-

EXECUTIVE SUMMARY 17

-

MARKET INTRODUCTION 20

-

DEFINITION 20

-

SCOPE OF THE STUDY 20

-

RESEARCH OBJECTIVE 20

-

MARKET STRUCTURE 21

-

RESEARCH METHODOLOGY 23

-

OVERVIEW 23

-

DATA FLOW 25

- DATA MINING PROCESS 25

-

PURCHASED DATABASE: 26

-

SECONDARY SOURCES: 27

- SECONDARY RESEARCH DATA FLOW: 28

-

PRIMARY RESEARCH: 29

- PRIMARY RESEARCH DATA FLOW: 30

-

APPROACHES FOR MARKET SIZE ESTIMATION: 31

- CONSUMPTION & NET TRADE APPROACH 31

-

DATA FORECASTING 31

- DATA FORECASTING TECHNIQUE 32

-

DATA MODELING 33

- MICROECONOMIC FACTOR ANALYSIS: 33

- DATA MODELLING: 34

-

TEAMS AND ANALYST CONTRIBUTION 35

-

MARKET DYNAMICS 38

-

INTRODUCTION 38

-

DRIVERS 39

- RISING DISPOSABLE INCOME 39

- INCREASING POPULARITY OF EDUCATIONAL TOYS 41

- GROWING INFLUENCE OF SOCIAL MEDIA AND ONLINE MARKETING 42

- EXPANSION OF E-COMMERCE PLATFORMS 43

- FOCUS ON CHILD DEVELOPMENT AND SAFETY STANDARDS 44

-

RESTRAINTS 46

- STRINGENT REGULATORY COMPLIANCE 46

- HIGH PRODUCTION COSTS 47

- INTENSE COMPETITION 47

- SHIFTING CONSUMER PREFERENCES 48

- ECONOMIC INSTABILITY 49

-

OPPORTUNITY 51

- EMERGING MARKETS GROWTH 51

- SUSTAINABLE AND ECO-FRIENDLY PRODUCTS 52

- PERSONALIZATION IN TOY DESIGN 53

- EXPANSION OF SUBSCRIPTION BOX SERVICES 54

- CROSS-INDUSTRY COLLABORATIONS 55

-

IMPACT ANALYSIS OF COVID - 19 56

- IMPACT ON OVERALL CONSUMER GOODS 56

- IMPACT ON GLOBAL TOYS MARKET 57

- IMPACT ON SUPPLY CHAIN OF TOYS MARKET 58

- IMPACT ON MARKET DEMAND OF TOYS MARKET 59

- IMPACT ON PRICING OF TOYS MARKET 60

-

MARKET FACTOR ANALYSIS 61

-

VALUE CHAIN ANALYSIS 61

-

SUPPLY CHAIN ANALYSIS 62

-

PORTER’S FIVE FORCES MODEL 64

- BARGAINING POWER OF SUPPLIERS 64

- BARGAINING POWER OF BUYERS 64

- THREAT OF NEW ENTRANTS 65

- THREAT OF SUBSTITUTES 65

- INTENSITY OF RIVALRY 65

-

REGULATORY UPDATE 65

- WHAT ARE THE KEY CHANGES TO BE INTRODUCED BY THE TOY REGULATION? 66

- SAFTEY STANDARD 66

-

MARKET TRENDS 67

-

CONSUMER BEHAVIOUR ANALYSIS 68

- STRATEGIC INSIGHTS 68

- PRICING ANALYSIS 69

-

Toys Market, BY PRODUCT TYPE 71

-

OVERVIEW 71

-

TRADITIONAL TOYS 76

- DOLLS ACTION FIGURES 76

- PLUSH TOYS STUFFED ANIMALS 76

- BOARD GAMES PUZZLES 77

- BUILDING SETS CONSTRUCTION TOYS (LEGO, MEGA BLOKS) 77

- ARTS CRAFTS TOYS 77

- ROLE-PLAYING DRESS-UP TOYS 77

-

EDUCATIONAL & STEM TOYS 77

- SCIENCE KITS 78

- MATH ENGINEERING SETS 78

- LANGUAGE COGNITIVE DEVELOPMENT TOYS 78

-

ELECTRONIC & SMART TOYS 78

- APP-CONNECTED TOYS 79

- INTERACTIVE AI-POWERED TOYS 79

- VIRTUAL REALITY (VR) AUGMENTED REALITY (AR) TOYS 79

-

OUTDOOR & SPORTS TOYS 79

- BICYCLES, SCOOTERS, RIDE-ONS 79

- REMOTE-CONTROLLED VEHICLES (CARS, DRONES, BOATS) 80

- WATER POOL TOYS 80

-

COLLECTIBLE & NOVELTY TOYS 80

- ACTION FIGURES COLLECTIBLES 80

- TRADING CARDS BLIND BOX TOYS 80

-

SUSTAINABLE & ECO-FRIENDLY TOYS 81

- WOODEN BAMBOO TOYS 81

- RECYCLED BIODEGRADABLE TOYS 81

-

Toys Market, BY AGE GROUP 82

-

OVERVIEW 82

-

INFANTS & TODDLERS (0-3 YEARS) 83

-

PRESCHOOL (3-5 YEARS) 83

-

EARLY CHILDHOOD (6-8 YEARS) 83

-

PRE-TEENS (9-12 YEARS) 84

-

TEENAGERS (13-18 YEARS) 84

-

Toys Market, BY MATERIAL TYPE 85

-

OVERVIEW 85

-

PLASTIC TOYS 86

-

WOODEN TOYS 86

-

METAL TOYS 86

-

FABRIC & PLUSH TOYS 87

-

BIODEGRADABLE & SUSTAINABLE TOYS 87

-

Toys Market, BY DISTRIBUTION CHANNEL 88

-

OVERVIEW 88

-

OFFLINE RETAIL 88

- TOY STORES 88

- DEPARTMENT STORES 89

- SUPERMARKETS HYPERMARKETS 89

- SPECIALTY HOBBY STORES 89

-

ONLINE RETAIL E-COMMERCE 89

- BRAND-OWNED WEBSITES 90

- MARKETPLACES 90

- SUBSCRIPTION-BASED TOY BOXES 90

-

Toys Market, BY END-USER 93

-

OVERVIEW 93

-

BOYS 94

-

GIRLS 94

-

UNISEX GENDER-NEUTRAL TOYS 94

-

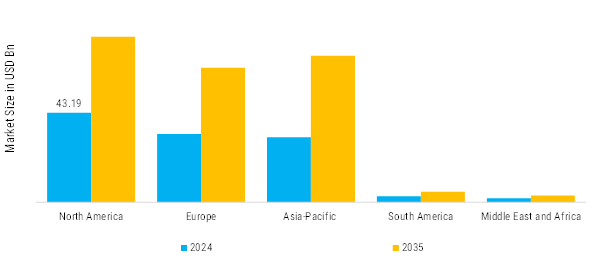

Toys Market, BY REGION 96

-

OVERVIEW 96

-

NORTH AMERICA 97

- US 105

- CANADA 112

-

EUROPE 118

- GERMANY 127

- FRANCE 134

- UK 140

- SPAIN 147

- ITALY 153

- RUSSIA 160

- REST OF EUROPE 166

-

ASIA PACIFIC 173

- CHINA 181

- INDIA 187

- JAPAN 194

- SOUTH KOREA 201

- MALAYSIA 207

- THAILAND 214

- INDONESIA 220

- REST OF APAC 227

-

SOUTH AMERICA 233

- BRAZIL 241

- MEXICO 248

- ARGENTINA 254

- REST OF SOUTH AMERICA 261

-

MIDDLE EAST AND AFRICA 268

- GCC COUNTRIES 276

- SOUTH AFRICA 282

- REST OF MEA 289

-

COMPETITIVE LANDSCAPE 297

-

INTRODUCTION 297

-

COMPANY MARKET SHARE ANALYSIS, 2024 (%) 298

-

COMPETITOR DASHBOARD 299

-

PUBLIC PLAYERS STOCK SUMMARY 300

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL, 2024 300

-

KEY DEVELOPMENTS & GROWTH STRATEGIES 301

- NEW PRODUCT LAUNCH/SERVICE DEPLOYMENT 301

- MERGER AND ACQUISITION 303

- PARTNERSHIP 304

- CAPACITY EXPANSION 305

-

COMPANY PROFILES 306

-

LEGO GROUP 306

- COMPANY OVERVIEW 306

- FINANCIAL OVERVIEW 307

- PRODUCTS OFFERED 307

- KEY DEVELOPMENTS 308

- SWOT ANALYSIS 310

- KEY STRATEGY 310

-

BANDAI NAMCO HOLDINGS INC. 311

- COMPANY OVERVIEW 311

- FINANCIAL OVERVIEW 312

- PRODUCTS OFFERED 312

- KEY DEVELOPMENTS 314

- SWOT ANALYSIS 314

- KEY STRATEGY 315

-

TAMIYA INCORPORATED 316

- COMPANY OVERVIEW 316

- FINANCIAL OVERVIEW 316

- PRODUCTS OFFERED 317

- KEY DEVELOPMENTS 318

- SWOT ANALYSIS 319

- KEY STRATEGY 319

-

SPIN MASTER CORPORATION 320

- COMPANY OVERVIEW 320

- FINANCIAL OVERVIEW 321

- PRODUCTS OFFERED 321

- KEY DEVELOPMENTS 323

- SWOT ANALYSIS 324

- KEY STRATEGY 324

-

HASBRO, INC. 325

- COMPANY OVERVIEW 325

- FINANCIAL OVERVIEW 326

- PRODUCTS OFFERED 326

- KEY DEVELOPMENTS 328

