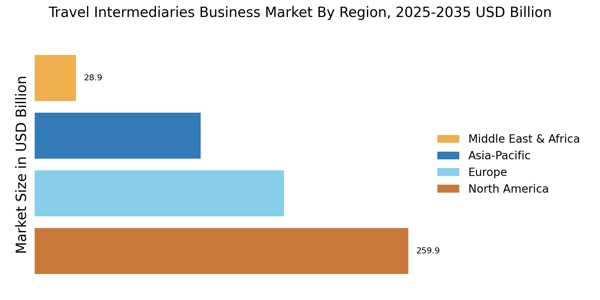

Emerging Markets

The emergence of new markets presents a compelling driver for the Travel Intermediaries Business Market, as increasing disposable incomes and a growing middle class in various regions fuel travel demand. Countries in Asia and Africa, for example, are witnessing a surge in outbound travel, with data indicating that travel spending in these regions is expected to grow by 10% annually. This trend creates opportunities for intermediaries to expand their services and cater to a diverse clientele. By tapping into these emerging markets, travel intermediaries can diversify their revenue streams and enhance their market presence. Consequently, the focus on emerging markets is likely to shape the strategic direction of the Travel Intermediaries Business Market.

Regulatory Compliance

Regulatory compliance is a significant driver affecting the Travel Intermediaries Business Market, as governments worldwide implement stricter regulations to ensure consumer protection and fair practices. Intermediaries must navigate a complex landscape of laws related to data privacy, consumer rights, and travel safety. For instance, the introduction of regulations such as the General Data Protection Regulation (GDPR) in various regions has compelled intermediaries to enhance their data handling practices. Compliance not only mitigates legal risks but also builds consumer trust, which is vital for long-term success. As regulatory frameworks continue to evolve, the ability of travel intermediaries to adapt and comply will be a determining factor in their operational viability within the Travel Intermediaries Business Market.

Sustainability Initiatives

Sustainability has emerged as a crucial driver within the Travel Intermediaries Business Market, as consumers increasingly prioritize eco-friendly travel options. Research indicates that 65% of travelers are willing to pay more for sustainable travel experiences, prompting intermediaries to incorporate green practices into their offerings. This includes promoting eco-friendly accommodations, carbon offset programs, and responsible tourism initiatives. By aligning with sustainability trends, travel intermediaries not only attract environmentally conscious consumers but also contribute to the preservation of destinations. The integration of sustainability into business models is becoming essential for intermediaries aiming to remain competitive and relevant in the evolving Travel Intermediaries Business Market.

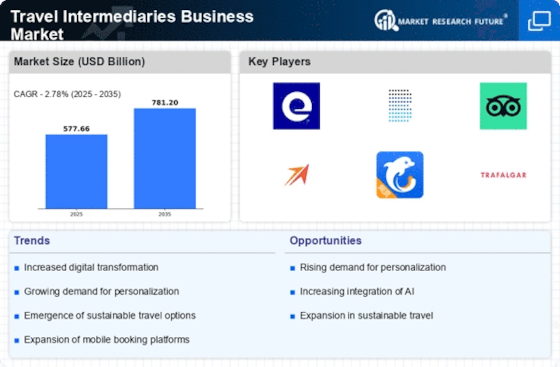

Technological Advancements

Technological integration is a pivotal driver in the Travel Intermediaries Business Market, as advancements in digital platforms and mobile applications reshape how consumers book travel. The rise of artificial intelligence and machine learning enables intermediaries to offer more efficient services, such as chatbots for customer support and personalized recommendations based on user behavior. Data suggests that 60% of travelers prefer using mobile devices for booking, highlighting the necessity for intermediaries to invest in technology. Furthermore, the implementation of blockchain technology is anticipated to enhance transparency and security in transactions, fostering trust among consumers. Thus, the ongoing technological evolution is likely to significantly influence the operational dynamics of the Travel Intermediaries Business Market.

Evolving Consumer Preferences

The Travel Intermediaries Business Market is currently witnessing a shift in consumer preferences towards personalized and unique travel experiences. Travelers increasingly seek tailored itineraries that cater to their specific interests, such as adventure, culture, or wellness. This trend is supported by data indicating that 70% of travelers express a desire for customized travel options. As a result, travel intermediaries are adapting their offerings to meet these demands, enhancing customer satisfaction and loyalty. The ability to provide personalized services not only differentiates intermediaries in a competitive landscape but also drives revenue growth. Consequently, the focus on understanding and responding to evolving consumer preferences is a critical driver for the Travel Intermediaries Business Market.