Growth of Automotive Aftermarket

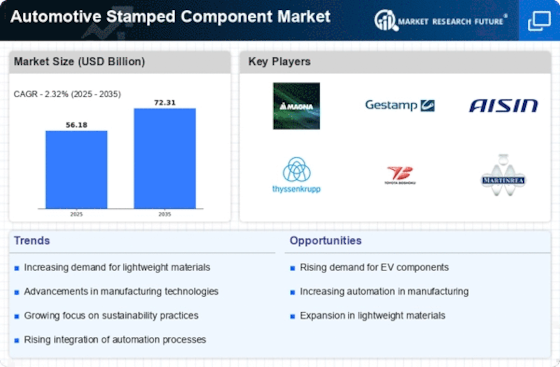

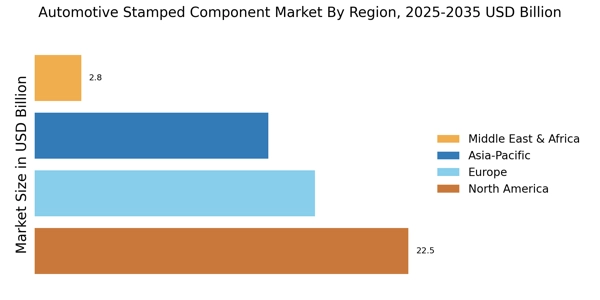

The Automotive Stamped Component Market is benefiting from the expansion of the automotive aftermarket sector. As vehicle ownership increases, the demand for replacement parts and components is on the rise. This trend is particularly evident in regions with a growing number of older vehicles, where the need for stamped components for repairs and upgrades is substantial. In 2025, the aftermarket is projected to account for a significant share of the overall automotive market, thereby creating lucrative opportunities for manufacturers in the Automotive Stamped Component Market. Companies that strategically position themselves to cater to this demand are likely to experience robust growth in the coming years.

Advancements in Stamping Technology

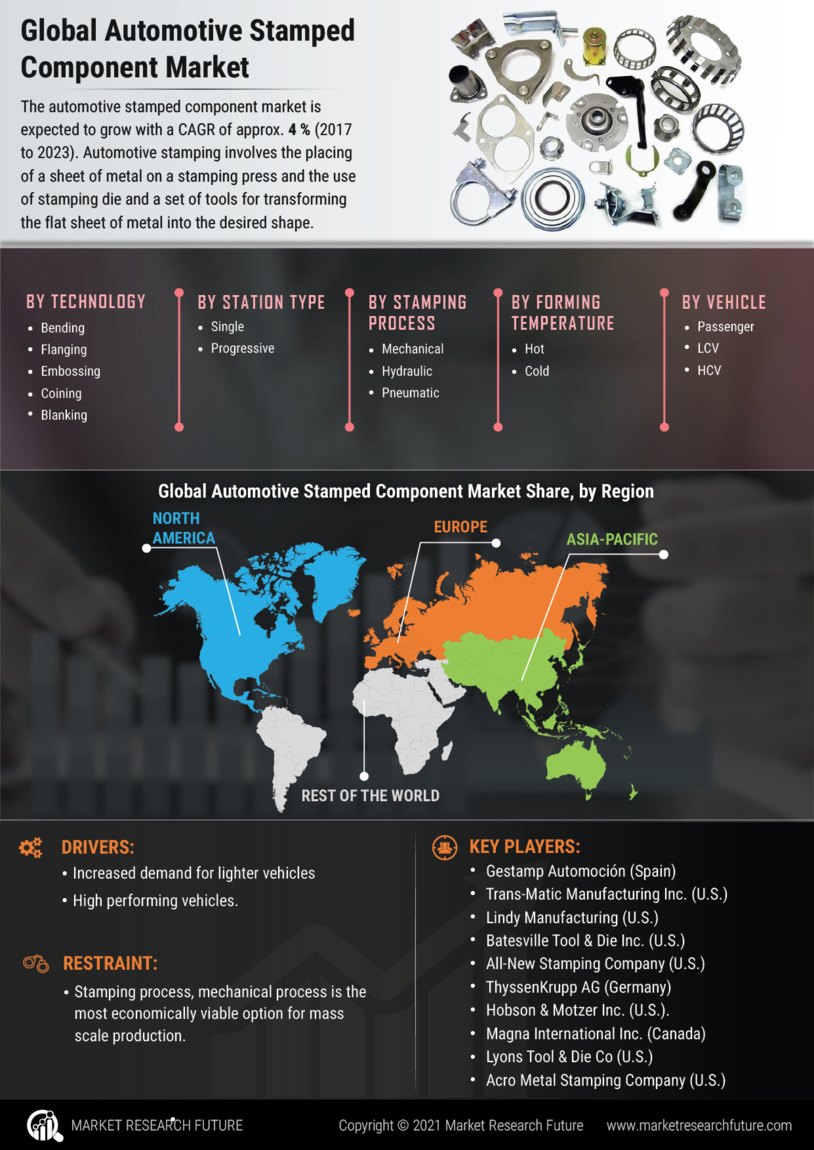

Technological innovations in stamping processes are transforming the Automotive Stamped Component Market. The introduction of advanced machinery and automation techniques has led to increased precision and efficiency in component manufacturing. For instance, the adoption of computer numerical control (CNC) machines allows for intricate designs and reduced waste, which is crucial in a competitive market. Furthermore, these advancements enable manufacturers to produce components at a lower cost while maintaining high quality. As a result, the Automotive Stamped Component Market is poised for expansion, as companies leverage these technologies to enhance production capabilities and meet the growing demands of the automotive sector.

Increasing Demand for Electric Vehicles

The Automotive Stamped Component Market is experiencing a notable surge in demand due to the rising popularity of electric vehicles (EVs). As manufacturers pivot towards EV production, the need for lightweight and efficient stamped components becomes paramount. In 2025, it is estimated that the EV market will account for a substantial percentage of total vehicle sales, thereby driving the demand for specialized stamped components that cater to electric drivetrains. This shift not only enhances vehicle performance but also aligns with consumer preferences for sustainability. Consequently, the Automotive Stamped Component Market is likely to witness significant growth as automakers invest in innovative stamping technologies to meet the evolving requirements of electric vehicle production.

Rising Production of Lightweight Vehicles

The Automotive Stamped Component Market is significantly influenced by the automotive industry's shift towards lightweight vehicles. As manufacturers strive to improve fuel efficiency and reduce emissions, the use of lightweight materials such as aluminum and high-strength steel is becoming increasingly prevalent. This trend is expected to continue, with projections indicating that lightweight vehicles will dominate the market by 2026. Consequently, the demand for stamped components that are compatible with these materials is likely to rise. Manufacturers in the Automotive Stamped Component Market must adapt to these changes by investing in new technologies and processes that facilitate the production of lightweight components.

Regulatory Compliance and Safety Standards

The Automotive Stamped Component Market is also shaped by stringent regulatory compliance and safety standards imposed by governments worldwide. As safety regulations become more rigorous, manufacturers are compelled to enhance the quality and reliability of stamped components. This necessitates the adoption of advanced manufacturing techniques and quality control measures to ensure compliance with safety standards. In 2025, it is anticipated that the Automotive Stamped Component Market will see increased investments in research and development to meet these regulatory requirements. This focus on compliance not only enhances product safety but also fosters consumer trust, thereby driving market growth.