Growth of the Automotive Industry

The automotive fuel-injection market is closely linked to the overall growth of the automotive industry in the US. As vehicle production increases, the demand for advanced fuel-injection systems rises correspondingly. The automotive industry is projected to grow at a CAGR of approximately 4% through 2027, driven by factors such as rising disposable incomes and urbanization. This growth translates into higher production volumes, which in turn fuels the demand for efficient fuel-injection technologies. Manufacturers are increasingly focusing on integrating advanced fuel systems to meet consumer expectations for performance and efficiency. Consequently, the automotive fuel-injection market is poised for expansion, as automakers seek to enhance their offerings in a competitive landscape. This interdependence between the automotive industry and the fuel-injection market underscores the importance of innovation and adaptation in meeting evolving consumer needs.

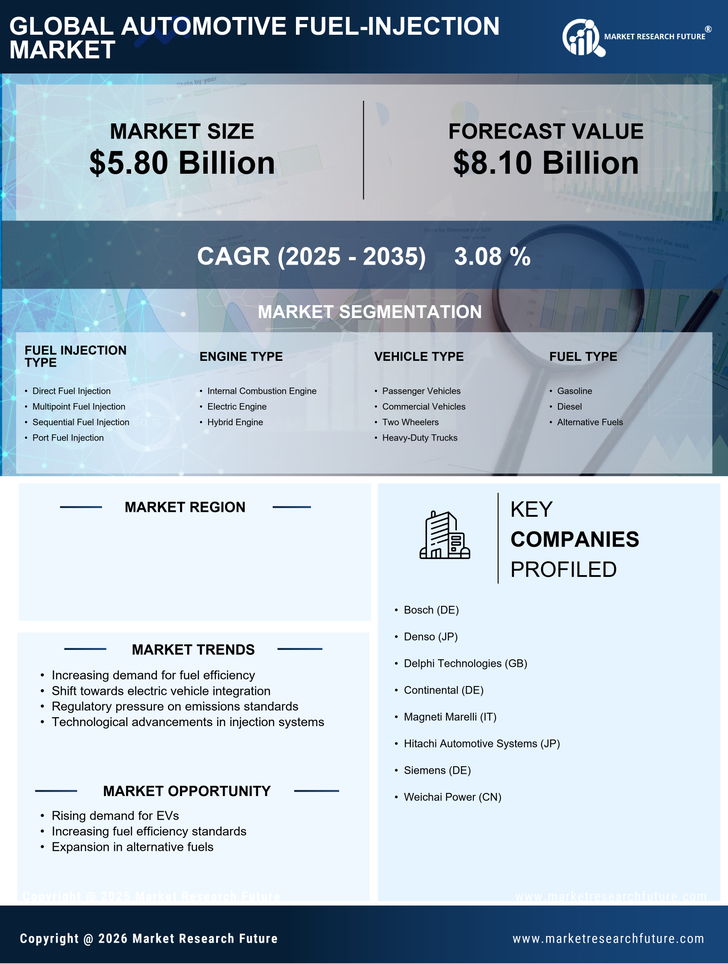

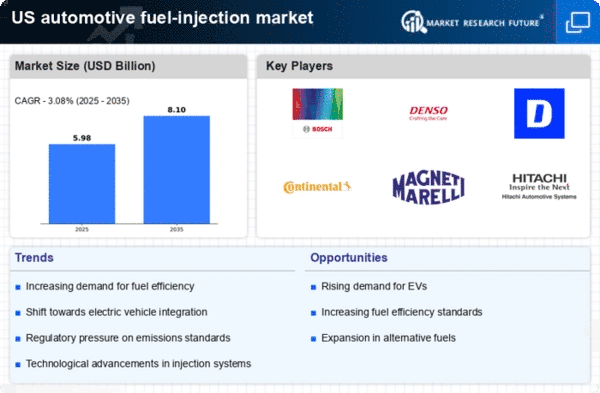

Rising Demand for Fuel Efficiency

The automotive fuel-injection market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, manufacturers are compelled to innovate. The market for fuel-efficient vehicles is projected to grow at a CAGR of approximately 5.5% through 2026. This trend is driving the adoption of advanced fuel-injection systems, which enhance combustion efficiency and reduce emissions. Consequently, the automotive fuel-injection market is likely to benefit from this shift, as automakers invest in technologies that optimize fuel consumption. The integration of direct fuel injection systems is particularly prominent, as they can improve fuel economy by up to 25% compared to traditional systems. This growing emphasis on fuel efficiency is a critical driver for the automotive fuel-injection market, shaping product development and market strategies.

Increasing Environmental Regulations

The automotive fuel-injection market is significantly influenced by stringent environmental regulations aimed at reducing vehicular emissions. In the US, the Environmental Protection Agency (EPA) has implemented regulations that mandate lower emissions from vehicles. These regulations compel manufacturers to adopt advanced fuel-injection technologies that comply with emission standards. For instance, the Tier 3 Vehicle Emission and Fuel Standards require a reduction in nitrogen oxides (NOx) and particulate matter (PM) emissions. As a result, the automotive fuel-injection market is witnessing a shift towards systems that not only meet these regulations but also enhance overall vehicle performance. The market is expected to grow as manufacturers invest in research and development to create compliant fuel-injection systems. This regulatory landscape is a driving force, pushing the automotive fuel-injection market towards innovation and sustainability.

Technological Innovations in Fuel Systems

The automotive fuel-injection market is propelled by continuous technological innovations that enhance fuel delivery systems. Advancements such as multi-port fuel injection and direct injection technologies are revolutionizing engine performance and efficiency. These innovations allow for precise fuel atomization, leading to improved combustion and reduced emissions. The market is projected to witness a growth rate of around 6% annually as manufacturers adopt these cutting-edge technologies. Furthermore, the integration of electronic control units (ECUs) with fuel-injection systems enables real-time adjustments, optimizing performance under varying driving conditions. This technological evolution not only boosts engine efficiency but also aligns with consumer preferences for high-performance vehicles. As a result, the automotive fuel-injection market is likely to expand, driven by the demand for advanced fuel systems that enhance vehicle performance and comply with regulatory standards.

Consumer Preference for Performance Vehicles

The automotive fuel-injection market is significantly influenced by changing consumer preferences towards high-performance vehicles. As consumers seek enhanced driving experiences, manufacturers are compelled to develop vehicles equipped with advanced fuel-injection systems that deliver superior power and efficiency. The trend towards performance-oriented vehicles is evident, with a growing segment of the market focusing on sports cars and high-performance models. This shift is likely to drive the adoption of direct fuel injection technologies, which can increase horsepower while maintaining fuel efficiency. The automotive fuel-injection market is expected to benefit from this trend, as manufacturers invest in research and development to create systems that cater to performance enthusiasts. This consumer-driven demand for performance vehicles is a crucial driver, shaping the future landscape of the automotive fuel-injection market.