Growth of the Bioeconomy

The burgeoning bioeconomy in the United States is significantly impacting the US Agricultural Surfactants Market. As industries shift towards renewable resources, the demand for biobased surfactants is on the rise. These surfactants, derived from natural sources, are gaining popularity due to their lower environmental footprint and effectiveness. The US government is actively promoting the use of biobased products through various initiatives, which is likely to bolster market growth. This trend indicates a shift in consumer preferences towards sustainable products, positioning the US Agricultural Surfactants Market favorably for future expansion.

Rising Crop Protection Needs

The increasing prevalence of pests and diseases in US agriculture is driving the demand for effective crop protection solutions, thereby influencing the US Agricultural Surfactants Market. Surfactants play a crucial role in enhancing the performance of pesticides and herbicides, ensuring better adhesion and penetration. As farmers face challenges from resistant pest populations, the need for advanced surfactant formulations that improve the efficacy of crop protection products becomes paramount. Market data indicates a steady increase in the adoption of surfactants in crop protection applications, suggesting a robust growth trajectory for the US Agricultural Surfactants Market.

Regulatory Framework and Compliance

The regulatory landscape surrounding agricultural chemicals is evolving, impacting the US Agricultural Surfactants Market. Stricter regulations on chemical usage and environmental safety are prompting manufacturers to innovate and reformulate their products. Compliance with the Environmental Protection Agency (EPA) guidelines is essential for market players, as non-compliance can lead to significant penalties. This regulatory pressure is likely to drive the demand for safer, more effective surfactants that meet these stringent standards. As a result, companies are investing in research to develop compliant products, which could enhance their market position within the US Agricultural Surfactants Market.

Increasing Demand for Sustainable Agriculture

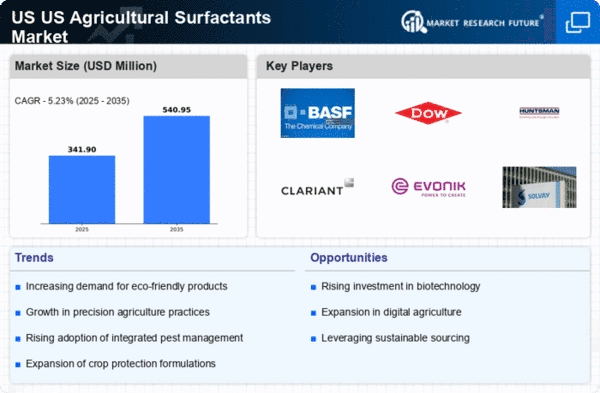

The US Agricultural Surfactants Market is experiencing a notable shift towards sustainable agricultural practices. Farmers are increasingly adopting eco-friendly surfactants that enhance the efficacy of pesticides and fertilizers while minimizing environmental impact. This trend is driven by consumer demand for organic produce and the need for sustainable farming methods. According to recent data, the market for biobased surfactants is projected to grow significantly, reflecting a broader commitment to sustainability in agriculture. As a result, manufacturers are focusing on developing innovative surfactant formulations that align with these sustainability goals, thereby driving growth in the US Agricultural Surfactants Market.

Technological Innovations in Agricultural Practices

Technological advancements are playing a pivotal role in shaping the US Agricultural Surfactants Market. The integration of precision agriculture techniques, such as drone technology and data analytics, is enhancing the application efficiency of surfactants. These innovations allow for targeted application, reducing waste and improving crop yields. Furthermore, the development of advanced surfactant formulations that improve the wetting and spreading properties of agrochemicals is gaining traction. This is particularly relevant as farmers seek to optimize their input costs while maximizing output. The ongoing research and development in this area suggest a promising future for the US Agricultural Surfactants Market.