India Applied AI in Finance Market Overview

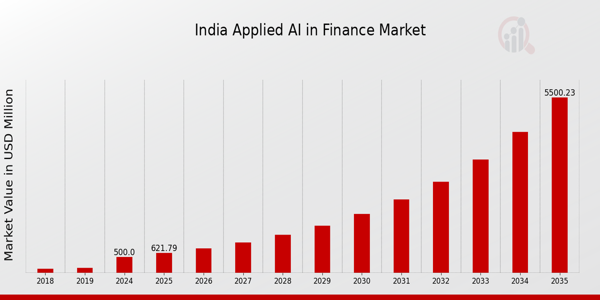

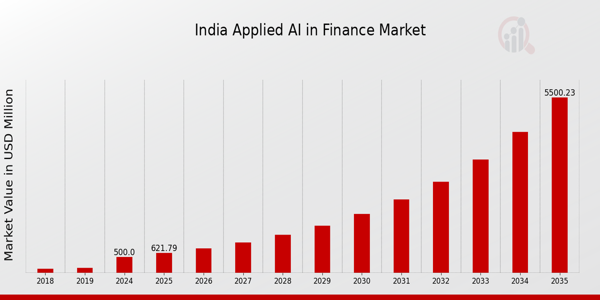

As per MRFR analysis, the India Applied AI in Finance Market Size was estimated at 288.74 (USD Million) in 2023. The India Applied AI in Finance Market Industry is expected to grow from 500 (USD Million) in 2024 to 5,500 (USD Million) by 2035. The India Applied AI in Finance Market CAGR (growth rate) is expected to be around 24.358% during the forecast period (2025 - 2035).

Key India Applied AI in Finance Market Trends Highlighted

The India Applied AI in Finance Market is experiencing significant evolution driven by various key market drivers. The increasing demand for automation in financial services is imperative as businesses strive to enhance efficiency and accuracy. The digitization of financial services is further fueled by government initiatives such as Digital India, which aim to promote technology integration in various sectors, including finance. This has catalyzed the adoption of AI technologies in areas like personalized banking, fraud detection, and risk management.

Opportunities are emerging from the rise of fintech startups in India, which are leveraging AI to offer innovative solutions and improve customer experience.The capacity to rapidly and efficiently process immense quantities of data is becoming increasingly important as these startups continue to challenge conventional lending and payment models. In recent years, there has been a shift in emphasis toward AI ethics and transparency, which has addressed concerns regarding data privacy and bias. Financial institutions are encouraged to implement responsible AI practices as the Reserve Bank of India prioritizes regulatory frameworks.

Furthermore, there is an increasing trend toward the integration of AI with blockchain technology to improve transaction efficiency and security. Another substantial trend is the proliferation of digital wallets and mobile banking, as a substantial portion of the Indian populace becomes more technologically adept. This presents banks with additional opportunities to implement AI-driven solutions.

The finance sector is experiencing an increase in the frequency of collaboration between established financial institutions and technology companies, which is promoting innovation and expediting the adoption of AI. In general, the future of applied AI in finance in India is being collectively influenced by a combination of technological advancements, regulatory support, and evolving consumer preferences.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

India Applied AI in Finance Market Drivers

Rapid Digital Transformation in India

India's financial sector is undergoing a rapid digital transformation, driven by nationwide initiatives such as Digital India and increased internet penetration. According to the Ministry of Electronics and Information Technology, internet usage in India rose to approximately 750 million users in early 2023, with a growth rate of over 20% per year. This digital proliferation is giving rise to innovative financial solutions powered by Artificial Intelligence (AI), allowing organizations like HDFC Bank and ICICI Bank to implement AI-driven customer service platforms, fraud detection systems, and credit risk assessments.

The Indian government is also promoting startups in the AI realm through policies and funding initiatives, leading to a surge in the adoption of Applied AI solutions in the finance industry. The growth in digital transactions has created a fertile environment for the 'India Applied AI in Finance Market Industry', which anticipates a significant expansion in its capacity and technological integration over the coming years.

Increasing Demand for Personalized Financial Services

There is a growing demand for personalized financial services among Indian consumers, as they seek tailored products that meet their specific needs and preferences. A survey by the Reserve Bank of India shows that over 60% of consumers express interest in customized financial solutions, indicating a strong market for AI applications that enable this level of personalization.

