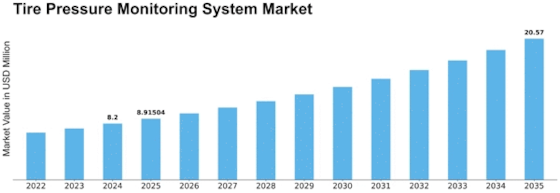

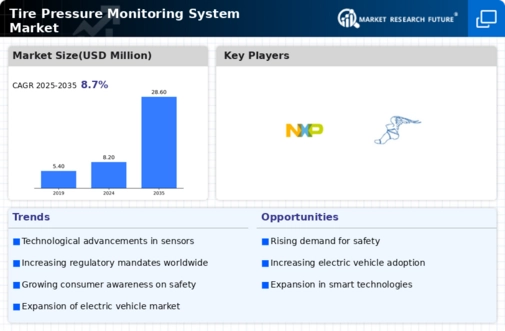

Tire Pressure Monitoring System Size

Tire Pressure Monitoring System Market Growth Projections and Opportunities

Several market factors contribute to the dynamics of the Tire Pressure Monitoring System (TPMS) market, influencing its growth and development. Governments throughout the world are implementing and strengthening rules concerning proper installation of TPMS in vehicles so as to improve road safety by preventing accidents resulting from improper tire pressure. This regulatory environment is one of the main drivers for implementing TPMS across different vehicle segments which stimulates growth in this market.

TPMS market is influenced by consumer awareness and education. Consumers have realized the long-term impacts of TPMS in preventing tire related accidents, better fuel economy and increasing tires lifespan. As a result of this increased awareness, it converts to a pull power since consumer actively search for vehicles that are loaded with high quality TPMS solutions.

Essential market factors that impact TPMS adoption include technological breakthroughs in the auto industry. As the vehicles are becoming more technically advanced, TPMS is developing in order to fit easily into other sophisticated systems. This can include support for the wireless communication technologies like Bluetooth and RFID so that it becomes possible to communicate in real time between TPMS sensors at different locations of the vehicle central system. The intersection of TPMS with the latest automotive technologies is also driving its development, as it coincides with other technological tendencies in the industry.

TPMS aftermarket segment represents both a cause and an effect of the dynamics in the market. The increased demand for TPMS in the aftermarket can be attributed to multiple factors, such as regulatory changes, growing consumer awareness and retrofitting older vehicles with improved safety specifications. As a result, we see an increase in aftermarket since many car owners want to equip their vehicles with TPMS solutions. At the same time, growth of aftermarket helps to stimulate overall development in TPMS market by creating possibilities for suppliers that can provide retrofit solutions as TPMS kits and parts.

The TPMS market is affected by cost considerations especially in regions that have cost conscious consumers. The adoption rates of the TPMS solutions are directly proportional to their affordability. Cost-effectiveness focus is necessary when pursuing market penetration, especially in emerging markets with price sensitivity being a key factor of consumer decisions.

The TPMS market is influenced some of the external factors, such as global economic conditions and trends in the automotive industry. Automobile manufacturers reduce their vehicle production during economic downturns and reduces the demand for TPMS systems. Conversely, during economic upswings and increased vehicle sales, the market witnesses heightened demand. As the automotive industry responds to economic fluctuations, the TPMS market experiences corresponding shifts, making it susceptible to broader economic trends.

Leave a Comment