Increasing Vehicle Production and Sales

The US Automotive Fuel Injection Pump Market is poised for growth due to the increasing production and sales of vehicles. The automotive sector in the United States has shown resilience, with a steady rise in vehicle manufacturing. According to industry reports, vehicle sales in the US are expected to reach approximately 17 million units annually by 2026. This surge in production directly correlates with the demand for fuel injection pumps, as every new vehicle requires a fuel delivery system. Additionally, the trend towards more fuel-efficient vehicles is driving manufacturers to invest in advanced fuel injection technologies. As automakers strive to enhance performance and meet consumer expectations, the demand for high-quality fuel injection pumps is likely to increase, thereby propelling market growth in the coming years.

Shift Towards Alternative Fuel Vehicles

The US Automotive Fuel Injection Pump Market is undergoing a paradigm shift as consumers increasingly gravitate towards alternative fuel vehicles (AFVs). This trend is fueled by growing environmental awareness and the desire for sustainable transportation solutions. As electric vehicles (EVs) and hybrid vehicles gain traction, the demand for specialized fuel injection systems that cater to these technologies is on the rise. Manufacturers are adapting their product offerings to include fuel injection pumps that are compatible with alternative fuels such as biofuels and hydrogen. This shift not only presents opportunities for growth but also challenges for traditional fuel injection pump manufacturers. The market is projected to expand as the adoption of AFVs continues to rise, with estimates suggesting that by 2030, nearly 30% of new vehicle sales in the US could be electric or hybrid.

Regulatory Compliance and Environmental Standards

The US Automotive Fuel Injection Pump Market is significantly influenced by stringent regulatory compliance and environmental standards. The Environmental Protection Agency (EPA) has implemented regulations aimed at reducing vehicular emissions, which has led to an increased demand for advanced fuel injection systems. These systems are designed to meet the latest emissions standards, thereby enhancing the overall efficiency of internal combustion engines. As a result, automotive manufacturers are compelled to adopt innovative fuel injection technologies to comply with these regulations. The market is expected to witness a surge in demand for fuel injection pumps that facilitate cleaner combustion processes. Furthermore, the push for sustainability and eco-friendly practices is likely to drive investments in the development of fuel injection systems that align with these environmental goals.

Technological Advancements in Fuel Injection Systems

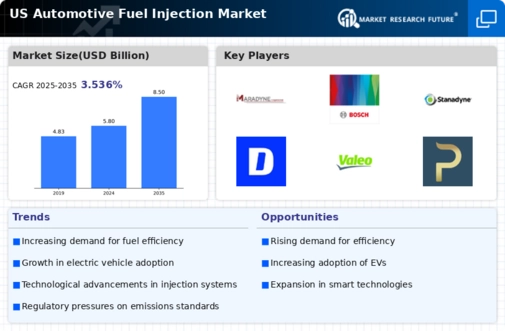

The US Automotive Fuel Injection Pump Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as direct fuel injection systems are enhancing engine efficiency and performance, leading to reduced emissions. The integration of electronic control units (ECUs) allows for precise fuel delivery, optimizing combustion processes. As a result, vehicles equipped with advanced fuel injection systems are becoming increasingly popular among consumers. According to recent data, the market for fuel injection pumps is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is driven by the demand for high-performance vehicles and the need for compliance with stringent environmental regulations. Consequently, manufacturers are investing in research and development to create more efficient and reliable fuel injection systems.

Growing Aftermarket Demand for Fuel Injection Systems

The US Automotive Fuel Injection Pump Market is witnessing a growing demand in the aftermarket segment. As vehicles age, the need for replacement and upgraded fuel injection systems becomes paramount. Consumers are increasingly seeking to enhance the performance and efficiency of their vehicles, leading to a rise in aftermarket sales of fuel injection pumps. This trend is further supported by the increasing average age of vehicles on the road, which is currently estimated to be around 12 years. As a result, aftermarket suppliers are expanding their product offerings to include a wider range of fuel injection systems that cater to various vehicle models. The growth of e-commerce platforms is also facilitating easier access to these products, thereby driving sales in the aftermarket segment. Consequently, this trend is expected to contribute positively to the overall growth of the US Automotive Fuel Injection Pump Market.