Banking giants such as Axis Bank and State Bank of India are utilizing AI algorithms to analyze customer data and predict preferences, thereby offering bespoke financial products. As more financial institutions embrace personalized AI-driven services, the 'India Applied AI in Finance Market Industry' is set for remarkable growth driven by consumer demand.

Regulatory Support for AI in Finance

The Indian government has laid down regulatory frameworks that are conducive to the integration of AI in finance. Initiatives such as the Reserve Bank of India's 'Regulatory Sandbox' allow financial institutions to test AI-based solutions in a controlled environment.

This support encourages innovation and minimizes risks for new technology adoption. According to the Indian Finance Ministry, over 30 entities have participated in the regulatory sandbox, showcasing the eagerness of the market to explore AI capabilities. Major banks are leveraging this regulatory framework to experiment with AI solutions effectively, resulting in increased investments and advancements within the 'India Applied AI in Finance Market Industry'.

Enhanced Risk Management and Fraud Detection

The necessity for enhanced risk management and fraud detection in the Indian financial sector is creating a robust market for Applied AI technologies. A report by the National Association of Software and Service Companies indicated that financial fraud in India is expected to cost the country approximately 1.3 trillion INR annually.

This alarming figure has pushed financial institutions to deploy AI systems for real-time fraud detection and prevention. Companies such as Paytm and Kotak Mahindra Bank have integrated cutting-edge AI solutions that analyze transaction patterns and identify irregularities instantly. As financial institutions continue to prioritize security in their operations, the adoption of AI in risk management will significantly contribute to the growth of the 'India Applied AI in Finance Market Industry'.

India Applied AI in Finance Market Segment Insights

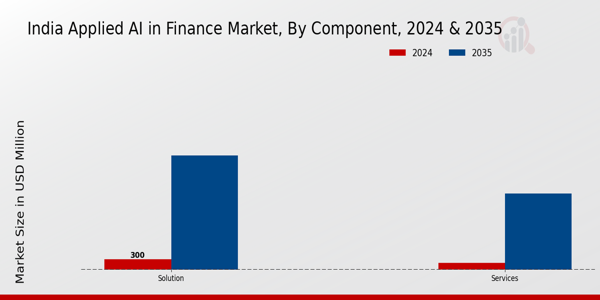

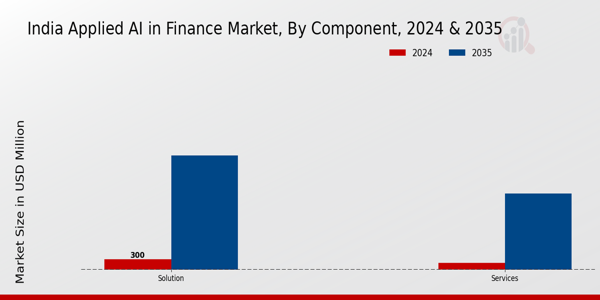

Applied AI in Finance Market Component Insights

The India Applied AI in Finance Market, particularly within the Component segment, is witnessing a robust growth trajectory due to the increased adoption of advanced technologies in financial services. Solutions and Services serve as the foundation of this market, with solutions focusing on AI-driven applications such as risk assessment, fraud detection, predictive analytics, and customer relationship management.

These solutions streamline operations and enhance decision-making processes across financial institutions, making them indispensable in today's digital economy.On the other hand, services play a crucial role in supporting the integration and deployment of such AI technologies, aiding organizations in navigating the complexities associated with implementation and maintenance.

The demand for specialized consulting and training services is on the rise as companies seek to harness the full potential of AI for competitive advantage. The growing emphasis on data security and compliance in India's financial landscape further reinforces the need for reliable solutions and effective services that not only drive efficiency but also ensure adherence to regulations.

With the influx of investments and initiatives by the government aimed at promoting digital finance, there is a significant opportunity for growth within this segment, paving the way for innovation and enhanced service delivery. The rise in mobile banking and digital payment systems is also contributing to the expansion of the Component segment, necessitating sophisticated AI solutions to provide personalized customer experiences and streamline operations.

