Rising Healthcare Expenditure

The increase in healthcare expenditure in the UK is a crucial factor driving the cardiac imaging-software market. With the government and private sectors allocating more funds towards healthcare services, there is a notable emphasis on improving diagnostic capabilities. The UK healthcare system has seen a rise in budget allocations, which has led to the procurement of advanced imaging technologies. This financial commitment suggests a growing recognition of the importance of early diagnosis and treatment of cardiovascular diseases. Consequently, the cardiac imaging-software market is likely to experience growth as healthcare facilities invest in software solutions that enhance imaging capabilities and improve patient management.

Growing Demand for Personalized Medicine

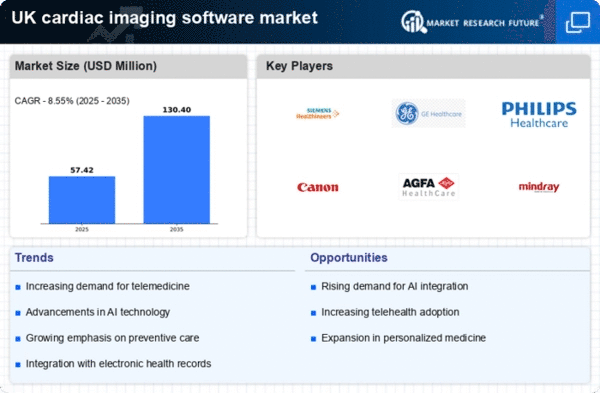

The shift towards personalized medicine is emerging as a significant driver for the cardiac imaging-software market. As healthcare providers increasingly focus on tailoring treatments to individual patient profiles, the need for advanced imaging solutions that can provide detailed insights into cardiac health becomes paramount. This trend is supported by the growing body of research indicating that personalized approaches can lead to better patient outcomes. In the UK, healthcare systems are likely to invest in cardiac imaging software that supports personalized treatment plans, thereby enhancing the overall effectiveness of cardiovascular care. The cardiac imaging-software market may see substantial growth as providers seek tools that facilitate this transition towards more individualized healthcare.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in the UK is a primary driver for the cardiac imaging-software market. According to recent health statistics, cardiovascular diseases account for approximately 27% of all deaths in the UK, highlighting a critical need for effective diagnostic tools. This growing health concern propels healthcare providers to adopt advanced imaging technologies to enhance patient outcomes. The cardiac imaging-software market is expected to benefit from this trend. Hospitals and clinics are seeking to implement solutions that facilitate early detection and treatment.. Furthermore, the demand for accurate imaging solutions is likely to increase as healthcare professionals aim to improve diagnostic accuracy and reduce the burden of cardiovascular diseases on the healthcare system.

Technological Advancements in Imaging Techniques

Technological innovations in imaging techniques are significantly influencing the cardiac imaging-software market. The introduction of advanced modalities such as 3D echocardiography and cardiac MRI has transformed diagnostic capabilities, allowing for more precise assessments of cardiac conditions. These advancements not only enhance image quality but also improve workflow efficiency in clinical settings. As healthcare facilities in the UK invest in state-of-the-art imaging technologies, the demand for sophisticated software solutions that can process and analyze complex imaging data is expected to rise. This trend indicates a shift towards more integrated and automated systems, which could potentially streamline operations and improve patient care in the cardiac imaging-software market.

Regulatory Initiatives Promoting Advanced Imaging Solutions

Regulatory initiatives in the UK aimed at promoting advanced imaging solutions are playing a pivotal role in shaping the cardiac imaging-software market. The government has introduced various policies to encourage the adoption of innovative technologies in healthcare, which includes support for advanced imaging software. These initiatives are designed to ensure that healthcare providers have access to the latest tools that can improve diagnostic accuracy and patient care. As a result, the cardiac imaging-software market is expected to benefit from increased investment and support from regulatory bodies, fostering an environment conducive to the development and implementation of cutting-edge imaging solutions.