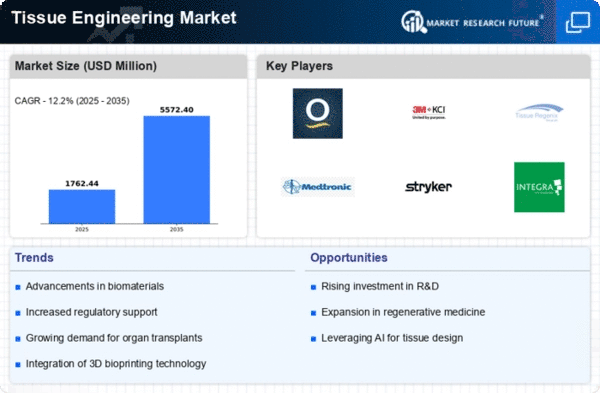

Market Growth Projections

The Global Tissue Engineering Market Industry is projected to experience substantial growth in the coming years. With a market size expected to reach 22.1 USD Billion in 2025 and an anticipated increase to 84.2 USD Billion by 2035, the industry is on a robust upward trajectory. This growth is underpinned by a compound annual growth rate of 14.3% from 2026 to 2035, reflecting the increasing integration of tissue engineering solutions in various medical applications. The expansion of this market is indicative of the broader trends in healthcare, where innovative technologies are becoming integral to patient care.

Regulatory Support and Frameworks

Regulatory support plays a vital role in shaping the Global Tissue Engineering Market Industry. Governments are establishing frameworks that facilitate the approval and commercialization of tissue-engineered products. This regulatory environment not only ensures safety and efficacy but also encourages innovation by providing clear pathways for product development. As regulatory bodies become more familiar with tissue engineering technologies, the approval process is likely to become more streamlined, fostering a conducive atmosphere for market growth. This supportive landscape is essential for attracting investments and encouraging collaboration among stakeholders.

Rising Demand for Regenerative Medicine

The Global Tissue Engineering Market Industry is experiencing a notable increase in demand for regenerative medicine, driven by the aging population and the prevalence of chronic diseases. As individuals seek innovative solutions for tissue repair and regeneration, the market is projected to reach 22.1 USD Billion in 2025. This growth is indicative of a broader trend towards personalized medicine, where tissue engineering plays a pivotal role in developing tailored therapies. The integration of advanced biomaterials and stem cell technologies further enhances the potential of regenerative medicine, suggesting a transformative shift in healthcare paradigms.

Technological Advancements in Biomaterials

Technological innovations in biomaterials are propelling the Global Tissue Engineering Market Industry forward. The development of novel scaffolds and bioactive materials enhances the efficacy of tissue regeneration processes. For instance, 3D printing technologies are increasingly utilized to create complex tissue structures that mimic natural tissues. This advancement not only improves the functionality of engineered tissues but also reduces the time required for development. As a result, the market is expected to witness a compound annual growth rate of 14.3% from 2026 to 2035, reflecting the growing confidence in these technologies to address diverse medical challenges.

Increased Investment in Research and Development

Investment in research and development is a critical driver of growth within the Global Tissue Engineering Market Industry. Governments and private entities are allocating substantial resources to advance tissue engineering technologies. This influx of funding facilitates the exploration of new applications, such as organ-on-a-chip models and bioprinting. The anticipated growth trajectory, with projections indicating a market size of 34.5 USD Billion by 2035, underscores the importance of sustained investment in R&D. Such financial commitments are likely to foster innovation, leading to breakthroughs that could redefine treatment methodologies across various medical fields.

Growing Awareness and Acceptance of Tissue Engineering

The Global Tissue Engineering Market Industry is benefiting from increasing awareness and acceptance of tissue engineering solutions among healthcare professionals and patients. Educational initiatives and successful case studies are contributing to a more informed public, which in turn drives demand for advanced therapies. As patients become more proactive in seeking out innovative treatments, the market is poised for expansion. This shift in perception is crucial, as it encourages healthcare providers to integrate tissue engineering techniques into standard practice, thereby enhancing patient outcomes and satisfaction.