- SWOT ANALYSIS 329

- KEY STRATEGY 329

-

MATTEL, INC. 330

- COMPANY OVERVIEW 330

- FINANCIAL OVERVIEW 331

- PRODUCTS OFFERED 331

- KEY DEVELOPMENTS 332

- SWOT ANALYSIS 333

- KEY STRATEGY 334

-

FUNKO INC. 335

- COMPANY OVERVIEW 335

- FINANCIAL OVERVIEW 336

- PRODUCTS OFFERED 336

- KEY DEVELOPMENTS 337

- SWOT ANALYSIS 338

- KEY STRATEGY 338

-

CLEMENTONI S.P.A 339

- COMPANY OVERVIEW 339

- FINANCIAL OVERVIEW 339

- PRODUCTS OFFERED 339

- KEY DEVELOPMENTS 340

- SWOT ANALYSIS 341

- KEY STRATEGY 341

-

FUNSKOOL (INDIA) LTD. 342

- COMPANY OVERVIEW 342

- FINANCIAL OVERVIEW 343

- PRODUCTS OFFERED 343

- KEY DEVELOPMENTS 345

- SWOT ANALYSIS 345

- KEY STRATEGY 346

-

GOLIATH GAMES 347

- COMPANY OVERVIEW 347

- FINANCIAL OVERVIEW 347

- PRODUCTS OFFERED 347

- KEY DEVELOPMENTS 348

- SWOT ANALYSIS 349

- KEY STRATEGY 349

-

DATA CITATIONS 352

-

-

LIST OF TABLES

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 79

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 81

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 89

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 89

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 92

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UNITS IN BILLION) 92

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 98

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 98

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 100

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 100

-

Toys Market, BY REGION, 2019-2035 (UNITS IN BILLION) 103

-

Toys Market, BY REGION, 2019-2035 (UNITS IN BILLION) 103

-

Toys Market, BY COUNTRY, 2019-2035 (USD BILLION) 104

-

Toys Market, BY COUNTRY, 2019-2035 (UNITS IN BILLION) 104

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 104

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 106

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 109

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 109

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 109

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 110

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 110

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 111

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 111

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 111

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 112

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 113

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 115

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 116

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 116

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 116

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 117

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 117

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 118

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 118

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 119

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 120

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 122

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 123

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 123

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 123

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 124

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 124

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 125

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 125

-

Toys Market, BY COUNTRY, 2019-2035 (USD BILLION) 126

-

Toys Market, BY COUNTRY, 2019-2035 (UNITS IN BILLION) 126

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 126

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 128

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 130

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 130

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 130

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 132

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 132

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 133

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 133

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 133

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 134

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 135

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 137

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 138

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 138

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 139

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 139

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 140

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 140

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 140

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 141

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 142

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 144

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 144

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 145

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 145

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 146

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 146

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 147

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 147

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 147

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 149

