Treated Distillate Aromatic Extracts Tdae Size

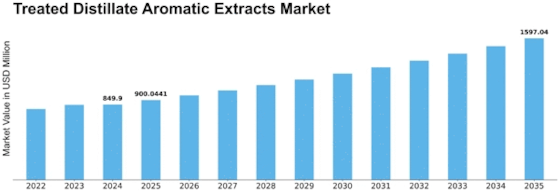

Treated Distillate Aromatic Extracts (TDAE) Market Growth Projections and Opportunities

The Treated Distillate Aromatic Extracts (TDAE) market is influenced by a variety of market factors that shape demand, supply, and overall industry dynamics.

Tire Industry Demand: The tire industry represents a major consumer of Treated Distillate Aromatic Extracts (TDAE) as a key component in tire manufacturing. TDAE is used as a process oil in tire formulations to improve the processability, resilience, and durability of rubber compounds. With the growth of the global automotive industry and increasing demand for tires in passenger vehicles, commercial vehicles, and off-road vehicles, the demand for TDAE in the tire industry is expected to rise.

Rubber Processing Applications: TDAE finds applications in various rubber processing industries such as automotive, industrial, and consumer goods manufacturing. It is utilized as a plasticizer, softener, and extender in rubber compounds for molded parts, seals, gaskets, hoses, belts, and industrial rubber products. TDAE enhances the processability, physical properties, and performance characteristics of rubber compounds, making it an essential ingredient in rubber processing applications.

Regulatory Compliance: Regulatory standards and environmental regulations governing the use of aromatic extracts in rubber processing influence the TDAE market. Compliance with regulatory requirements such as REACH regulations in Europe and EPA regulations in the United States is essential for TDAE manufacturers and users. Adherence to regulatory standards ensures product safety, environmental sustainability, and market access for TDAE products in the rubber processing industry.

Environmental Concerns: Environmental concerns related to the use of aromatic extracts in rubber processing drive market demand for alternative process oils such as TDAE. TDAE is considered a safer and more environmentally friendly alternative to traditional aromatic extracts such as Distillate Aromatic Extracts (DAE) and Refined Aromatic Extracts (RAE) due to its lower polycyclic aromatic hydrocarbon (PAH) content and reduced environmental impact. With increasing awareness of environmental issues and sustainability initiatives, the demand for TDAE as a green process oil is expected to grow.

Technological Advancements: Technological advancements in TDAE production processes and rubber compounding techniques influence market trends and product innovation. Manufacturers are investing in research and development to improve TDAE manufacturing processes, enhance product quality, and optimize performance characteristics. Technological innovations contribute to the development of high-quality TDAE products that meet the evolving needs of rubber processors and end-users in various industries.

Automotive Industry Trends: Trends in the automotive industry, such as lightweighting, fuel efficiency, and tire performance, drive demand for high-quality rubber compounds and process oils like TDAE. TDAE plays a crucial role in improving tire rolling resistance, wet traction, and tread wear properties, thereby contributing to tire performance and fuel efficiency in vehicles. With the automotive industry's focus on sustainability and innovation, the demand for TDAE in tire manufacturing is expected to increase.

Emerging Markets: Emerging markets in Asia-Pacific, Latin America, and the Middle East represent significant growth opportunities for the TDAE market. Rapid industrialization, urbanization, and infrastructure development in emerging economies drive demand for rubber products such as tires, automotive parts, construction materials, and industrial goods. As emerging markets continue to expand and modernize, the demand for TDAE as a process oil in rubber processing is projected to grow.

Supply Chain Dynamics: Supply chain dynamics such as raw material availability, logistics, and distribution networks impact the TDAE market. The availability of feedstock materials such as vacuum gas oil (VGO) and the accessibility of refining and processing facilities influence TDAE production capacity and supply. Efficient logistics and distribution channels are essential for ensuring timely delivery of TDAE products to customers in the rubber processing industry.

Price Volatility: Price volatility in crude oil and petroleum-derived feedstocks affects TDAE pricing and market competitiveness. Fluctuations in crude oil prices, supply-demand dynamics, and geopolitical factors impact the cost of raw materials and production costs for TDAE manufacturers. Price volatility in the TDAE market influences purchasing decisions, contract negotiations, and profit margins for manufacturers, distributors, and end-users in the rubber processing industry.

Market Competition and Industry Consolidation: Market competition among TDAE manufacturers and suppliers influences market dynamics and pricing strategies. Industry consolidation, mergers, and acquisitions contribute to market consolidation and competitive positioning in the TDAE market. Established players and multinational corporations dominate the TDAE market, while new entrants and regional players focus on niche markets and specialized applications to gain market share and competitive advantage.

Leave a Comment