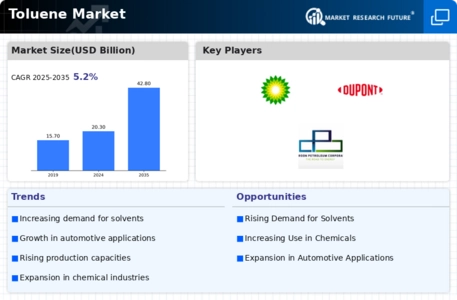

Top Industry Leaders in the Toluene Market

Toluene, the ubiquitous aromatic solvent, dances between the allure of lucrative applications and the shadow of stringent regulations. fuels diverse industries, yet faces a complex competitive landscape marked by strategic players, technological advancements, and environmental concerns. Let's delve into the waltz of opportunity and challenge that defines the toluene market.

Toluene, the ubiquitous aromatic solvent, dances between the allure of lucrative applications and the shadow of stringent regulations. fuels diverse industries, yet faces a complex competitive landscape marked by strategic players, technological advancements, and environmental concerns. Let's delve into the waltz of opportunity and challenge that defines the toluene market.

Market Share Strategies:

-

Product Diversification: Leading players like ExxonMobil and BASF are expanding their portfolios beyond traditional solvent-based applications, offering toluene derivatives like benzene and xylene for pharmaceuticals and plastics production. -

Technological Advancements: Pioneering new extraction processes and cleaner production technologies, like ExxonMobil's XTL™ process for converting natural gas into toluene, is key to differentiation. -

Sustainability Push: Developing eco-friendly alternatives like bio-based solvents and closed-loop recycling systems, exemplified by Solvay's Rhodivac® toluene recycling technology, is crucial for future success. -

Regional Expansion: Targeting high-growth regions like Asia-Pacific and Latin America, driven by booming construction and chemical industries, presents significant opportunities. China National Petroleum Corporation's strategic partnerships in Southeast Asia exemplify this trend.

Factors Influencing Market Share:

-

Fluctuating Crude Oil Prices: Toluene, derived from crude oil refining, witnesses price fluctuations linked to global oil markets, impacting profit margins and product pricing. -

Evolving Environmental Regulations: Stringent regulations in some regions, like Europe's REACH restrictions on toluene emissions, necessitate alternative formulations and compliance measures. -

Growing Awareness of Health Risks: Toluene's potential neurotoxic effects raise concerns, prompting stricter occupational safety standards and influencing consumer preferences towards eco-friendly options. -

Alternative Solvents: Development of safer and less volatile solvents like N-methylpyrrolidone can pose challenges for traditional toluene applications.

Key Players

- Exxon Mobil Corporation (US)

- Covestro AG (Germany)

- BP p.l.c. (UK)

- China Petroleum & Chemical Corporation (China)

- BASF SE (Germany)

- Royal Dutch Shell plc (The Netherlands) Formosa Chemicals & Fiber Corporation (Taiwan)

- Indian Oil Corporation Ltd (India)

- TOTAL S.A. (France)

- DuPont de Nemours, Inc (US)

- SK innovation co. Ltd (South Korea)

- CPC Corporation (Taiwan)

- GS Caltex Corporation (South Korea)

- and China National Petroleum Corporation (China)

Recent Developments :

-

September 2023: A consortium of chemical companies and research institutions collaborate on a project to develop sustainable production processes for toluene derivatives, aiming to reduce environmental impact. -

October 2023: LyondellBasell Industries invests in a new recycling facility in North America, aiming to capture and reprocess waste toluene from various industries, promoting circular economy within the market. -

November 2023: A team of scientists successfully synthesizes a novel bio-based solvent with properties similar to toluene, potentially offering a safer and more sustainable alternative for certain applications. -

December 2023: The United Nations Environment Programme calls for stricter global regulations on toluene use in paints and coatings, potentially impacting market dynamics in the long run.