As India continues to enhance its technological infrastructure, the Applied AI in Finance Market is well-positioned to attract further investment and propel the economy towards a more data-driven future, reinforcing its importance in the country's strategic planning for financial services.Overall, the Component segment in the India Applied AI in Finance Market is characterized by a dynamic interplay between innovative solutions and essential services, mirroring the evolving landscape of technology and finance in the region.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Applied AI in Finance Market Deployment Mode Insights

The Deployment Mode segment of the India Applied AI in Finance Market is gaining significant traction, driven by the increasing need for rapid data processing and enhanced operational efficiency in financial services. With the shift towards digital transformation, organizations are increasingly opting for cloud-based solutions, which offer scalability, flexibility, and reduced costs when compared to traditional models. The cloud deployment models allow financial institutions to leverage advanced algorithms and machine learning capabilities, thus streamlining their operations and enhancing customer experience.

Meanwhile, on-premise solutions continue to hold relevance, particularly among large banks and financial entities that prioritize data security and compliance with regulatory frameworks. This preference for on-premise deployments reflects the focus on safeguarding sensitive financial data. The market statistics suggest that as more organizations adopt AI-driven technologies, the Deployment Mode segment will play a pivotal role in shaping the future of the financial industry in India. Furthermore, the ongoing advancements in internet connectivity and infrastructure are paving the way for the growth of both deployment modes, addressing the evolving demands of the fintech landscape.

Applied AI in Finance Market Application Insights

The India Applied AI in Finance Market is witnessing a substantial evolution, particularly in the Application segment, as it incorporates technologies that enhance operational efficiency and customer experiences. Virtual Assistants hold a significant position, as they streamline customer interactions and support services in finance-related queries, ultimately improving client satisfaction. Furthermore, Business Analytics and Reporting tools play a critical role in transforming raw data into actionable insights, allowing financial institutions to make informed decisions quickly.

Customer Behavioral Analytics is becoming increasingly important in understanding consumer preferences and predicting trends, enabling tailored service offerings that foster customer loyalty. Other applications in this segment are also emerging, reflecting the diverse needs of the financial sector in India. With the growing trend toward digitalization and the government's push for a cashless economy, the Application segment is poised for continuous growth, demonstrating the potential of Applied AI to reshape the financial landscape.

From a broader perspective, the increasing adoption of mobile banking and digital finance in urban areas further underpins the significance of these applications, offering numerous opportunities for innovation within the industry.

Applied AI in Finance Market Organization Size Insights

The Organization Size segment of the India Applied AI in Finance Market reveals a significant diversification in adoption across various business scales, particularly SMEs and Large Enterprises. SMEs are increasingly leveraging applied AI technologies to enhance operational efficiencies, optimize customer experiences, and reduce costs, positioning them as agile competitors in the finance sector. Meanwhile, Large Enterprises dominate the landscape due to substantial investments in cutting-edge technologies that enable advanced data analytics and decision-making capabilities.This segment benefits from a growing trend towards digital transformation, driven by a regulatory environment that encourages innovation within the financial services industry.

Furthermore, the rise of fintech solutions and the demand for enhanced security measures contribute to the rapid growth of AI applications in finance, creating opportunities for both SMEs and Large Enterprises to innovate and collaborate. The influence of government initiatives aimed at promoting digital literacy and technology adoption plays a crucial role in expanding the application of AI within the financial sector across diverse organization sizes, highlighting a balance between accessibility for smaller firms and advanced capabilities among larger organizations.

India Applied AI in Finance Market Key Players and Competitive Insights

The India Applied AI in Finance Market is witnessing significant competition, driven by the rapid advancements in technology and increasing demand for efficient financial services. Players in this market are investing heavily in artificial intelligence to enhance customer experience, streamline operations, and optimize risk management. The growing emphasis on automation, data analytics, and machine learning is reshaping traditional banking and finance practices, fostering an environment where innovation and technology converge to deliver cutting-edge solutions. Fintech startups are aggressively entering the landscape, complementing established financial institutions, while regulatory frameworks are evolving to accommodate the growing role of AI in financial services.

This competitive arena is marked by collaborations, investments, and emerging business models that underline the pivotal role of applied AI in shaping the future of finance in India.

ICICI Bank has emerged as a formidable player in the India Applied AI in Finance Market, leveraging its extensive customer base and technological capabilities to integrate AI solutions into various banking services. The institution has made significant strides in using artificial intelligence to enhance customer interactions, improve credit assessment, and strengthen fraud detection mechanisms. With a strong digital presence, ICICI Bank has been at the forefront of utilizing AI to streamline operations and offer personalized banking experiences.

The bank's willingness to adopt innovative technologies has enabled it to remain competitive and meet the changing demands of its customers, setting a benchmark for other institutions in the market.

