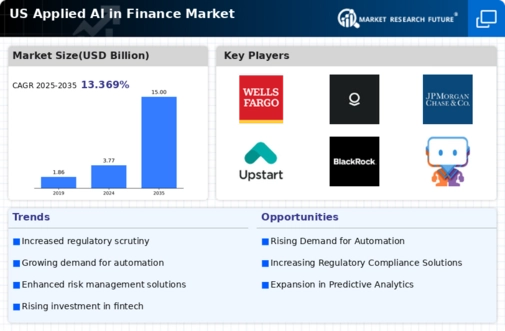

The US Applied AI in Finance Market is characterized by rapid advancements and intense competition, driven by the increasing adoption of artificial intelligence technologies. Financial institutions are increasingly leveraging AI to enhance operational efficiency, improve customer experience, and manage risks more effectively. With a focus on big data analytics, machine learning algorithms, and automation, firms are innovating to meet shifting consumer demands and regulatory requirements. As companies strive for a competitive edge, strategic partnerships and technological investments are becoming commonplace, reshaping the landscape of the financial services sector.

Understanding the competitive dynamics within this market is crucial for stakeholders seeking to navigate its complexities and capitalize on emerging opportunities.

Wells Fargo has established itself as a formidable player in the US Applied AI in Finance Market, harnessing technology to drive innovation across its banking services. The company has invested heavily in machine learning and advanced analytics to improve its risk management practices and enhance the personalization of financial services for its customers. Wells Fargo's strength lies in its extensive network and customer base, allowing it to capture valuable data that informs its AI initiatives.

The firm focuses on leveraging AI to streamline operations, optimize marketing strategies, and improve customer engagement, ensuring that it remains competitive in an increasingly digital landscape. This commitment to technological advancement positions Wells Fargo as a leader within the financial sector in the United States.

Palantir Technologies has carved out a notable presence in the US Applied AI in Finance Market, with its cutting-edge data analytics platforms playing a pivotal role in driving insights for financial institutions. The company's primary offerings, such as Palantir Foundry, empower clients to integrate, analyze, and visualize vast amounts of data, enhancing decision-making processes in areas such as risk assessment and compliance. Palantir's strengths lie in its innovative technology and ability to address complex challenges faced by financial organizations.

The company has pursued strategic partnerships and collaborations to strengthen its market position, and it continues to explore mergers and acquisitions to expand its capabilities within the finance sector. By aligning its solutions with the specific needs of financial institutions, Palantir Technologies solidifies its role as a key player in leveraging AI for the industry's future in the US market.