the emergence of closer relations between the textile industry and the chemical industry. The Sustainable Apparel Coalition, a network of more than a hundred companies, has been a driving force behind the drive to adopt sustainable practices.

Europe

- The REACH regulations have had a strong influence on the textile coatings market, forcing manufacturers to meet stricter chemical safety standards and encouraging the development of safer alternatives.

- Germany is in the forefront in the use of digital printing technology in the textile industry. Firms such as Kornit Digital are changing the way the textile coating is applied, making it more individualized and reducing waste.

- Brands are investing in the development of new materials for the recovery of the materials, and the Ellen MacArthur Foundation is promoting the development of biodegradable textile coatings.

Asia-Pacific

- China's Belt and Road initiative is increasing investment in textile production, thus increasing production capacity and demand for high-tech textile coatings.

- Indian textiles are slowly moving towards sustainable practices. One such company is Arvind, which is focusing on eco-friendly coatings to meet the growing demand for sustainable fashion.

- Southeast Asia's rapid urbanization is driving the demand for functional textiles for various applications, such as for automobiles and construction, and thereby promoting the development of textile coating technology.

MEA

- The UAE's Vision 2021 initiative has sparked innovation in all sectors, including textiles. This has led to a rise in investment in advanced textile coatings for protective and functional applications.

- The harsh climatic conditions in the region are driving the market for textiles with a water-repellent and UV-resistant finish. Local companies, such as Al Khaleej Textiles, are responding to this demand by developing these specialized products.

- And so, thanks to government programs to diversify the economy, the textile industry has grown, especially in the manufacture of coated fabrics.

Latin America

- Brazil’s textile industry is undergoing a process of modernization, with government support for the technological development of the textile surface-finishing industry, thus increasing its competitiveness on the world market.

- Latin America is a land of sport and outdoor clothes, and the growing popularity of these has made the demand for durable and water-repellent textile coatings grow. Adapting to this demand, companies like Santista Textil have altered their product ranges.

- Region-wide commercial relations encourage the exchange of new textile technology and lead to a gradual change in the orientation of the local manufacturers toward the more modern coatings.

Did You Know?

“This is the time for the textile coatings market to grow, with the new smart textiles and the new eco-friendly coatings taking the lead.” — Market Research Future

Segmental Market Size

The textile coatings market is experiencing stable growth, driven by the rising demand for performance textiles across various industries. The key factors driving the market are the growing consumer preference for durable and water-repellent fabrics, as well as the stricter regulations on eco-friendly materials. Also, the advancements in coatings technology are enhancing the product performance, further driving the market.

The development of textile coatings has now reached a mature stage. Companies like BASF and Dow lead the field in their inventive applications. North America and Europe are the leading regions in the field of application in the automobile, aircraft and outdoor industries. Among the most important applications are protective clothing for workers and water-repellent fabrics for outdoor sportswear. The global trend towards a reduction in weight in the production of products is pushing the market forward. Nanotechnology and digital printing are determining the further development of textile coatings. They make it possible to produce more efficient production processes and to improve the properties of the products.

Future Outlook

The textile coatings market is expected to grow significantly from 2024 to 2035. The value of the market is expected to increase from $ 4.7 billion to $ 7.5 billion, at a compound annual growth rate (CAGR) of 4.34%. This growth is mainly due to the growing demand for advanced textiles in various industries such as the automobile, medical, and outdoor industries. The demand for durable, water-repellent, and stain-repellent textiles is increasing, which will lead to a greater use of advanced coatings. The share of coated textiles in the automobile industry is expected to be about 30% in 2035. This is mainly due to the increasingly strict regulations on vehicle emissions and the need for lightweight materials to improve fuel efficiency.

The textile coatings market is characterized by the development of new products and new processes, primarily aimed at the development of eco-friendly and sustainable coating materials. A greater emphasis on the environment and the desire to reduce the impact on the environment are driving manufacturers to develop and use greener alternatives. Furthermore, the combination of smart textiles with coatings that offer features such as temperature control and moisture transport is expected to gain in importance, especially in the sports and activewear segments. These developments will not only result in a broader and more diversified market, but also in a more diversified product range that will meet a broader range of customer needs and preferences.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 6681.42 Million |

| Growth Rate | 4.93 % (2024-2032) |

Textile Coatings Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.