Expansion of Cloud Computing Services

The expansion of cloud computing services is significantly influencing the US Application Release Automation Market. As more organizations migrate their operations to the cloud, the demand for automation tools that facilitate seamless application deployment in cloud environments is increasing. Cloud-based application release automation solutions offer scalability, flexibility, and cost-effectiveness, making them attractive to businesses of all sizes. Recent statistics indicate that the cloud services market in the US is projected to grow substantially, further driving the need for effective release automation strategies. This trend suggests that organizations are prioritizing cloud compatibility in their automation efforts, leading to a more integrated approach to application release management in the evolving digital landscape.

Growing Demand for Faster Release Cycles

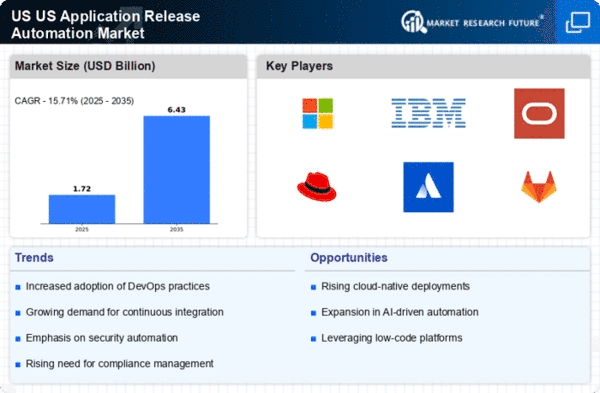

The US Application Release Automation Market is experiencing a notable surge in demand for faster release cycles. Organizations are increasingly recognizing the need to accelerate their software delivery processes to remain competitive. According to recent data, companies that implement application release automation can reduce their release times by up to 50 percent. This demand is driven by the necessity for businesses to respond swiftly to market changes and customer feedback. As a result, the adoption of automation tools is becoming a strategic priority for many US enterprises. The ability to deploy applications rapidly not only enhances operational efficiency but also improves customer satisfaction, thereby solidifying the importance of application release automation in the current market landscape.

Increased Focus on Compliance and Regulatory Standards

In the US Application Release Automation Market, there is an increasing focus on compliance and regulatory standards, particularly in sectors such as finance, healthcare, and government. Organizations are required to adhere to stringent regulations that govern data security and software integrity. As a result, application release automation tools that incorporate compliance features are gaining traction. These tools help organizations ensure that their software releases meet necessary regulatory requirements, thereby reducing the risk of non-compliance penalties. The growing awareness of the importance of compliance is likely to drive the adoption of application release automation solutions, as businesses seek to mitigate risks associated with regulatory violations while maintaining efficient release processes.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies into the US Application Release Automation Market is transforming how organizations manage their software releases. AI and ML can analyze vast amounts of data to predict potential issues, optimize release schedules, and enhance overall performance. This technological advancement is expected to drive significant growth in the market, as companies seek to leverage these capabilities to improve their release processes. By automating decision-making and reducing human error, AI and ML can lead to more reliable and efficient releases. As organizations increasingly adopt these technologies, the market for application release automation is likely to expand, reflecting a shift towards more intelligent and adaptive release strategies.

Rising Importance of Continuous Integration and Continuous Deployment

The emphasis on continuous integration (CI) and continuous deployment (CD) practices is a key driver in the US Application Release Automation Market. Organizations are increasingly adopting CI/CD pipelines to streamline their development processes and enhance collaboration among teams. This shift is indicative of a broader trend towards agile methodologies, which prioritize iterative development and rapid feedback loops. Data suggests that companies utilizing CI/CD practices can achieve deployment frequency rates that are significantly higher than those relying on traditional methods. As the demand for faster and more reliable software releases continues to grow, the integration of application release automation within CI/CD frameworks is becoming essential for organizations aiming to maintain a competitive edge.