Emergence of Advanced Materials

The emergence of advanced materials is reshaping the automotive stamped-component market. Manufacturers are increasingly utilizing high-strength steel and aluminum alloys to enhance vehicle performance and safety. These materials offer improved strength-to-weight ratios, which are essential for modern automotive designs. In 2025, it is anticipated that the use of advanced materials in stamped components will grow by 15%, reflecting the industry's commitment to innovation. This trend not only supports the development of lighter vehicles but also contributes to improved fuel efficiency and reduced emissions. As a result, the automotive stamped-component market is likely to see a shift towards these advanced materials, aligning with industry goals for enhanced performance.

Increasing Vehicle Production Rates

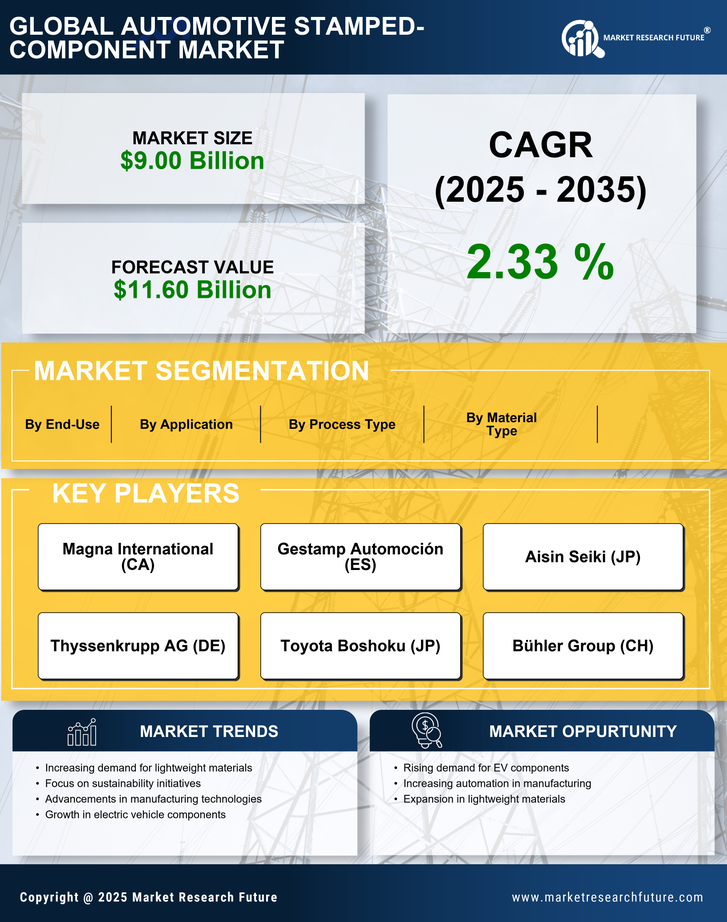

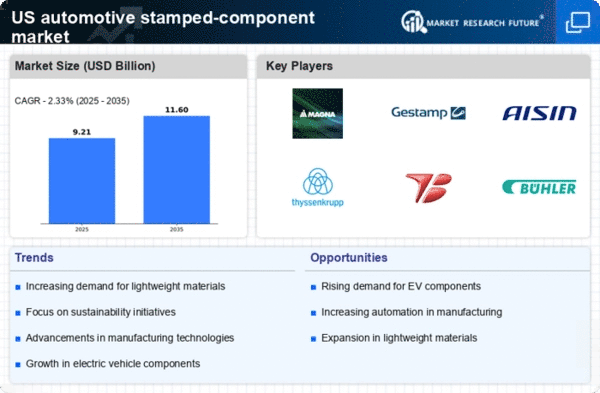

The automotive stamped-component market is poised for growth due to increasing vehicle production rates in the US. As the economy stabilizes, manufacturers are ramping up production to meet consumer demand. In 2025, vehicle production is expected to reach approximately 15 million units, which will directly impact the demand for stamped components. This surge in production necessitates a reliable supply chain and efficient manufacturing processes, thereby driving investments in the stamping sector. The automotive stamped-component market is likely to benefit from this trend, as manufacturers seek to optimize their operations to keep pace with rising production levels.

Rising Demand for Electric Vehicles

The automotive stamped-component market is experiencing a notable shift due to the increasing demand for electric vehicles (EVs) in the US. As manufacturers pivot towards EV production, the need for lightweight and efficient stamped components becomes paramount. In 2025, it is estimated that EV sales will account for approximately 25% of total vehicle sales in the US, driving the demand for specialized components. This transition necessitates innovative stamping techniques to produce parts that meet the unique requirements of electric drivetrains. Consequently, the automotive stamped-component market is likely to see a surge in investments aimed at developing components that enhance vehicle efficiency and performance.

Technological Advancements in Stamping Processes

Technological advancements in stamping processes are significantly influencing the automotive stamped-component market. Innovations such as computer numerical control (CNC) and robotics are enhancing precision and efficiency in manufacturing. These technologies allow for the production of complex geometries and tighter tolerances, which are essential for modern automotive designs. In 2025, the market is projected to grow at a CAGR of 5.2%, driven by these advancements. As manufacturers adopt these technologies, they can reduce waste and improve production speed, thereby meeting the increasing demands of the automotive industry. This trend indicates a shift towards more automated and efficient stamping operations.

Focus on Sustainability and Eco-Friendly Practices

Sustainability is becoming a critical driver in the automotive stamped-component market. As consumers and regulatory bodies push for greener practices, manufacturers are increasingly adopting eco-friendly materials and processes. The automotive industry is projected to invest over $10 billion in sustainable practices by 2026, which includes the use of recycled materials in stamped components. This shift not only helps in reducing the carbon footprint but also aligns with the growing consumer preference for environmentally responsible products. Consequently, the automotive stamped-component market is likely to evolve, with a focus on sustainable manufacturing practices that meet both regulatory standards and consumer expectations.