Turpentine Size

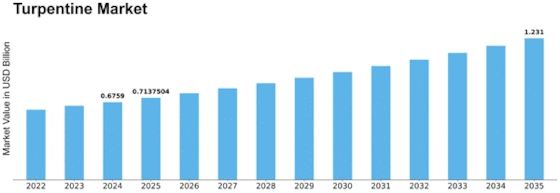

Turpentine Market Growth Projections and Opportunities

The turpentine market is shaped by several key factors that impact its growth, demand, and overall dynamics. One significant market factor is the demand for turpentine in various industries, including paints and coatings, pharmaceuticals, fragrance, and adhesive manufacturing. Turpentine serves as a key ingredient in the production of paints and coatings, where it acts as a solvent and helps achieve desired viscosity and drying properties. Similarly, in the pharmaceutical and fragrance industries, turpentine is used as a raw material in the production of medicines, perfumes, and aromatherapy products. The demand for these end-use products directly influences the demand for turpentine.

Technological advancements also play a crucial role in shaping the turpentine market. Innovations in extraction techniques, purification processes, and storage methods contribute to improving the efficiency and quality of turpentine production. Additionally, advancements in downstream industries, such as the development of eco-friendly paints and bio-based adhesives, may create new opportunities for turpentine manufacturers. Keeping pace with these technological developments allows companies to remain competitive and meet evolving consumer preferences and regulatory requirements.

Regulatory policies and environmental standards represent another significant market factor for the turpentine industry. Governments worldwide enact regulations concerning the production, handling, and disposal of chemicals, including turpentine. Compliance with these regulations is essential for manufacturers to ensure product safety, environmental sustainability, and legal compliance. Furthermore, growing environmental concerns, such as deforestation and habitat degradation, may influence market demand for sustainably sourced turpentine products, prompting companies to adopt responsible sourcing practices.

Economic factors also have a substantial impact on the turpentine market. Economic indicators, such as GDP growth, consumer spending, and industrial production, influence the demand for turpentine-based products. During periods of economic expansion, increased construction activity, manufacturing output, and consumer purchasing power can drive up demand for paints, coatings, and other turpentine-utilizing products. Conversely, economic downturns may lead to reduced demand for discretionary items, affecting the turpentine market negatively.

Raw material availability and pricing are critical market factors for the turpentine industry. Turpentine is primarily derived from pine trees, particularly species like the longleaf pine and slash pine. Fluctuations in timber availability, forestry practices, and natural disasters, such as wildfires and storms, can impact the supply of pine resin, the primary raw material for turpentine production. Moreover, changes in the price of crude oil, which affects the cost of synthetic solvents and alternatives to turpentine, may influence market dynamics and pricing strategies for turpentine-based products.

Consumer preferences and trends also shape the turpentine market landscape. Increasing awareness of environmental sustainability and health-consciousness among consumers drives demand for eco-friendly and non-toxic products, including those made with natural ingredients like turpentine. Additionally, shifting trends in interior design, architecture, and home improvement influence the demand for decorative paints, wood finishes, and varnishes, which often contain turpentine. Manufacturers must respond to these evolving preferences by offering innovative products that meet consumer needs and expectations.

Competition within the turpentine industry is another significant market factor. With numerous manufacturers and suppliers operating globally, competition can be fierce, leading to price competition, product differentiation, and marketing efforts to gain market share. Companies may differentiate themselves through product quality, customer service, distribution networks, and branding strategies. Collaboration and partnerships within the industry, as well as mergers and acquisitions, may also impact market dynamics and competitive positioning.

Demographic factors, such as population growth, urbanization, and lifestyle changes, also influence the turpentine market. As populations expand and urban areas develop, there's an increased demand for infrastructure, construction, and housing, driving the need for paints, coatings, and adhesives. Moreover, changing lifestyles and preferences, such as the growing popularity of DIY projects and home renovation activities, contribute to the demand for turpentine-based products among consumers.

Leave a Comment