Rising Cybersecurity Threats

The Transaction Monitoring Market is increasingly driven by the rising threats posed by cybercriminals. As financial institutions face sophisticated attacks, the need for robust transaction monitoring systems becomes paramount. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, highlighting the urgency for effective monitoring solutions. Organizations are compelled to invest in advanced technologies that can detect anomalies and prevent fraudulent activities. This trend is likely to propel the growth of the transaction monitoring market, as firms seek to safeguard their assets and maintain customer trust. The integration of machine learning and artificial intelligence into monitoring systems is expected to enhance detection capabilities, thereby addressing the evolving landscape of cyber threats.

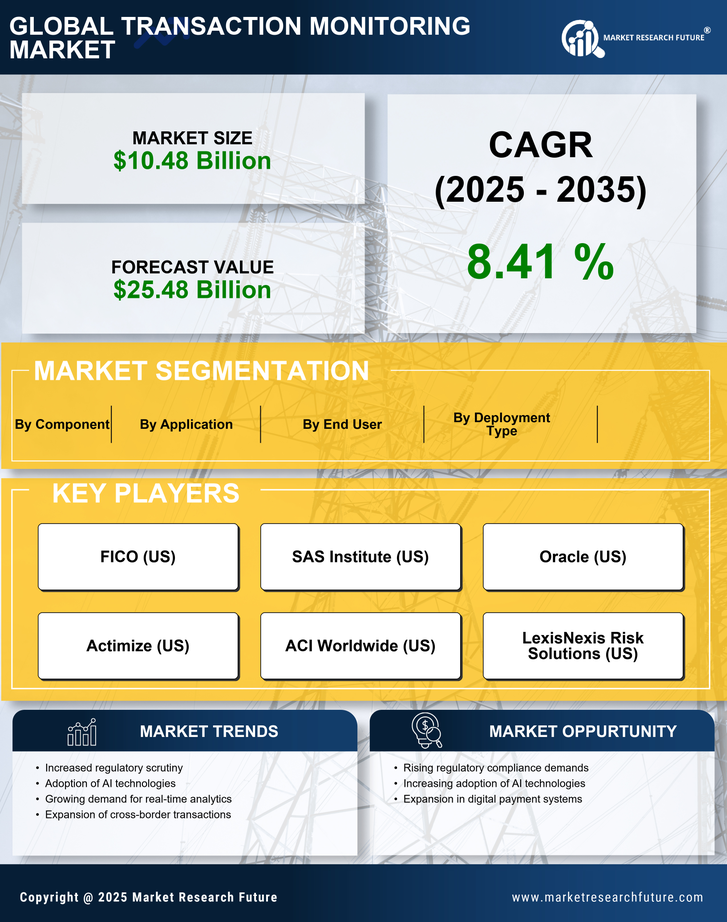

Increased Regulatory Scrutiny

The Transaction Monitoring Market is significantly influenced by the heightened regulatory scrutiny faced by financial institutions. Governments and regulatory bodies are imposing stricter compliance requirements to combat money laundering and terrorist financing. In 2025, the global anti-money laundering (AML) compliance market is projected to reach approximately 8 billion dollars, indicating a robust demand for transaction monitoring solutions. Financial institutions are now required to implement comprehensive monitoring systems that can track and report suspicious activities in real-time. This regulatory environment compels organizations to adopt advanced transaction monitoring technologies, thereby driving market growth. The emphasis on compliance not only mitigates risks but also enhances the overall integrity of the financial system.

Emergence of Fintech Innovations

The Transaction Monitoring Market is significantly influenced by the emergence of fintech innovations. As technology continues to evolve, fintech companies are introducing novel solutions that challenge traditional banking practices. In 2025, it is expected that fintech investments will reach over 300 billion dollars, underscoring the demand for advanced transaction monitoring systems. These innovations often incorporate artificial intelligence and blockchain technology, which can enhance the efficiency and accuracy of monitoring processes. As fintech firms strive to differentiate themselves in a competitive market, the integration of robust transaction monitoring solutions becomes essential. This trend is likely to reshape the transaction monitoring landscape, as organizations adapt to the rapid pace of technological advancements.

Expansion of Digital Payment Systems

The Transaction Monitoring Market is being propelled by the rapid expansion of digital payment systems. With the increasing adoption of e-commerce and mobile payments, financial transactions are becoming more complex and diverse. In 2025, the digital payment market is projected to surpass 10 trillion dollars, creating a pressing need for effective transaction monitoring solutions. As businesses embrace digital platforms, they face heightened risks of fraud and financial crime. Consequently, organizations are compelled to implement sophisticated monitoring systems that can adapt to the evolving payment landscape. This trend is likely to drive innovation within the transaction monitoring market, as firms seek to enhance their capabilities to manage risks associated with digital transactions.

Growing Demand for Real-Time Monitoring

The Transaction Monitoring Market is witnessing a growing demand for real-time monitoring solutions. As transactions become increasingly digital and instantaneous, the need for immediate detection of fraudulent activities is critical. In 2025, it is anticipated that the real-time transaction monitoring segment will account for a substantial share of the market, driven by the need for timely responses to potential threats. Financial institutions are investing in technologies that enable them to analyze transactions as they occur, thereby minimizing losses and enhancing customer satisfaction. This shift towards real-time monitoring is likely to reshape the transaction monitoring landscape, as organizations prioritize speed and efficiency in their operations.