US Automotive Magnet Wire Market Summary

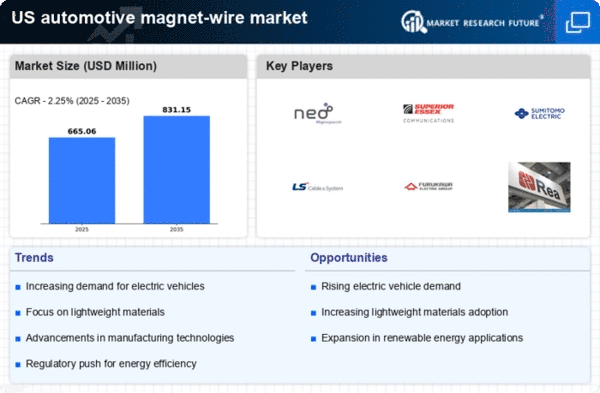

As per Market Research Future analysis, the US automotive magnet-wire market size was estimated at 650.43 USD Million in 2024. The US automotive magnet-wire market is projected to grow from 665.06 USD Million in 2025 to 831.15 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 2.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US The automotive magnet-wire market is experiencing a transformative shift. This shift is driven by technological advancements and the rise of electric vehicles.

- The market is witnessing a notable rise in demand for magnet wire due to the increasing adoption of electric vehicles, which are projected to dominate the automotive sector.

- Sustainability initiatives are influencing manufacturers to develop eco-friendly magnet wire solutions, aligning with global environmental goals.

- Technological advancements in manufacturing processes are enhancing the efficiency and performance of magnet wire, catering to the evolving needs of the automotive industry.

- Key market drivers include the increased demand for lightweight materials and the growth of advanced driver assistance systems (ADAS), which are shaping the future of automotive design.

Market Size & Forecast

| 2024 Market Size | 650.43 (USD Million) |

| 2035 Market Size | 831.15 (USD Million) |

| CAGR (2025 - 2035) | 2.25% |

Major Players

Magnequench (US), Superior Essex (US), Sumitomo Electric Industries (JP), LS Cable & System (KR), Furukawa Electric Co (JP), Rea Magnet Wire Company (US), Ametek Inc (US), KME Germany GmbH (DE)