Truck Axle Size

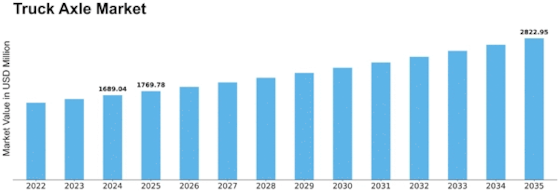

Truck Axle Market Growth Projections and Opportunities

The dynamics of the truck axle market are driven by several factors in this market, which have had an important effect on its performance. First, the global demand for commercial vehicles is one of the main drivers. However, as economies develop and industrial activities increase, transportation of goods will be high leading to demand for trucks. Thus, the need for truck axles increases as well since they are key elements in these heavy-duty vehicles. In addition to this, government standardization through regulations and emission standards also influences the market development for truck axles. Attention to environmental sustainability is growing more pronounced as regulatory bodies across the globe lay down strict emission standards for vehicles, including trucks. This has resulted in the evolution of sophisticated axle technologies that contribute to better fuel economy and low emissions. The truck axle market manufacturers are forced to innovate constantly to adhere to these regulations and meet the developing standards of sustainability within an industry. Other important aspect is technological innovations in the automotive sector. As technology improves, truck axle manufacturers are implementing cutting-edge features such as electronic stability control and new materials that improve the effectiveness of truck axles. These technological advancements do not only lead to more effective trucks but also support the growth and competitiveness of market for truck axle. The truck axle market is also significantly influenced by the economics scene. Economic factors like GDP growth determine a business or person’s ability to purchase. When the economy is growing, there are usually increases in construction and manufacturing activities which results to a demand for commercial vehicles meaning that truck axels will be demanded. On the other hand, recessions can lead to a lack of growth in these sectors which would reduce demand for new trucks and eventually truck axles. The truck axle market is also negatively affected by supply chain disruptions and the prices of raw materials. Given the intricate global supply chain for truck axles, shocks in this supply chain result to delays and additional costs.

Leave a Comment