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 151

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 151

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 151

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 152

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 152

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 152

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 153

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 153

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 154

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 155

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 157

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 157

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 158

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 158

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 159

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 159

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 160

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 160

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 160

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 162

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 164

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 164

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 164

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 165

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 165

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 165

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 166

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 166

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 167

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 168

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 170

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 170

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 171

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 171

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 172

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 172

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 173

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 173

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 173

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 175

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 177

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 177

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 177

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 178

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 178

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 179

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 179

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 179

-

Toys Market, BY COUNTRY, 2019-2035 (USD BILLION) 180

-

Toys Market, BY COUNTRY, 2019-2035 (UNITS IN BILLION) 181

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 181

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 183

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 185

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 185

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 185

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 186

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 186

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 187

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 187

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 187

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 188

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 189

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 191

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 192

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 192

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 192

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 193

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 193

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 194

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 194

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 194

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 196

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 198

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 198

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 198

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 199

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 199

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 200

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 200

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 201

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 201

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 203

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 204

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 205

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 205

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 206

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 206

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 206

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 207

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 207

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 208

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 209

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 211

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 211

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 212

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 212

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 213

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 213

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 213

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 214

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 214

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 216

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 218

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 218

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 218

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 219

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 219

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 220

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 220

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 220

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 221

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 222

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 224

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 225

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 225

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 225

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 226

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 226

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 227

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 227

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 227

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 229

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 231

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 231

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 231

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 232

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 232

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 233

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 233

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 233

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 234

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 235

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 237

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 237

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 238

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 238

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 239

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 239

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 240

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 240

-

Toys Market, BY COUNTRY, 2019-2035 (USD BILLION) 241

-

Toys Market, BY COUNTRY, 2019-2035 (UINITS IN BILLION) 241

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 241

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 243

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 245

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 245

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 246

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 246

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 246

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 247

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 247

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 248

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 248

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 250

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 251

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 252

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 252

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 253

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 253

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 254

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 254

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 254

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 255

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 256

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 258

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 259

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 259

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 259

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 260

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 260

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 261

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 261

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 261

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 263

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 265

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 265

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 266

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 266

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 266

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 267

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 267

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 268

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 268

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 270

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 271

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 272

