Rising Smartphone Penetration

The proliferation of smartphones has been a pivotal driver in the Mobile Banking Market. As of October 2025, smartphone penetration rates have reached approximately 80% in many regions, facilitating easier access to banking services. This trend indicates that more consumers are likely to engage with mobile banking applications, which are designed to be user-friendly and accessible. The convenience of managing finances through mobile devices has led to a surge in mobile banking users, with estimates suggesting that the number of mobile banking users could exceed 2 billion by the end of 2025. This growing user base is expected to further stimulate innovation and competition within the Mobile Banking Market, as financial institutions strive to enhance their offerings and improve customer experience.

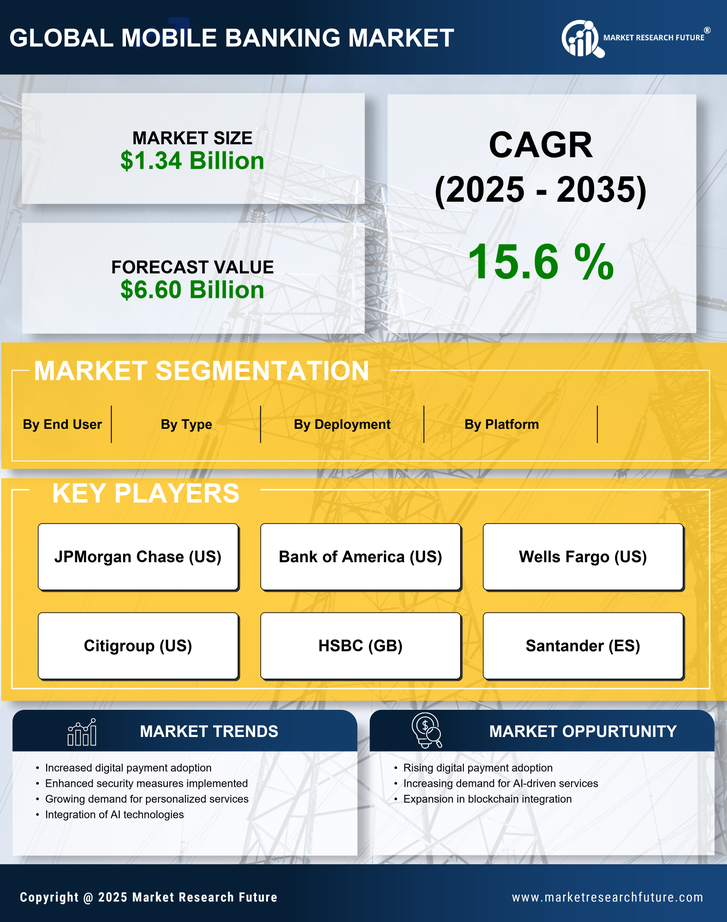

Shift Towards Cashless Transactions

The ongoing shift towards cashless transactions is significantly influencing the Mobile Banking Market. As consumers increasingly prefer digital payment methods, the demand for mobile banking solutions has surged. Recent data indicates that cashless transactions have grown by over 30% in various markets, reflecting a broader trend towards digitalization in financial services. This transition is not merely a response to consumer preferences but also a strategic move by financial institutions to streamline operations and reduce costs associated with cash handling. Consequently, the Mobile Banking Market is witnessing a robust expansion, as banks and fintech companies innovate to provide seamless and secure mobile payment solutions that cater to the evolving needs of consumers.

Increased Focus on Financial Inclusion

The drive towards financial inclusion is a crucial factor propelling the Mobile Banking Market. Many underserved populations lack access to traditional banking services, and mobile banking presents a viable solution to bridge this gap. As of October 2025, initiatives aimed at promoting financial literacy and access to mobile banking services are gaining momentum in various regions. This focus on inclusion is not only a social imperative but also a business opportunity for financial institutions. By catering to unbanked and underbanked populations, the Mobile Banking Market is poised for substantial growth, as more individuals gain access to essential financial services through mobile platforms.

Regulatory Support for Digital Banking

Regulatory frameworks are evolving to support the growth of the Mobile Banking Market. Governments and financial authorities are increasingly recognizing the importance of digital banking in promoting financial inclusion and economic growth. As of October 2025, several countries have implemented favorable regulations that encourage the adoption of mobile banking services, such as simplified licensing processes and enhanced consumer protection measures. This regulatory support not only fosters innovation but also instills consumer confidence in mobile banking solutions. The Mobile Banking Market is likely to benefit from these developments, as more financial institutions are encouraged to invest in mobile technologies and expand their service offerings to meet regulatory standards.

Technological Advancements in Mobile Banking

Technological advancements are reshaping the Mobile Banking Market, driving innovation and enhancing user experience. The integration of advanced technologies such as blockchain, artificial intelligence, and machine learning is revolutionizing how financial services are delivered. As of October 2025, many banks are leveraging these technologies to improve security, streamline operations, and offer personalized services to customers. For instance, AI-driven analytics are enabling banks to better understand customer behavior and preferences, leading to more tailored offerings. This technological evolution is likely to attract more users to mobile banking platforms, thereby expanding the Mobile Banking Market and fostering a competitive landscape among financial service providers.