Market Analysis

In-depth Analysis of UPS Battery Market Industry Landscape

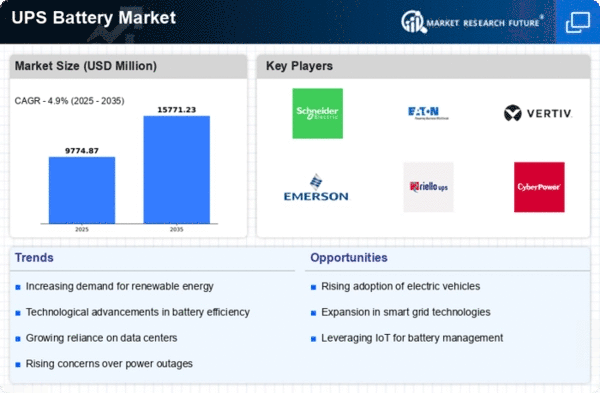

The UPS (Uninterruptible Power Supply) battery market is a dynamic and quickly developing area that assumes a critical part in guaranteeing continuous power supply for different applications. The market elements of UPS batteries are impacted by a mix of variables, going from innovative progressions to the rising interest for dependable power arrangements.

One vital driver of market elements in the UPS battery industry is the steady advancement in battery innovation. As progressions in battery science and configuration keep on arising, makers can deliver batteries with higher energy thickness, longer life cycles, and further developed execution. These mechanical upgrades not just improve the general productivity of UPS frameworks yet additionally add to a more economical and harmless to the ecosystem power supply.

The developing dependence on electronic gadgets and basic foundation in different ventures is another huge variable forming the market elements of UPS batteries. With a rising number of organizations and families relying upon a constant power supply, the interest for solid UPS arrangements has flooded. This pattern is especially obvious in areas like IT, medical services, broadcast communications, and assembling, where even a short power interference can bring about information misfortune, hardware harm, or functional free time.

Market elements are additionally affected by the rising consciousness of the significance of reinforcement power arrangements in moderating the effect of blackouts. As organizations and people become more aware of the potential monetary and functional misfortunes related with influence interruptions, the reception of UPS frameworks with cutting edge battery innovations is supposed to develop. This elevated mindfulness is driving interests in solid power framework and adding to the development of the UPS battery market.

The cutthroat scene further adds to the market elements, with different makers competing for piece of the pie through item separation and cost seriousness. As a consequence of this, there is a constant focus on research and development with the goal of developing batteries that not only meet the performance requirements of UPS systems but also provide additional features like smart monitoring, remote management, and modular designs. This serious climate cultivates advancement and drives the market toward more productive and financially savvy UPS battery arrangements.

Unofficial laws and drivers likewise assume a part in molding the market elements of UPS batteries. Regulations promoting the use of eco-friendly battery technologies have resulted from environmental concerns and the push for sustainable energy solutions. In order to meet these regulations and meet global sustainability goals, UPS battery manufacturers are making investments in the creation of recyclable and environmentally friendly materials.

Technological advancements, a growing awareness of the significance of backup power, rising demand for dependable power solutions, competitive forces, and regulatory influences all contribute to the dynamic and multifaceted dynamics of the UPS battery market. As the world turns out to be all the more carefully associated and reliant upon continuous power, the UPS battery market is ready for proceeded with development and development, with producers endeavoring to meet the advancing necessities of different enterprises and add to a stronger and feasible power framework.

Leave a Comment