Rising Importance of Content Quality

In the content intelligence market, the emphasis on content quality is becoming increasingly pronounced. Businesses are beginning to understand that high-quality content is crucial for attracting and retaining customers. This shift is reflected in the allocation of marketing budgets, with an estimated 40% of marketing expenditures now directed towards content creation and optimization. As organizations prioritize quality over quantity, the demand for tools that can analyze and enhance content quality is likely to grow. The content intelligence market is responding to this need by offering solutions that assess readability, engagement metrics, and overall effectiveness of content. This focus on quality not only improves customer satisfaction but also enhances brand reputation, making it a vital driver in the current landscape.

Increased Focus on Customer Experience

The content intelligence market is witnessing a shift towards enhancing customer experience as a primary business objective. Companies are increasingly aware that personalized and relevant content can significantly influence customer satisfaction and loyalty. Research indicates that organizations that prioritize customer experience can achieve up to a 60% increase in customer retention rates. This trend is driving the demand for content intelligence solutions that enable businesses to analyze customer behavior and preferences effectively. By leveraging these insights, companies can create tailored content that resonates with their audience, thereby improving overall engagement. The content intelligence market is thus likely to see continued growth as businesses invest in technologies that enhance customer experience.

Expansion of Digital Marketing Channels

The proliferation of digital marketing channels is significantly impacting the content intelligence market. As businesses diversify their marketing strategies across various platforms, the need for cohesive content strategies becomes paramount. In 2025, it is estimated that digital advertising spending in the US will exceed $200 billion, with a substantial portion allocated to content marketing. This expansion necessitates advanced content intelligence solutions that can analyze performance across multiple channels, ensuring that content is tailored to specific audiences. The content intelligence market is thus poised to grow as companies seek to optimize their content for diverse platforms, enhancing their reach and engagement with target demographics.

Growing Demand for Data-Driven Insights

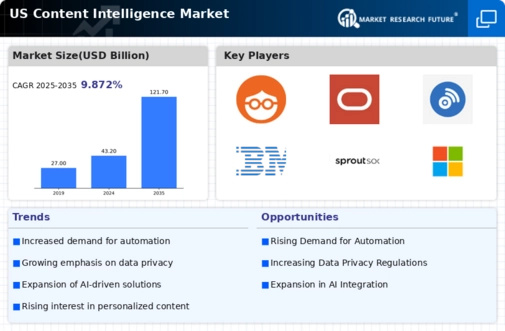

The content intelligence market is experiencing a notable surge in demand for data-driven insights. Organizations are increasingly recognizing the value of leveraging data to inform content strategies and enhance decision-making processes. In 2025, the market is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 25%. This growth is driven by the need for businesses to optimize their content for better engagement and conversion rates. As companies strive to remain competitive, the integration of data analytics into content creation and distribution becomes essential. The content intelligence market is thus positioned to benefit from this trend, as firms seek solutions that provide actionable insights derived from vast amounts of data.

Emergence of Compliance and Regulatory Standards

The content intelligence market is also being shaped by the emergence of compliance and regulatory standards. As data privacy regulations become more stringent, organizations are compelled to ensure that their content practices align with legal requirements. This has led to an increased demand for content intelligence solutions that can help businesses navigate these complexities. In 2025, it is anticipated that compliance-related expenditures will account for approximately 15% of total marketing budgets. The content intelligence market is responding to this need by providing tools that facilitate compliance monitoring and reporting, ensuring that organizations can maintain their content strategies without risking legal repercussions. This focus on compliance is likely to drive innovation and growth within the market.

Leave a Comment