Increased Investment in R&D

Investment in research and development (R&D) within the automotive carbon-fiber-composites market is on the rise, as manufacturers seek innovative solutions to enhance performance and reduce costs. Companies are allocating substantial budgets to explore new composite formulations and manufacturing techniques, which could lead to breakthroughs in material properties and production efficiency. This trend is likely to foster collaboration between automotive manufacturers and material scientists, potentially resulting in the introduction of advanced carbon-fiber composites that are more affordable and easier to produce. Such advancements may further stimulate market growth, as they align with the industry's push for sustainable and efficient vehicle designs.

Rising Fuel Efficiency Standards

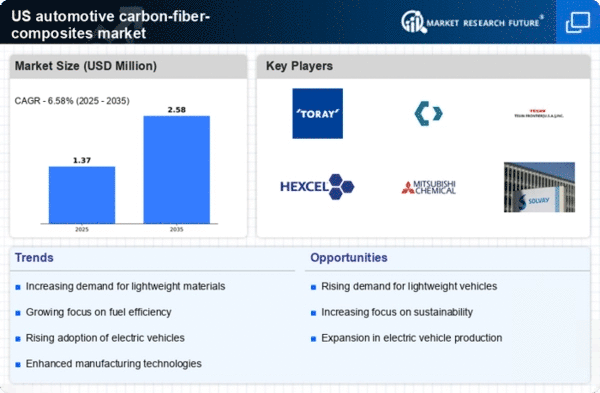

The automotive carbon-fiber-composites market is experiencing a surge in demand due to the implementation of stringent fuel efficiency standards in the US. Regulatory bodies are increasingly mandating that automakers reduce emissions and improve fuel economy, which has led to a greater emphasis on lightweight materials. Carbon-fiber composites, known for their high strength-to-weight ratio, are becoming a preferred choice for manufacturers aiming to meet these regulations. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, driven by the need for compliance with these evolving standards.

Expansion of Electric Vehicle Market

The expansion of the electric vehicle (EV) market is significantly influencing the automotive carbon-fiber-composites market. As the demand for EVs continues to rise, manufacturers are seeking lightweight materials to enhance battery efficiency and overall vehicle range. Carbon-fiber composites are particularly advantageous in this context, as they contribute to weight reduction without compromising structural integrity. The automotive carbon-fiber-composites market is expected to see substantial growth as automakers integrate these materials into their EV designs, aligning with the industry's shift towards electrification and sustainability.

Consumer Preference for High-Performance Vehicles

The automotive carbon-fiber-composites market is benefiting from a notable shift in consumer preferences towards high-performance vehicles. As consumers increasingly seek vehicles that offer superior speed, handling, and overall driving experience, manufacturers are turning to carbon-fiber composites to achieve these performance metrics. The lightweight nature of these materials allows for enhanced acceleration and improved fuel efficiency, making them attractive to performance-oriented buyers. This trend is expected to drive a significant portion of the market, as automakers incorporate carbon-fiber composites into their designs to cater to this growing demographic.

Sustainability Initiatives in Automotive Manufacturing

Sustainability initiatives are becoming a focal point in the automotive carbon-fiber-composites market, as manufacturers strive to reduce their environmental footprint. The shift towards eco-friendly production processes and materials is prompting companies to explore carbon-fiber composites, which can be produced with lower energy consumption compared to traditional materials. Furthermore, the recyclability of carbon-fiber composites is appealing to manufacturers aiming to meet sustainability goals. This trend is likely to gain momentum, as consumers and regulatory bodies increasingly prioritize environmentally responsible practices in the automotive sector.