Cognizant has carved a niche for itself in the India Applied AI in Finance Market by providing advanced technological solutions that empower financial institutions to harness the power of AI. Known for its consultancy and technology services, Cognizant offers a suite of products designed to optimize operations and enhance decision-making processes for banks and financial organizations. The company has developed frameworks for risk management, regulatory compliance, and customer engagement, helping institutions achieve a competitive edge. Cognizant's strategic partnerships and mergers have fortified its position in the market, allowing for seamless integration of AI capabilities into traditional financial services.

With its strong market presence, the company continues to innovate, focusing on delivering tailored solutions that meet the dynamic needs of the Indian financial landscape.

Key Companies in the India Applied AI in Finance Market Include:

- ICICI Bank

- Cognizant

- Mindtree

- Wipro

- Infosys

- Teleperformance

- Fractal Analytics

- Mu Sigma

- Tata Consultancy Services

- Axis Bank

- Quantemplate

- HDFC Bank

- Quantiphi

- Nucleus Software

India Applied AI in Finance Industry Developments

The India Applied AI in Finance Market has witnessed significant developments in recent months, showcasing a dynamic landscape for leading companies. ICICI Bank and HDFC Bank have been at the forefront, incorporating AI-driven solutions for improving customer experiences and risk management. In August 2023, Tata Consultancy Services announced a partnership with a global fintech to enhance its AI capabilities in financial services. Cognizant has also been increasing investments in AI technologies, focusing on delivering enhanced analytics.

Moreover, Fractal Analytics has made strides with client engagement, leveraging AI for predictive analytics and better decision-making in finance. In terms of mergers and acquisitions, Wipro acquired a startup specializing in AI for financial services in July 2023, emphasizing its commitment to augmenting its capabilities in the sector. Infosys is reportedly expanding its offerings in AI cybersecurity features to meet the increasing demand for secure financial transactions.

As the market grows, firms such as Axis Bank and Mu Sigma are continuously innovating to maintain competitiveness, underscoring the vibrant evolution of the applied AI landscape within the Indian financial framework.

India Applied AI in Finance Market Segmentation Insights

Applied AI in Finance Market Component Outlook

Applied AI in Finance Market Deployment Mode Outlook

Applied AI in Finance Market Application Outlook

- Virtual Assistants

- Business Analytics and Reporting

- Customer Behavioral Analytics

- Others

Applied AI in Finance Market Organization Size Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

288.74 (USD Million) |

| MARKET SIZE 2024 |

500.0 (USD Million) |

| MARKET SIZE 2035 |

5500.0 (USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

24.358% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

ICICI Bank, Cognizant, Mindtree, Wipro, Infosys, Teleperformance, Fractal Analytics, Mu Sigma, Tata Consultancy Services, Axis Bank, Quantemplate, HDFC Bank, Quantiphi, Zebra Medical Vision, Nucleus Software |

| SEGMENTS COVERED |

Component, Deployment Mode, Application, Organization Size |

| KEY MARKET OPPORTUNITIES |

Fraud detection enhancements, Customer experience personalization, Risk management optimization, Regulatory compliance automation, Investment analysis improvement |

| KEY MARKET DYNAMICS |

Growing demand for efficiency, Regulatory compliance requirements, Enhanced customer experience, Risk management optimization, Increase in data analytics adoption |

| COUNTRIES COVERED |

India |

Frequently Asked Questions (FAQ):

The projected market size of the India Applied AI in Finance Market in 2024 is valued at 500.0 USD Million.

The expected CAGR for the India Applied AI in Finance Market from 2025 to 2035 is 24.358%.

The market size of the India Applied AI in Finance Market is expected to reach 5500.0 USD Million by 2035.

The 'Solution' segment of the India Applied AI in Finance Market is projected to be valued at 3300.0 USD Million in 2035.

The expected value of the 'Services' segment in the India Applied AI in Finance Market in 2024 is 200.0 USD Million.

Major players in the India Applied AI in Finance Market include ICICI Bank, Cognizant, Wipro, and HDFC Bank.

Growth opportunities in the India Applied AI in Finance Market are driven by increasing demand for automation and predictive analytics.

Challenges facing the India Applied AI in Finance Market include regulatory compliance and data security issues.

The current global scenario has increased the demand for digital solutions in the India Applied AI in Finance Market.

The anticipated growth rate for the India Applied AI in Finance Market between 2025 and 2035 is a robust 24.358%.