- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Global Torpedo Market Overview

Torpedo Market Size was valued at USD 1.1 billion in 2022. The Torpedo market is projected to grow from USD 1.1704 Billion in 2024 to USD 1.6981 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period (2024 - 2032). Increasing their budgets for R&D initiatives and enhancing the nation's defense capabilities are the key market drivers enhancing market growth.

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

What is a torpedo?

A torpedo is an underwater missile with a self-contained engine that is guided to its target and is intended to target and sink enemy ships or submarines.

Torpedo Market Trends

- Increasing their budgets for R&D initiatives is driving the market growth

In naval combat, a torpedo is an ocean designed as a weaponized system that is used as a method of attack against adversaries. It is a mobile, autonomous underwater weapon that can launch from various platforms, such as missiles, submarines, boats, or airplanes. The propulsion, explosives, and guided systems comprise its three main components. The system is propelled by the torpedo propulsion system, and the guided system helps the torpedo get to its target. The torpedo explodes when it collides with the target once it reaches the intended location. As a result, the increase in maritime border disputes and maritime trade has influenced the growing use of naval vessels equipped with anti-submarine and advanced weaponry, which is expected to spur the growth of the torpedo market during the forecast period. By increasing their budgets for R&D initiatives, defense organizations are concentrating on creating cutting-edge weapon solutions for the naval industry.

For instance, to enhance the nation's defense capabilities, the Indian Defense Ministry increased the defense budget by 10% annually starting in 2021. The benefits are most significant for the Navy. The capital budget for the Indian Navy has increased by a startling 44.53 percent for FY 2022–23. According to the defense ministry, the funding increase will be applied to constructing a maritime force that is prepared for the future, establishing operations, and establishing strategic infrastructure. Similarly, in February 2021, the Navy's budget increased for the fiscal year 2022–2023 by 44 points 53 percent. According to the defense ministry, they would concentrate on developing new platforms, generating employment opportunities, building strategic infrastructure, filling critical skills gaps, and developing a dependable maritime capability for the future of an effective naval force. A similar situation occurred when the U. S. naval force was developed with USD 211.7 billion from the Department of Defense in 2021. Thus, driving the torpedo market revenue.

Torpedo Market Segment Insights

- Torpedo Operation Insights

Based on operation, the torpedo market segmentation includes autonomous and guided. The autonomous segment dominated the market; navies employ autonomous torpedoes for various operations, including mine-sweeping, anti-submarine warfare, and intelligence gathering. Submarines, surface ships, and aircraft are just a few of the many platforms from which they can be launched to enhance the torpedo market CAGR ly in recent years.

- Torpedo Launch Platform Insights

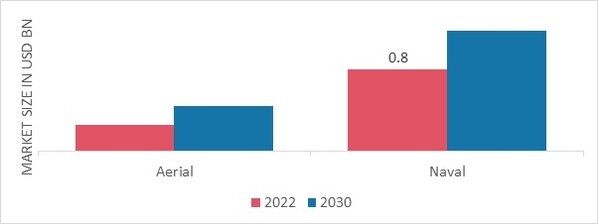

Based on the launch platform, the torpedo market segmentation includes aerial and naval. The naval segment held the majority share in 2022 concerning the Torpedo market revenue. The segment for surface-launched platforms includes torpedoes fired from surface vessels. Underwater-launched platforms include both surface vessel launched platforms and underwater-launched platforms. The surface-launched platform category dominated Torpedo's market share. The increased purchase of surface naval vessels is to blame for this large share. The naval surface ships have tubes for torpedo release into the ocean. Destroyers and cruisers can join an anti-submarine battle immediately by launching acoustic homing torpedoes from the Mark 32 ocean-propelled Triple Torpedo Tube (TTT) launcher. Torpedoes fired by the Mark 32 are launched into the water far from the sub-chaser using a pneumatic discharge device.

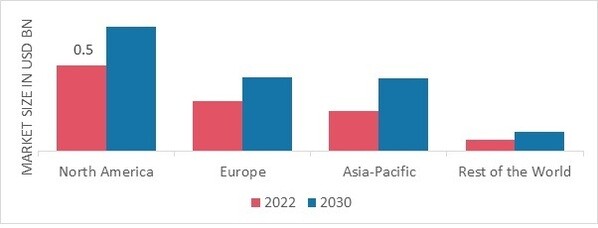

Figure 1: Torpedo Market by Launch Platform, 2022 & 2030 (USD billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

- Torpedo Propulsion Insights

Based on the propulsion, the torpedo market data includes thermal and electric power. The thermal powered category generated the most income propulsion systems powered by heat rather than electricity or pneumatics can move at higher speeds. Long-distance travel is possible for torpedoes using thermal propulsion systems without frequent refueling or recharging implants for torpedoes, positively impacting the market growth.

