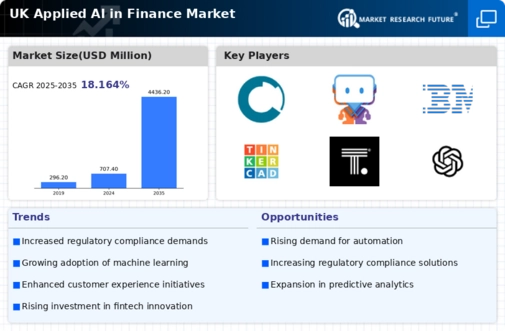

The UK Applied AI in Finance Market is characterized by rapid technological advancements and an increasingly competitive landscape, driven by the need for financial institutions to enhance efficiency, improve decision-making, and mitigate risks through data-driven solutions. With the integration of artificial intelligence across various segments of finance, firms are harnessing the power of machine learning and analytics to not only streamline operations but also tailor financial products to meet the specific needs of customers. The heightened adoption of AI technologies is fueled by regulatory requirements, the demand for innovative financial services, and the imperative for better compliance processes.

This shifting market dynamic poses both opportunities and challenges as different players strive to carve out their niches in an evolving environment.

Ayasdi has established a noteworthy presence in the UK Applied AI in Finance Market, focusing on developing advanced machine learning solutions. The company excels in creating powerful data analysis tools that help financial institutions detect patterns and enhance their operational capabilities. Strengths include its ability to simplify complex data processing, allowing organizations to interpret vast amounts of data effectively. This capability positions Ayasdi to address various aspects of finance, ranging from fraud detection to risk assessment, making it an appealing choice for banks and financial services looking to leverage sophisticated AI-driven insights.

The company's technology is noted for its intuitive design and robust analytical features, enabling clients to gain actionable intelligence without extensive data science expertise.

Numerai is notable within the UK Applied AI in Finance Market for its innovative approach to financial modeling and investing through crowdsourced data science. The firm provides a platform where data scientists globally can submit predictions regarding stock market trends, enabling the aggregation of insights and strategies for hedge fund management. Key services include its unique data science tournament, which incentivizes predictive models, fostering an environment of continuous improvement. Numerai benefits from a strong ecosystem presence, attracting data scientists while maintaining transparency and collaboration.

The company's strategic partnerships and ongoing engagements in fintech innovation underline its competitive edge. Numerai is also actively engaged in expanding its capabilities through select mergers and acquisitions, further solidifying its market position within the UK by continuously enhancing its technological offerings and adapting to the dynamic requirements of the financial sector.