Energy Efficiency Initiatives

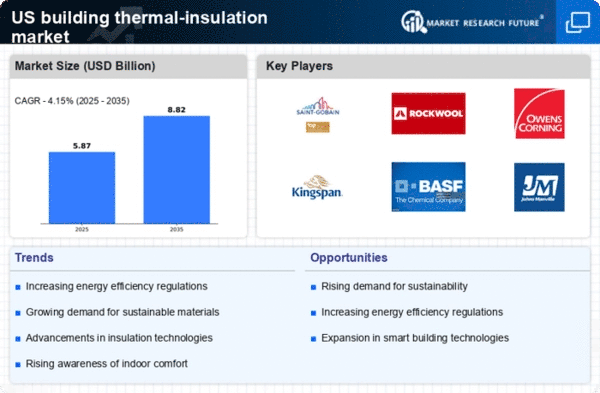

The growing emphasis on energy efficiency in the building thermal-insulation market is driven by both consumer demand and regulatory frameworks. In the US, energy-efficient buildings are increasingly prioritized, with the Department of Energy promoting initiatives that encourage the use of high-performance insulation materials. This trend is reflected in the market, where the demand for insulation products that meet or exceed energy codes is rising. As of 2025, the market is projected to grow at a CAGR of approximately 6.5%, indicating a robust shift towards energy-efficient solutions. The building thermal-insulation market is thus positioned to benefit from these initiatives, as builders and homeowners seek to reduce energy consumption and lower utility costs.

Rising Construction Activities

The resurgence of construction activities in the US is a pivotal driver for the building thermal-insulation market. With the construction sector experiencing a notable uptick, the demand for insulation materials is expected to rise correspondingly. According to recent data, the construction industry is projected to grow by 5% annually, leading to increased investments in residential and commercial buildings. This growth is likely to stimulate the demand for effective thermal insulation solutions, as builders aim to enhance energy efficiency and comply with building codes. Consequently, the building thermal-insulation market is poised to capitalize on this trend, as more projects incorporate advanced insulation technologies to meet performance standards.

Government Incentives and Rebates

Government incentives and rebates play a crucial role in promoting the adoption of insulation solutions within the building thermal-insulation market. Various federal and state programs offer financial incentives for homeowners and builders who invest in energy-efficient insulation products. These initiatives are designed to encourage the use of materials that reduce energy consumption and greenhouse gas emissions. As of 2025, it is estimated that such programs could lead to a 15% increase in insulation installations across residential and commercial sectors. Consequently, the building thermal-insulation market stands to benefit from these financial incentives, as they lower the upfront costs associated with high-performance insulation solutions.

Consumer Awareness and Preferences

Consumer awareness regarding energy conservation and environmental sustainability is significantly influencing the building thermal-insulation market. As homeowners become more informed about the benefits of insulation, including reduced energy bills and improved comfort, the demand for high-quality insulation products is likely to increase. Surveys indicate that over 70% of consumers prioritize energy-efficient features when selecting building materials. This shift in consumer preferences is prompting manufacturers to innovate and offer products that align with these values. The building thermal-insulation market is thus adapting to meet the evolving expectations of consumers, which may lead to increased market penetration of eco-friendly insulation solutions.

Technological Advancements in Insulation Materials

Technological advancements are reshaping the landscape of the building thermal-insulation market. Innovations in material science have led to the development of advanced insulation products that offer superior thermal performance and durability. For instance, the introduction of aerogel and vacuum insulation panels has revolutionized the market by providing exceptional insulation properties in thinner profiles. These advancements not only enhance energy efficiency but also contribute to space-saving designs in modern construction. As technology continues to evolve, the building thermal-insulation market is likely to witness increased adoption of these cutting-edge materials, further driving growth and improving overall building performance.

.png)