- Torpedo Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America Torpedo market will dominate this market. The U. S. Recently, the Navy has purchased several cutting-edge naval systems. The U.S. has increased investment and recent technological advancements. U.S. Market expansion in North America will be aided by government funding to purchase new vessels.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: TORPEDO MARKET SHARE BY REGION 2022 (%)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe’s Torpedo market accounts for the second-largest market share. More cutting-edge naval vessels are being delivered, and several important players are present, including BAE Systems PLC, Atlas Elektronik GmbH, Saab AB, Leonardo S.P. A., and Naval Group. Additionally, the growing conflict between Russia and Ukraine has accelerated the development of advanced weapon systems, which propels market expansion during the projection period. For instance, the Russian Navy has begun work on a long-range, nuclear-powered torpedo. This nuclear-armed torpedo is being tested; delivery is expected in 2027. The rest of the world is expected to experience a significant growth rate in the upcoming years. A rise in border disputes and anti-piracy operations in the Persian Gulf and other major sea lanes. Brazil also played a role in the creation of new submarines. Further, the German Torpedo market held the largest market share, and the UK Torpedo market was the fastest-growing market in the European region.

The Asia Pacific Torpedo Market is expected to grow at the fastest CAGR from 2023 to 2030. This growth can be attributed to the increased attention paid to enhancing India's and China's naval force capabilities. These nations' governments are purchasing torpedoes equipped with modern ships and submarines to enhance maritime security and operations in response to the escalating disputes and tensions among neighboring nations. The Indian Shipyards announced in February 2021 that they were discussing upcoming surface ship and submarine programs with the Naval Group. Moreover, the India Torpedo market held the largest market share, and the China Torpedo market was the fastest-growing market in the Asia Pacific region.

Torpedo Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Torpedo market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Torpedo industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Torpedo industry to benefit clients and increase the market sector. The Torpedo industry has recently offered some of the most significant medical advantages. Major players in the Torpedo market, including Atlas Elektronik GmbH (Germany), BAE Systems plc (UK), Bharat Dynamics Limited (India), China Shipbuilding Industry Corporation (China), Leonardo SpA (Italy), Naval Group (France), Raytheon Company (US), Saab AB (Sweden), Tactical Missiles Corporation JSC (Russia) and others, are attempting to increase market demand by investing in research and development operations.

BAE Systems plc (UK) British multinational defense, security, and aerospace company BAE Systems plc. It is among the biggest defense contractors in the world, with operations in the United Kingdom, the United States, and several other nations. Among the many goods and services that BAE Systems designs, develop, and produces are military aircraft, missiles, ships, submarines, and armored vehicles. In 1999, British Aerospace and Marconi Electronic Systems merged to form the business. It employs about 85,000 people worldwide and has its headquarters in Farnborough, Hampshire, in the UK. In addition to being a significant supplier to the US military, BAE Systems has a long history of providing defense equipment to the UK armed forces. The FTSE 100 Index includes BAE Systems, traded on the London Stock Exchange. The company works in cyber security, intelligence, surveillance, defense, and aerospace markets.

Bharat Dynamics Limited (India), A public sector enterprise (PSU) under the Ministry of Defence in India, is called Bharat Dynamics Limited (BDL). The business was founded in 1970 and primarily produced missiles and related defense gear. It is based in Hyderabad, India. BDL manufactures a variety of missiles, such as surface-to-air missiles, anti-tank guided missiles, and anti-tank mines. The company also produces countermeasure dispensing systems, torpedo launchers, and other defense hardware. BDL exports its goods to other nations and is a significant supplier of defense equipment to the Indian Armed Forces. BDL offers technical support, consulting in missile systems and related technologies, and its manufacturing capabilities. To stay on the cutting edge of defense technology, the company actively pursues research and development activities and has partnerships with several international defense companies and research institutions.

Key Companies in the Torpedo market include

- Atlas Elektronik GmbH (Germany)

- BAE Systems plc (UK)

- Bharat Dynamics Limited (India)

- China Shipbuilding Industry Corporation (China)

- Leonardo SpA (Italy)

- Naval Group (France)

- Raytheon Company (US)

- Saab AB (Sweden)

- Tactical Missiles Corporation JSC (Russia)

Torpedo Industry Developments

For Instance, July 2022 The ambitious technical modernization plan (TMP) 2021–35, unveiled in 2019, will be updated, according to the Polish Armed Forces (PAF). This plan includes about 2,000 modernization programs.

For Instance, September 2022 The Russian Poseidon Nuclear Torpedo is a nuclear weapon designed to annihilate sizable port cities that play an important role in commerce and industry. Poseidon is a huge torpedo on the ocean floor that might be impossible to stop. Additionally, it substitutes a nuclear payload for a conventional high-explosive warhead.

For Instance, January 2021 The Russian defense sector announced that it was developing a 14-meter-long robotic vessel for the Russian Navy to improve and boost its anti-submarine warfare (ASW) capabilities.

For Instance, October 2022 The Supersonic Missile Assisted Torpedo System (SMAT) was successfully launched from Abdul kalam island, according to India's Defense Research and Development Organization (DRDO). The operation successfully demonstrated the proposed distance's full range. The system is made to increase the capability of battling submarines that travel farther than usual.

Torpedo Market Segmentation

Torpedo Operation Outlook

- Autonomous

- Guided

Torpedo Launch Platform Outlook

- Aerial

- Naval

Torpedo Propulsion Outlook

- Thermal Powered

- Electric Powered

Torpedo Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.