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 272

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 273

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 273

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 274

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 274

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 275

-

Toys Market, BY COUNTRY, 2019-2035 (USD BILLION) 275

-

Toys Market, BY COUNTRY, 2019-2035 (UNITS IN BILLION) 276

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 276

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 278

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 279

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 280

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 280

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 281

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 281

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 282

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 282

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 282

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 283

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 284

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 286

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 286

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 287

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 287

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 288

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 288

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 289

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 289

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 289

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 291

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 293

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 293

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 293

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 294

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 294

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 295

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 295

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 295

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (USD BILLION) 296

-

Toys Market, BY PRODUCT TYPE, 2019-2035 (UNITS IN BILLION) 297

-

Toys Market, BY AGE GROUP, 2019-2035 (USD BILLION) 299

-

Toys Market, BY AGE GROUP, 2019-2035 (UNITS IN BILLION) 300

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (USD BILLION) 300

-

Toys Market, BY MATERIAL TYPE, 2019-2035 (UINITS IN BILLION) 300

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 301

-

Toys Market, BY DISTRIBUTION CHANNEL, 2019-2035 (UNITS IN BILLION) 301

-

Toys Market, BY END USER, 2019-2035 (USD BILLION) 302

-

Toys Market, BY END USER, 2019-2035 (UNITS IN BILLION) 302

-

NEW PRODUCT LAUNCH/SERVICE DEPLOYMENT 308

-

MERGER AND ACQUISITION 310

-

PARTNERSHIP 311

-

CAPACITY EXPANSION 312

-

LEGO GROUP: PRODUCTS OFFERED 314

-

LEGO GROUP: KEY DEVELOPMENTS 315

-

BANDAI NAMCO HOLDINGS INC.: PRODUCTS OFFERED 319

-

BANDAI NAMCO HOLDINGS INC.: KEY DEVELOPMENTS 321

-

TAMIYA INCORPORATED: PRODUCTS OFFERED 324

-

SPIN MASTER CORPORATION, PRODUCTS OFFERED 328

-

SPIN MASTER CORPORATION: KEY DEVELOPMENTS 330

-

HASBRO, INC.: PRODUCTS OFFERED 333

-

HASBRO, INC.: KEY DEVELOPMENTS 335

-

MATTEL, INC.: PRODUCTS OFFERED 338

-

MATTEL, INC.: KEY DEVELOPMENTS 339

-

FUNKO INC.: PRODUCTS OFFERED 343

-

FUNKO INC.: KEY DEVELOPMENTS 344

-

CLEMENTONI S.P.A: PRODUCTS OFFERED 346

-

FUNSKOOL (INDIA) LTD.: PRODUCTS OFFERED 350

-

FUNSKOOL (INDIA) LTD.: KEY DEVELOPMENTS 352

-

GOLIATH GAMES: PRODUCTS OFFERED 354

-

GOLIATH GAMES: KEY DEVELOPMENTS 355

-

-

LIST OF FIGURES

-

GLOBAL TOYS MARKET SNAPSHOT, 2024 25

-

GLOBAL TOYS MARKET: STRUCTURE 28

-

GLOBAL TOYS MARKET: MARKET GROWTH FACTOR ANALYSIS (2025-2035) 46

-

WORLD DISPOSABLE INCOME PER CAPITA BY REGION, DOLLARS PER PERSON (PPP) 47

-

EUROPEAN ECOMMERCE MARKET REVENUE 2020-2027, IN USD BILLION 51

-

DRIVER IMPACT ANALYSIS (2025-2035) 52

-

RESTRAINT IMPACT ANALYSIS (2025-2035) 57

-

SUPPLY CHAIN ANALYSIS 70

-

PORTER’S FIVE FORCES MODEL: GLOBAL TOYS MARKET 71

-

Toys Market, BY PRODUCT TYPE, 2024 (% SHARE) 83

-

Toys Market, BY AGE GROUP, 2024 (% SHARE) 90

-

Toys Market, BY MATERIAL TYPE, 2024 (% SHARE) 93

-

Toys Market, BY DISTRIBUTION CHANNEL, 2024 (% SHARE) 99

-

Toys Market, BY END USER, 2024 (% SHARE) 101

-

GLOBAL TOYS MAJOR PLAYERS MARKET SHARE ANALYSIS, 2024 (%) 305

-

BENCHMARKING OF MAJOR COMPETITORS 306

-

PUBLIC PLAYERS STOCK SUMMARY 307

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL, 2024 307

-

LEGO GROUP: FINANCIAL OVERVIEW SNAPSHOT 314

-

LEGO GROUP: SWOT ANALYSIS 317

-

BANDAI NAMCO HOLDINGS INC.: FINANCIAL OVERVIEW SNAPSHOT 319

-

BANDAI NAMCO HOLDINGS INC.: SWOT ANALYSIS 321

-

TAMIYA INCORPORATED: SWOT ANALYSIS 326

-

SPIN MASTER CORPORATION, FINANCIAL OVERVIEW 328

-

SPIN MASTER CORPORATION: SWOT ANALYSIS 331

-

HASBRO, INC., FINANCIAL OVERVIEW 333

-

HASBRO, INC.: SWOT ANALYSIS 336

-

MATTEL, INC.: FINANCIAL OVERVIEW SNAPSHOT 338

-

MATTEL, INC.: SWOT ANALYSIS 340

-

FUNKO INC.: FINANCIAL OVERVIEW SNAPSHOT 343

-

FUNKO INC. : SWOT ANALYSIS 345

-

CLEMENTONI S.P.A: SWOT ANALYSIS 348

-

FUNSKOOL (INDIA) LTD.: FINANCIAL OVERVIEW SNAPSHOT 350

-

FUNSKOOL (INDIA) LTD.: SWOT ANALYSIS 352

-

GOLIATH GAMES: SWOT ANALYSIS 356

Leave a Comment