Market Analysis

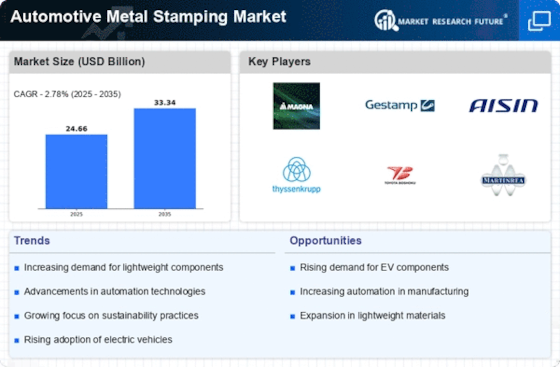

Automotive Metal Stamping Market (Global, 2023)

Introduction

Metal stamping is a basic element in the manufacture of vehicle components, and is used to make a wide variety of car parts, such as body panels, structural parts, and complex assemblies. It is characterized by its reliance on advanced and inventive production methods that make the process more precise, economical, and efficient. The demand for high-quality stamped parts will continue to grow, as the car industry evolves in response to trends such as electrification, lightening, and increased safety standards. Also, as manufacturers adopt more sustainable production practices, they are using new materials and new production methods in their stamped parts. The stamped parts industry is highly competitive, with a mixture of established and newer companies that compete to keep up with the technological developments and the evolving needs of the vehicle industry. The stamped parts industry is undergoing rapid change, and understanding the ins and outs of it is essential to those who want to meet the challenges and opportunities presented by the ongoing transformation of the car industry.

PESTLE Analysis

- Political

- In 2023, the automobile stamping die market is influenced by various political factors such as trade policy and tariffs. In the United States, for example, the tariffs of 25% on steel and 10% on aluminum were imposed on imports of these two materials, which directly affected the cost structure of the companies using these materials. The $ 1200 billion budget of the Biden administration to build and renovate the transport network will indirectly benefit the automobile industry and increase the demand for cars and their components, including stamped parts.

- Economic

- In 2023, the world economy was recovering from the pandemic. The automobile industry was expected to have revenues of $2.5 to $3 billion. The stamping industry, which supplies essential parts for the automobile industry, was expected to grow as well. The U.S. unemployment rate had fallen to 4.2%, and as a result, the demand for automobiles and for stamping parts was on the rise. However, the inflation rate had been reported at 3.5%, which would affect the prices of raw materials and the strategies of manufacturers.

- Social

- In 2023, social trends will be such that electric vehicles will make up 20 percent of all new cars sold. This shift will force the carmakers to change their production processes, including their metal stamping, to take account of the new shapes and materials that are to be used in EVs. Also, the emphasis on sustainable development, with a willingness on the part of a majority of consumers to pay more for a product with a lower environmental impact, will influence the choice of materials and methods used in the stamping of metals.

- Technological

- The metalworking industry is undergoing rapid changes, due to the rapid development of new technology. Industry 4.0, automation and the Internet of Things are increasingly used. About one-third of the manufacturers are using smart factory solutions. These new techniques improve efficiency and reduce waste in the stamping process. And the use of high-strength steels and aluminium alloys is also increasing, and about 40% of new models now use these materials to improve performance and fuel economy.

- Legal

- The regulations affecting the stamping market in 2023 include a ban on idling, strict regulations on emissions and safety standards. The European Union has set a goal of reducing the average CO2 emissions of new cars to 95 grams per kilometer by 2025, which forces the manufacturers to make innovations in their production. In addition, the manufacturers must comply with the Fair Labor Standards Act, which sets certain standards for wages and working conditions and thus increases the costs and management of the workforce.

- Environmental

- The automobile market in 2023 will be dominated by the aforementioned climatic conditions. The universal drive for sustainability has resulted in stricter regulations on waste management and on emissions. The EPA, for example, has set a goal of reducing the amount of hazardous waste produced by 50% by 2025. Consequently, the metal stamping industry has invested heavily in new production methods and in recycling. Approximately 25% of stamped parts are now made of recycled material, which reflects the desire to reduce the carbon footprint.

Porter's Five Forces

- Threat of New Entrants

- The automobile industry has a moderately high barrier to entry because of the large capital outlay required for the necessary machinery and equipment. The scale economies and close relationships with automobile manufacturers also create a high barrier to entry. However, technological advances and the opportunity to supply niche markets may encourage new entrants.

- Bargaining Power of Suppliers

- The bargaining power of the suppliers of the metal stamping industry is relatively low. The number of suppliers of raw materials such as steel and aluminium is large, and this makes for a competitive market. Suppliers are often able to offer the automobile manufacturers better terms, as the automobile manufacturers can often choose between several suppliers. Moreover, the trend towards vertical integration, as exemplified by Ford, further reduces the bargaining power of the suppliers.

- Bargaining Power of Buyers

- The purchasers of the sheet metal stamped products, especially the large car manufacturers, have considerable bargaining power. They often buy in large quantities and are able to dictate prices, thanks to their size and influence on the market. The existence of a number of suppliers and the importance of cost reductions in the car industry also add to the bargaining power of the buyers.

- Threat of Substitutes

- The threat of substitutes in the car-parts market is moderate. Metal stamping is the dominant production method, but injection moulding and composite materials are gaining ground. The unique properties of metal, such as strength and resistance to wear, mean that it is difficult for substitutes to fully replace metal stamping in many applications.

- Competitive Rivalry

- Competition is high in the market for stampings for automobiles, a result of the presence of numerous established competitors and the constant demand for innovation and cost reduction. Companies compete on the basis of factors such as price, quality and technological advancement. Furthermore, the pressure on automobile manufacturers to conform to the ever-increasing standards demanded by government regulations and consumers’ expectations further increases competition among suppliers of stamped parts.

SWOT Analysis

Strengths

- High precision and efficiency in manufacturing processes.

- Strong demand from the automotive industry for lightweight components.

- Established relationships with major automotive manufacturers.

- Ability to produce complex shapes and designs.

Weaknesses

- High initial investment costs for advanced stamping machinery.

- Dependence on the cyclical nature of the automotive industry.

- Limited flexibility in adapting to rapid design changes.

- Potential for high operational costs due to energy consumption.

Opportunities

- Growing trend towards electric vehicles increasing demand for metal components.

- Advancements in technology enabling smarter manufacturing processes.

- Expansion into emerging markets with rising automotive production.

- Increased focus on sustainability and recycling in manufacturing.

Threats

- Intense competition from low-cost manufacturers in developing countries.

- Fluctuations in raw material prices affecting profitability.

- Regulatory changes impacting manufacturing processes and materials used.

- Economic downturns leading to reduced automotive production.

Summary

The automobile stamping market in 2023 is characterized by the strengths of precision manufacturing and the high demand for industry, but it also faces the weaknesses of high costs and dependence on market cycles. Opportunities are presented by the shift to electric vehicles and the development of technology, and the threats are competition and economic fluctuations. The industry should use its strengths to explore new markets, so as to reduce the risk and take advantage of the trend.

Leave a Comment