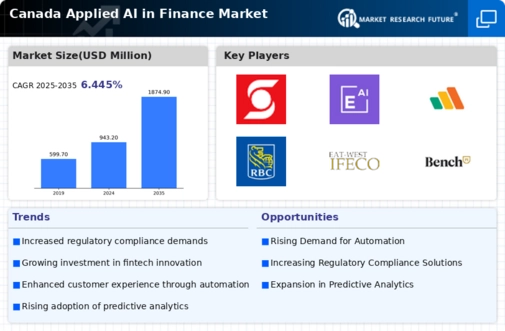

The Canada Applied AI in Finance Market is experiencing significant evolution, driven by advancements in technology and a growing demand for enhanced financial services. The competitive landscape is characterized by a diverse array of players, including traditional banks, fintech companies, and emerging AI-driven startups. These entities leverage data analytics, machine learning, and artificial intelligence to optimize financial operations, improve customer experiences, and bolster risk management processes.

Organizations in this market are competing not only on technology but also on their ability to provide innovative solutions that cater to the specific needs of Canadian consumers, thereby reshaping the financial services ecosystem.The Bank of Nova Scotia has firmly established its presence in the Canada Applied AI in Finance Market, showcasing strengths that further its competitive edge. As one of Canada's largest banks, it possesses extensive customer data and a strong technological infrastructure, allowing for the implementation of AI solutions that enhance customer service and streamline operations.

The Bank of Nova Scotia focuses on integrating AI into various aspects of its operations, such as fraud detection and customer personalization, thus improving efficiency and customer satisfaction.

Its strong brand reputation and extensive branch network across Canada create a robust platform for deploying innovative AI technologies that cater to diverse customer needs, making it a formidable player in the market.Wealthsimple is positioned as a prominent competitor in the Canadian Applied AI in Finance Market, defined by its focus on new-age digital investment services. Known for its user-friendly platform, Wealthsimple provides a range of services, including robo-advisory, stock trading, and tax-loss harvesting, all enhanced with advanced AI algorithms. This allows the company to offer personalized investment strategies at low costs.

Wealthsimple has also made strides in partnerships and acquisitions to enhance its service offerings, significantly broadening its market reach. Its commitment to democratizing finance in Canada and leveraging AI to optimize investment decisions reinforces its strength in the competitive financial landscape, making it a key player as it continues to innovate and scale.