Growth of Streaming Services

The audio ic market is significantly influenced by the rapid growth of streaming services, which have transformed how consumers access and enjoy audio content. In 2025, the revenue generated from streaming services in the US is projected to exceed $30 billion, highlighting the increasing reliance on digital platforms for music and audio consumption. This shift necessitates high-performance audio components to deliver an optimal listening experience, thereby driving demand for advanced audio ic solutions. As streaming platforms continue to expand their offerings, the audio ic market is likely to see increased investment in technologies that enhance audio fidelity and user engagement, further solidifying its position within the broader entertainment ecosystem.

Advancements in Audio Technology

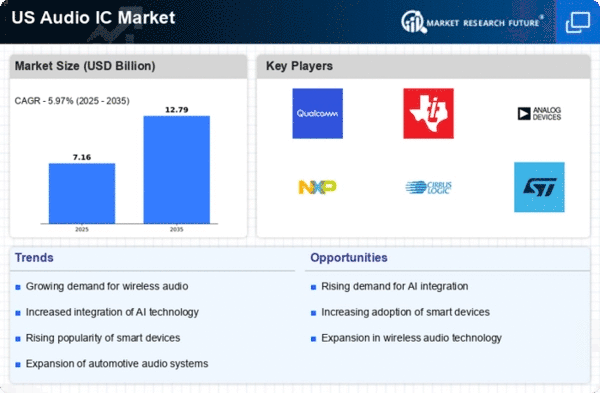

Technological advancements significantly impact the audio ic market, as innovations in audio processing and sound enhancement technologies emerge. The integration of artificial intelligence and machine learning into audio devices allows for personalized sound experiences, which appears to resonate well with consumers. In 2025, the audio technology sector is expected to grow at a CAGR of around 8%, indicating a strong market potential for audio ic manufacturers. These advancements not only improve sound quality but also enable features such as noise cancellation and spatial audio, which are increasingly sought after in modern audio devices. As a result, the audio ic market is likely to benefit from these technological developments, driving growth and encouraging further investment in research and development.

Increased Focus on Mobile Gaming

The audio ic market is experiencing a boost from the increased focus on mobile gaming, which has become a dominant form of entertainment among consumers. As mobile gaming continues to gain traction, the demand for high-quality audio components that enhance the gaming experience is on the rise. In 2025, the mobile gaming market in the US is projected to reach approximately $25 billion, indicating a substantial opportunity for audio ic manufacturers. This growth is likely to drive innovation in audio technologies, as gamers seek immersive soundscapes and realistic audio effects. As a result, the audio ic market may see a surge in demand for specialized audio solutions designed specifically for gaming applications, further diversifying its product offerings.

Surge in Consumer Electronics Demand

The Audio IC Market experiences a notable surge in demand driven by the increasing popularity of consumer electronics. As devices such as smartphones, tablets, and smart speakers become ubiquitous, the need for high-quality audio components intensifies. In 2025, the consumer electronics sector in the US is projected to reach approximately $400 billion, with audio components playing a crucial role in enhancing user experience. This trend indicates a robust growth trajectory for the audio ic market, as manufacturers strive to meet consumer expectations for superior sound quality. Furthermore, the proliferation of streaming services and digital content consumption further fuels this demand, compelling audio ic manufacturers to innovate and provide advanced solutions that cater to the evolving preferences of consumers.

Rising Adoption of Smart Home Devices

The audio ic market is poised for growth due to the rising adoption of smart home devices, which integrate audio functionalities into everyday living. As consumers increasingly seek convenience and connectivity, smart speakers and home automation systems are becoming commonplace. In 2025, the smart home market in the US is expected to surpass $100 billion, with audio components being a vital aspect of these systems. This trend suggests a growing need for audio ic solutions that can seamlessly integrate with various smart home technologies, enhancing user experience through voice control and multi-room audio capabilities. Consequently, the audio ic market is likely to benefit from this trend, as manufacturers develop innovative products tailored to the smart home ecosystem.