Market Trends

Key Emerging Trends in the Thermal Spray Coatings Market

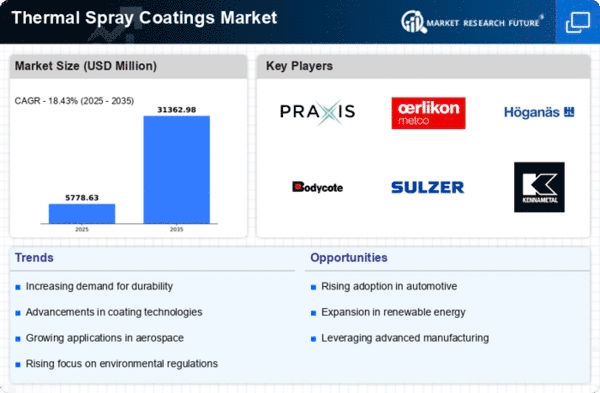

The thermal spray coatings market has been marked by certain trends over the years, which reflect the increasing demand for high-performance surface protection solutions across various industries. One of the major driving factors for this market is an emphasis on improving the durability and performance of industrial parts. Another factor shaping market trends is the extensive use of thermal-spray coating materials in the aerospace and automotive industries. These sectors require high-quality protective materials that can be used to protect crucial pieces from harsh environments as well as functional loads. Thermal spray coating technology can offer adaptable solutions for using polymers, metals, or ceramics, among others, so as to achieve desired protective properties. In the last few years, environmental concerns have significantly affected how the thermal spray coatings markets respond to demand changes in this sector, too. A need exists for environmentally friendly coatings that have minimal effects on natural resources because emphasis is being put on sustainable practices now more than ever before. Most importantly, however, sustainability goals seem compatible with thermal spray technologies owing to their efficacy regarding material utilization efficiency coupled with low waste stream generation relative to traditional coating techniques utilized elsewhere. Thermal spray coating system's role does not end here; it provides protection layers against harsh conditions experienced within power generation units used across oil fields or gas fields, including renewable energy sources. Apart from these sectoral patterns witnessed over time, the thermal spray coatings market has also been shaped by advances in coating technologies and materials. Ongoing research and development activities are aimed at improving coating properties such as adhesion, hardness, and thermal resistance for different industries. Market trends in this industry have seen a move towards protective solutions that offer high levels of protection but are environmentally friendly and highly efficient at the same time. As industries continue to look for reliable yet cost-effective ways to enhance the performance and durability of their assets, the future direction of surface protection systems is expected to be heavily influenced by thermal spray coatings. Consequently, driven by technological advancements in addition to growing environmental consciousness, increased growth rate plus innovative changes will be observed within the thermal spray coatings market throughout the next few years.

Leave a Comment