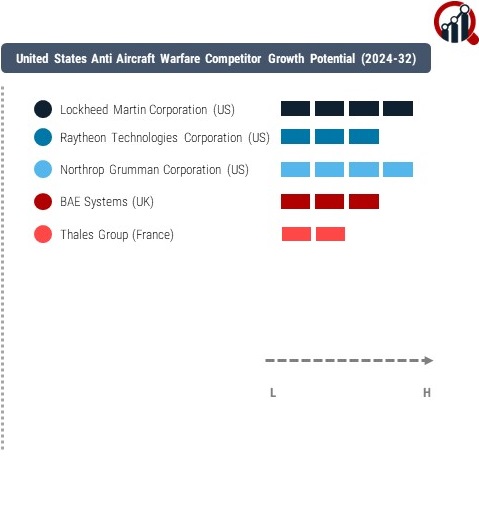

Top Industry Leaders in the United States Anti Aircraft Warfare Market

US Anti Aircraft Warfare Market

Key players in the US Anti-Aircraft Warfare market focus on innovation, technological advancement, and strategic partnerships to maintain their competitive edge. They invest heavily in research and development to enhance the effectiveness of their systems, while also pursuing collaborations with other defense contractors and government agencies to expand their market reach.

Strategies Adopted By Key Players US Anti Aircraft Warfare Market

- Lockheed Martin Corporation (US)

- Raytheon Technologies Corporation (US)

- Northrop Grumman Corporation (US)

- BAE Systems (UK)

- Thales Group (France)

Factors for Market Share Analysis: Market share in the US Anti-Aircraft Warfare sector is determined by various factors including technological superiority, reliability, cost-effectiveness, and ability to meet the specific requirements of the US military. Companies that offer comprehensive solutions encompassing detection, tracking, and interception capabilities tend to command a larger market share.

New and Emerging Companies: Despite the dominance of established players, there are several new and emerging companies entering the US Anti-Aircraft Warfare market. These companies often specialize in niche areas such as drone defense systems, electronic warfare, or cyber security. Some notable newcomers include Anduril Industries, Shield AI, and Citadel Defense, which are gaining traction with innovative approaches to aerial defense.

Industry News: Recent developments in the US Anti-Aircraft Warfare market include the introduction of next-generation systems designed to counter evolving threats such as hypersonic missiles and unmanned aerial vehicles (UAVs). Additionally, there is a growing emphasis on incorporating artificial intelligence and machine learning capabilities into anti-aircraft systems to improve response times and accuracy.

Current Company Investment Trends: Major players in the US Anti-Aircraft Warfare market continue to invest significant resources in expanding their product portfolios and enhancing existing capabilities. This includes investments in sensor technology, missile defense systems, and networked command and control systems. Additionally, there is a growing trend towards the integration of cyber security measures to protect against emerging threats in the digital domain.

Overall Competitive Scenario: The US Anti-Aircraft Warfare market remains highly competitive, driven by rapid technological advancements and evolving security threats. Established companies leverage their experience and financial resources to maintain market leadership, while new entrants disrupt the industry with innovative solutions. Strategic collaborations and government contracts play a crucial role in shaping the competitive landscape, with companies vying for lucrative opportunities to supply cutting-edge anti-aircraft systems to the US military and allied nations. As the demand for advanced aerial defense capabilities continues to rise, competition in the US Anti-Aircraft Warfare market is expected to intensify, driving further innovation and investment in the years to come.

Recent Development:

April 2023, Lockheed Martin, based in Grand Prairie, Texas, secured a contract modification worth USD 2.45 billion for the production of Phased Array Tracking Radar Intercept on Target (PATRIOT) Advanced Capability-3 missiles.

June 2023, Raytheon integrated air defense systems, including radars, command and control systems, and interceptors, to develop a comprehensive multilayered defense system for safeguarding air bases.