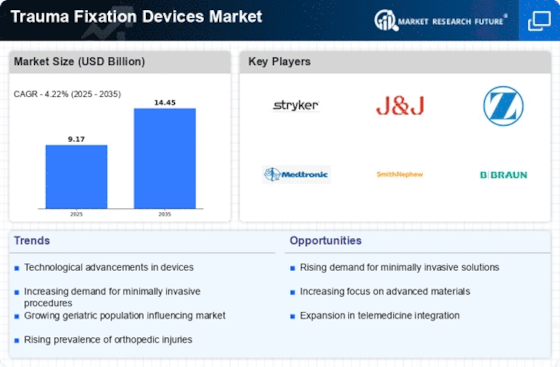

Market Share

Trauma Fixation Devices Market Share Analysis

The Trauma Fixation Devices Market is important for treating fractures and traumatic injuries, it has a dynamic landscape where companies have applied different strategies in the market share positioning. One major strategy is to continuously innovate on trauma fixation device design and materials. These firms spend considerably on research and development, introducing state-of-the-art devices such as locking plates, intramedullary nails and external fixation systems that offer better stability and expedite patient recovery. By developing groundbreaking solutions that address orthopedic surgeon’s or trauma patients’ specific needs, these companies seek to attract health care providers looking for cutting-edge trauma fixation devices that optimize fracture management. Pricing strategies are critical in market share positioning within the Trauma Fixation Devices Market. Others adopt cost leadership approach, selling their products at competitive prices in order to target a wide range of health care facilities particularly ones with budget constraints in certain places. However, there are other firms who use premium pricing strategies to appeal to healthcare providers and institutions ready to pay more for high quality and innovative orthopedics because of their products’ durability; advanced features or unique materials. Companies perform market segmentation tailoring their trauma fixation devices according anatomical areas or types of fractures being treated by them. For instance, some may develop devices used in long bone fractures while others will focus on pelvic fractures or periarticular fractures all which requires different approaches of fixing. Operating with this approach allows firms position themselves as experts specializing in particular segments of the Trauma Fixation Devices Market hence catering to various needs that orthopedic surgeons have and those of trauma care teams. The expansion of distribution channels is vital ensuring extensive availability and accessibility of trauma fixation devices required world over. This helps these companies extend their market reach through strategic partnerships with hospitals, orthopedic clinics as well as medical device distributors among others avenues open. The use of digital platforms for product promotion, training and ordering has increasingly become important since it provides efficiency and accessibility to healthcare professionals seeking reliable and advanced trauma fixation solutions.

Strategic alliances and collaborations with orthopedic associations and trauma centers contribute significantly to market share positioning. Companies engage in partnerships for clinical studies, surgeon training programs, and collaboration in research initiatives to stay at the forefront of trauma fixation advancements. These collaborations enhance the scientific credibility of trauma fixation devices and provide opportunities for feedback from experienced practitioners to improve product performance.

Leave a Comment