Rising Consumer Demand for Convenience

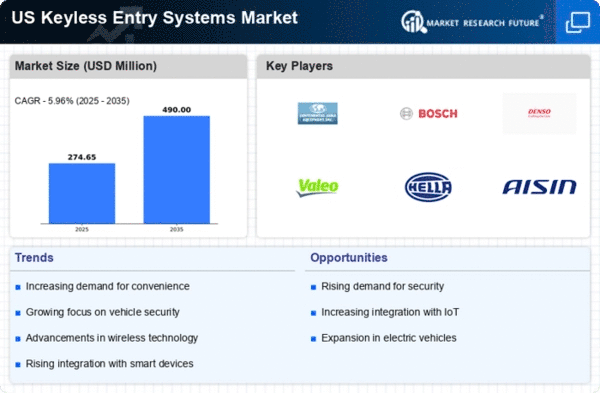

The automotive keyless-entry-systems market experiences a notable surge in consumer demand for convenience features in vehicles. As lifestyles become increasingly fast-paced, consumers seek solutions that simplify their daily routines. Keyless entry systems provide a seamless experience, allowing users to unlock and start their vehicles without fumbling for keys. This trend is reflected in the growing sales of vehicles equipped with such systems, which accounted for approximately 30% of new car sales in the US in 2025. The automotive keyless-entry-systems market is thus positioned to benefit from this shift in consumer preferences, as manufacturers respond by integrating advanced keyless technologies into their offerings.

Increased Focus on Vehicle Electrification

The automotive keyless-entry-systems market is significantly influenced by the ongoing trend of vehicle electrification. As more consumers opt for electric vehicles (EVs), the integration of keyless entry systems becomes essential for enhancing user experience. EVs often feature advanced technology, and keyless entry systems align with the modern, tech-savvy image of these vehicles. In 2025, it is projected that EVs will constitute around 25% of new vehicle sales in the US, driving demand for compatible keyless entry solutions. The automotive keyless-entry-systems market is thus likely to expand as manufacturers adapt their offerings to meet the needs of the growing EV segment.

Expansion of Automotive Connectivity Solutions

The expansion of automotive connectivity solutions significantly impacts the automotive keyless-entry-systems market. As vehicles become more connected, the integration of keyless entry systems with mobile applications and smart devices is becoming increasingly prevalent. This connectivity allows users to control their vehicles remotely, enhancing convenience and security. In 2025, it is estimated that over 35% of new vehicles will feature integrated connectivity solutions, driving demand for advanced keyless entry systems. The automotive keyless-entry-systems market is thus poised for growth as manufacturers innovate to provide seamless integration with emerging technologies.

Growing Awareness of Vehicle Safety Regulations

The automotive keyless-entry-systems market is increasingly shaped by the growing awareness of vehicle safety regulations. As regulatory bodies implement stricter safety standards, manufacturers are compelled to enhance the security features of their keyless entry systems. This trend is particularly evident in the US, where compliance with safety regulations is paramount for market success. In 2025, it is anticipated that vehicles meeting enhanced safety standards will capture a larger share of the market, potentially exceeding 50%. Consequently, the automotive keyless-entry-systems market is likely to see a shift towards systems that not only comply with regulations but also exceed consumer expectations for safety.

Technological Advancements in Automotive Security

Technological advancements play a pivotal role in shaping the automotive keyless-entry-systems market. Innovations in security features, such as biometric authentication and encrypted signals, enhance the safety of keyless entry systems. As vehicle theft becomes a pressing concern, consumers are increasingly inclined to invest in vehicles equipped with advanced security measures. The automotive keyless-entry-systems market is witnessing a transformation, with manufacturers prioritizing the development of systems that not only offer convenience but also robust security. In 2025, it is estimated that vehicles with enhanced security features will represent over 40% of the market, indicating a strong consumer preference for safety.