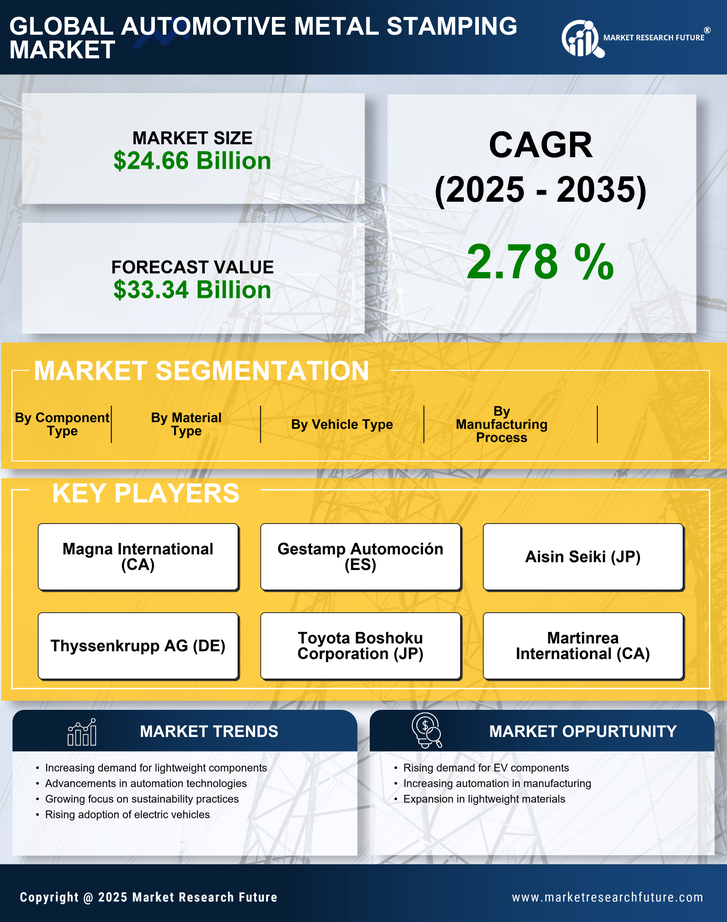

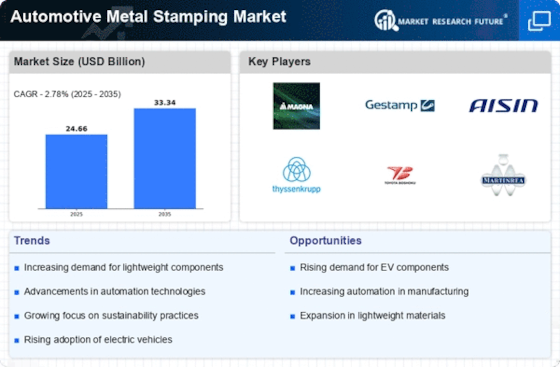

Growth in Electric Vehicle Production

The Automotive Metal Stamping Market is poised for growth due to the rising production of electric vehicles (EVs). As automakers pivot towards electric mobility, the need for specialized components that can be efficiently produced through metal stamping processes becomes increasingly critical. The EV market is expected to expand rapidly, with projections indicating that electric vehicle sales could account for a substantial percentage of total vehicle sales by 2030. This transition necessitates the development of new stamping techniques and materials tailored for electric vehicle applications, thereby creating opportunities for innovation within the Automotive Metal Stamping Market. The integration of advanced metal stamping technologies will likely enhance the performance and safety of EVs, further driving market growth.

Rising Demand for Lightweight Vehicles

The Automotive Metal Stamping Market is experiencing a notable increase in demand for lightweight vehicles. This trend is primarily driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly utilizing metal stamping techniques to produce lightweight components that maintain structural integrity while minimizing weight. According to recent data, the demand for lightweight materials in vehicles is projected to grow significantly, with estimates suggesting that the market for lightweight automotive components could reach several billion dollars by 2026. This shift towards lightweight vehicles not only aligns with regulatory requirements but also appeals to environmentally conscious consumers, thereby propelling the Automotive Metal Stamping Market forward.

Regulatory Compliance and Safety Standards

The Automotive Metal Stamping Market is increasingly influenced by stringent regulatory compliance and safety standards. Governments worldwide are implementing more rigorous regulations aimed at enhancing vehicle safety and environmental performance. As a result, automotive manufacturers are compelled to adopt advanced metal stamping techniques that meet these evolving standards. Compliance with safety regulations not only ensures consumer protection but also enhances the reputation of manufacturers. The Automotive Metal Stamping Market must adapt to these changes by investing in innovative stamping technologies that can produce components meeting the required specifications. This focus on compliance is likely to drive demand for high-quality stamped parts, thereby contributing to market growth.

Technological Innovations in Metal Stamping

The Automotive Metal Stamping Market is witnessing a wave of technological innovations that are reshaping production processes. Advancements in stamping technology, such as the adoption of computer numerical control (CNC) machines and automation, are enhancing precision and efficiency in manufacturing. These innovations allow for the production of complex geometries and intricate designs that were previously challenging to achieve. As manufacturers strive to improve their competitive edge, the integration of these technologies is becoming essential. The Automotive Metal Stamping Market is expected to benefit from these advancements, as they not only reduce production costs but also improve product quality. Consequently, the market is likely to see an increase in demand for technologically advanced stamped components.

Increasing Investment in Automotive Manufacturing

The Automotive Metal Stamping Market is benefiting from a surge in investment in automotive manufacturing facilities. As manufacturers seek to enhance production capabilities and meet growing consumer demand, investments in advanced manufacturing technologies are becoming more prevalent. Recent reports indicate that capital expenditures in the automotive sector are on the rise, with many companies allocating significant budgets towards upgrading their stamping operations. This influx of investment is expected to lead to improved efficiency and productivity within the Automotive Metal Stamping Market. Furthermore, the establishment of new manufacturing plants in emerging markets is likely to create additional demand for metal stamping services, thereby bolstering the overall market landscape.