Rising Fuel Costs

The compact electric-construction-equipment market is experiencing a shift due to rising fuel costs, which have made traditional diesel-powered equipment less economically viable. As fuel prices fluctuate, construction companies are increasingly looking for cost-effective alternatives. Electric equipment, which typically incurs lower operational costs, presents a compelling solution. The total cost of ownership for electric machinery can be significantly lower, with estimates suggesting savings of up to 30% compared to conventional equipment over its lifespan. This economic incentive is likely to drive the adoption of electric machinery, thereby expanding the compact electric-construction-equipment market. As fuel prices continue to rise, the trend towards electrification in construction is expected to accelerate.

Increased Focus on Health and Safety

The market is also being driven by an increased focus on health and safety within the construction industry. Electric equipment typically produces less noise and fewer emissions, contributing to a safer working environment for operators and nearby workers. This focus on safety is becoming a priority for construction companies, as they seek to minimize risks associated with traditional machinery. The adoption of electric equipment can lead to a reduction in workplace accidents and health-related issues, which is likely to enhance productivity. As safety regulations become more stringent, the compact electric-construction-equipment market is expected to grow, with an estimated increase of 10% in market share over the next few years.

Regulatory Support for Electrification

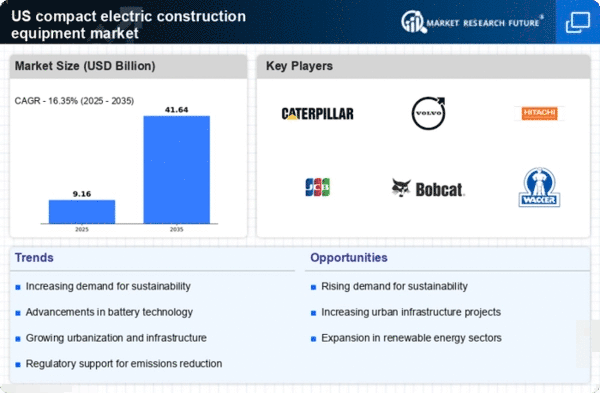

The compact electric-construction-equipment market benefits from increasing regulatory support aimed at reducing emissions and promoting electrification. Various state and federal initiatives are being implemented to encourage the adoption of electric machinery. For instance, incentives such as tax credits and grants are available for companies investing in electric equipment. This regulatory environment is expected to drive market growth, as businesses seek to comply with stricter environmental regulations. The U.S. government has set ambitious targets for reducing greenhouse gas emissions, which could lead to a projected increase in the market size by approximately 20% over the next five years. As regulations become more stringent, the demand for electric construction equipment is likely to rise, further propelling the compact electric-construction-equipment market.

Growing Demand for Urban Infrastructure

The market is poised for growth due to the increasing demand for urban infrastructure development. As cities expand and modernize, there is a pressing need for construction equipment that can operate in confined spaces with minimal environmental impact. Electric machinery is particularly suited for urban environments, where noise and emissions regulations are stringent. The market is projected to grow by approximately 15% annually as urbanization trends continue. Additionally, the compact nature of electric equipment allows for greater maneuverability in tight spaces, making it an attractive option for contractors. This demand for urban infrastructure is likely to be a key driver for the compact electric-construction-equipment market.

Technological Innovations in Battery Technology

Advancements in battery technology are significantly influencing the compact electric-construction-equipment market. Innovations such as improved energy density and faster charging capabilities are making electric equipment more viable for construction applications. The introduction of lithium-ion batteries has enhanced the performance and efficiency of electric machinery, allowing for longer operational periods and reduced downtime. As battery technology continues to evolve, it is expected that the range and capabilities of electric construction equipment will expand, potentially increasing market penetration. The compact electric-construction-equipment market could see a growth rate of around 25% as these technological improvements make electric options more appealing to contractors.