China : Unmatched Growth and Innovation

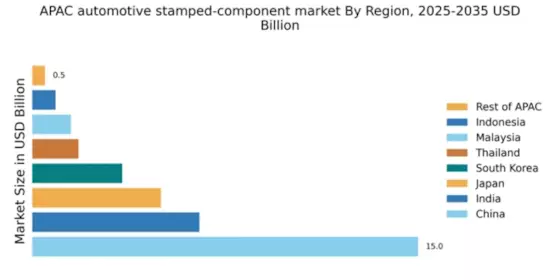

China holds a commanding 15.0% market share in the automotive stamped-component sector, driven by rapid industrialization and a booming automotive industry. Key growth drivers include government initiatives promoting electric vehicles (EVs) and significant investments in infrastructure. The demand for lightweight materials and advanced manufacturing technologies is on the rise, supported by favorable regulatory policies aimed at enhancing production efficiency and sustainability.

India : Rapid Growth in Automotive Sector

India's automotive stamped-component market accounts for 6.5% of the APAC share, reflecting a growing demand for vehicles and components. The government's push for 'Make in India' and investments in infrastructure are key growth drivers. Additionally, the increasing adoption of electric vehicles and stringent emission regulations are shaping consumption patterns, leading to a shift towards sustainable manufacturing practices.

Japan : Innovation and Quality at Forefront

Japan's market share stands at 5.0%, characterized by high-quality manufacturing and advanced technology. The automotive sector is bolstered by strong R&D investments and a focus on innovation. Government policies promoting eco-friendly vehicles and smart manufacturing are driving demand. The aging population is also influencing consumption patterns, with a shift towards more accessible vehicle designs.

South Korea : Competitive Edge in Technology

South Korea holds a 3.5% market share in the automotive stamped-component market, driven by major players like Hyundai Mobis and strong domestic demand. The government's support for smart mobility and electric vehicles is fostering growth. Key cities such as Seoul and Busan are central to automotive manufacturing, with a focus on high-tech components and sustainable practices shaping the market landscape.

Malaysia : Strategic Location and Development

Malaysia's automotive stamped-component market represents 1.5% of the APAC share, benefiting from its strategic location and government incentives for manufacturing. The National Automotive Policy encourages local production and innovation. Demand is rising for components in both domestic and export markets, with a focus on eco-friendly technologies and lightweight materials driving consumption patterns.

Thailand : Automotive Manufacturing Powerhouse

Thailand accounts for 1.8% of the automotive stamped-component market, recognized as a manufacturing hub in the ASEAN region. The government's investment in infrastructure and incentives for foreign investment are key growth drivers. Major cities like Bangkok and Chonburi are central to automotive production, with a competitive landscape featuring both local and international players focusing on quality and efficiency.

Indonesia : Expanding Automotive Landscape

Indonesia's market share is 0.91%, with significant growth potential driven by increasing vehicle ownership and government support for the automotive sector. The push for local manufacturing and investment in infrastructure are key factors. Major cities like Jakarta and Surabaya are focal points for automotive production, with a growing number of players entering the market to meet rising demand.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a modest 0.5% market share in the automotive stamped-component sector, characterized by diverse market conditions. Each country presents unique challenges and opportunities, influenced by local regulations and economic conditions. The competitive landscape varies significantly, with both established players and new entrants vying for market share in niche segments.