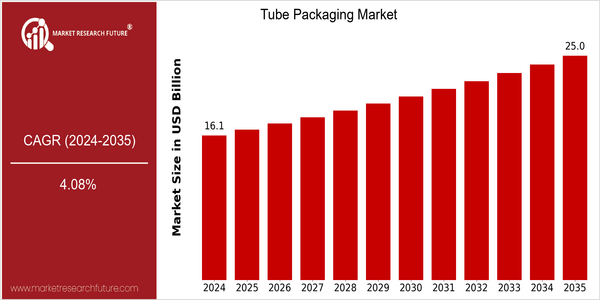

Tube Packaging Size

Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 16.11 Billion |

| 2035 | USD 25.01 Billion |

| CAGR (2025-2035) | 4.08 % |

Note – Market size depicts the revenue generated over the financial year

The tube packaging market is expected to grow significantly, with a market size of $16 billion in 2024 and $25.01 billion in 2035. This growth rate represents a CAGR of 4.08 % from 2025 to 2035. The growth is based on various factors, such as the increasing demand for convenient and sustainable packaging solutions in various industries, such as cosmetics, pharmaceuticals, food and beverages. Also, the shift towards the use of biodegradable and recyclable materials is driving innovation in the tube packaging design and production processes. The tube packaging market is dominated by major players, such as Amcor, Essel Propack and Albea. These companies are investing heavily in R & D to enhance their product offerings and meet changing customer preferences. Strategic initiatives, such as collaborations and joint ventures, are increasingly common in the tube packaging industry. Product launches with high-barrier materials and convenient designs highlight the industry's commitment to sustainable and functional packaging. These trends will continue to shape the industry in the coming years.

Regional Market Size

Regional Deep Dive

The tube packaging market is growing at a significant pace across several regions, driven by a growing demand for convenience, sustainable and new packaging solutions. In North America, the market is characterized by the presence of established players and a focus on eco-friendly materials. In Europe, premium packaging is in the spotlight, while Asia-Pacific is experiencing rapid growth due to rising incomes and urbanization. In the Middle East and Africa, the cosmetics and personal care industry is growing rapidly, and Latin America is adapting to changing consumer preferences and regulations that support sustainable packaging solutions.

Europe

- In Europe, there is a notable shift towards premium and luxury tube packaging, particularly in the cosmetics and personal care sectors, with brands like L'Oréal and Unilever investing in high-quality packaging designs.

- The European Union's stringent regulations on plastic usage and waste management are pushing companies to explore alternative materials and designs, which is likely to reshape the market landscape significantly.

Asia Pacific

- In Asia-Pacific, rapid urbanization and rising disposable incomes are driving the market for cosmetics and toiletries, thereby driving the market for syringes. In this area, companies like Huhtamaki and Mondi are expanding their activities.

- Innovations in smart packaging technologies, such as QR codes and NFC-enabled tubes, are gaining traction in markets like Japan and South Korea, enhancing consumer engagement and product traceability.

Latin America

- In Latin America, there is a growing trend towards sustainable packaging solutions, with companies like Grupo Phoenix and Tetra Pak focusing on eco-friendly tube designs to meet consumer demand.

- Regulatory changes in countries like Brazil are promoting the use of recyclable materials, which is expected to drive innovation and investment in the tube packaging sector.

North America

- The North American tube-packaging market is characterized by a growing demand for biodegradable and recyclable materials, which is mainly driven by the growing preference of consumers for sustainable products. In this respect, Amcor and Sonoco are in the lead, developing eco-friendly tube-packaging solutions.

- Regulatory changes in the U.S. regarding plastic waste management are prompting manufacturers to innovate and adopt more sustainable practices, which is expected to enhance the market's growth potential in the coming years.

Middle East And Africa

- The Middle East and Africa are experiencing growth in the tube packaging market, particularly in the cosmetics and personal care sectors, with local brands like Nivea and Oriflame expanding their product lines.

- Government initiatives aimed at promoting local manufacturing and reducing import dependency are encouraging investments in tube packaging production facilities, which is expected to boost market growth in the region.

Did You Know?

“Did you know that tube packaging can reduce product waste by up to 20% compared to traditional packaging methods, making it a more efficient choice for both manufacturers and consumers?” — Packaging World

Segmental Market Size

The tube packaging market is experiencing a steady growth driven by the increasing demand for convenience and portability in product packaging. This is especially true for personal care and cosmetic products, which are often sold in tubes due to their ease of use and aesthetics. Also, government regulations promoting sustainable packaging are pushing manufacturers to use eco-friendly materials, which further drives the tube packaging market. Colgate-Palmolive and Procter & Gamble are currently the leading companies in tube packaging, implementing the most sustainable practices and designs. Tube packaging is primarily used in the cosmetics, pharmaceuticals, and food industries, as it offers good barrier properties and easy dispensing. The rising awareness of hygiene in the wake of the H1N1 flu pandemic and the increasing sustainable practices are accelerating the tube packaging market. A variety of technological developments, such as advanced printing and biodegradable materials, are influencing the evolution of tube packaging to meet the needs of both consumers and governments.

Future Outlook

In the tube packaging market, the annual growth rate is slated to be 4.08% from 2024 to 2035. The tube packaging industry is mainly driven by the rising demand for convenient and sustainable packaging solutions in various industries such as cosmetics, pharmaceuticals, and food and beverages. As more and more companies focus on the concept of sustainability, the use of eco-friendly materials and the innovation of tube design are expected to increase market penetration, possibly exceeding 60% in certain segments by 2035. The development of smart packaging and the development of biodegradable materials are also expected to drive the development of the industry. Regulations on sustainable development have also made manufacturers more willing to use tube packaging. The rise in e-commerce and the popularity of individualization have also changed consumers' preferences and market structures, which have become more complex and fierce. , the tube packaging industry has developed rapidly, and the opportunities for development and innovation are considerable.

Leave a Comment