Focus on Cost Reduction Strategies

The automotive metal-stamping market is witnessing a heightened focus on cost reduction strategies among manufacturers. As competition intensifies, companies are seeking ways to optimize their operations and minimize expenses. This trend is leading to the adoption of lean manufacturing principles, which aim to eliminate waste and enhance efficiency. By streamlining processes and improving resource allocation, manufacturers can reduce production costs, which is crucial in a market where profit margins are often tight. In 2025, it is anticipated that companies implementing these strategies will see a potential cost reduction of up to 10%, thereby enhancing their competitiveness in the automotive metal-stamping market. This focus on cost efficiency not only benefits manufacturers but also allows for more competitive pricing of metal-stamped components, ultimately benefiting consumers.

Increased Vehicle Production Rates

The automotive metal-stamping market is significantly impacted by increased vehicle production rates in the United States. As consumer demand for automobiles continues to rise, manufacturers are ramping up production to meet this need. In 2025, the automotive industry is expected to produce over 15 million vehicles, which directly correlates with the demand for metal-stamped components. This surge in production necessitates a robust supply chain and efficient manufacturing processes, thereby driving growth in the automotive metal-stamping market. Additionally, the trend towards electric vehicles (EVs) is further stimulating demand for specialized metal components, as these vehicles often require unique designs and materials. This evolving production landscape indicates a promising outlook for the automotive metal-stamping market, as it adapts to the changing needs of the automotive industry.

Rising Demand for Lightweight Materials

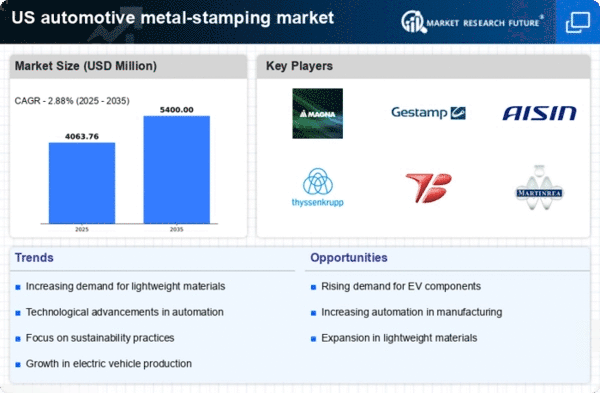

The automotive metal-stamping market is increasingly influenced by the rising demand for lightweight materials in vehicle manufacturing. As automakers strive to enhance fuel efficiency and reduce emissions, the use of lightweight metals such as aluminum and high-strength steel is becoming more prevalent. This shift is expected to drive the market's growth, with projections indicating a potential increase of 6% in market size by 2026. Lightweight components not only improve vehicle performance but also align with regulatory standards aimed at reducing carbon footprints. Consequently, manufacturers in the automotive metal-stamping market are adapting their processes to accommodate these materials, which may require new tooling and techniques. This evolving landscape suggests that companies focusing on lightweight solutions will likely gain a competitive edge in the automotive sector.

Technological Advancements in Manufacturing

The automotive metal-stamping market is experiencing a surge in technological advancements that enhance production efficiency and precision. Innovations such as computer numerical control (CNC) machines and advanced robotics are streamlining the stamping process, reducing waste and improving product quality. As manufacturers adopt these technologies, they can achieve higher output rates and lower operational costs. In 2025, the market is projected to grow by approximately 5% annually, driven by these advancements. Furthermore, the integration of Industry 4.0 principles, including IoT and data analytics, allows for real-time monitoring and predictive maintenance, which can significantly reduce downtime. This trend indicates a shift towards more automated and intelligent manufacturing processes, positioning the automotive metal-stamping market for sustained growth in the coming years.

Emerging Trends in Electric Vehicle Manufacturing

The automotive metal-stamping market is being shaped by emerging trends in electric vehicle (EV) manufacturing. As the automotive industry shifts towards electrification, the demand for specialized metal components tailored for EVs is on the rise. These components often require advanced stamping techniques and materials to accommodate the unique design and performance requirements of electric vehicles. In 2025, the market for EVs is projected to grow by over 20%, which will likely drive demand for metal-stamped parts. This trend presents both challenges and opportunities for manufacturers in the automotive metal-stamping market, as they must adapt to new specifications and production methods. The increasing focus on sustainability and energy efficiency in vehicle design further emphasizes the importance of innovation in metal-stamping processes, suggesting a dynamic future for the industry.

.png)