Growth of IoT Applications

The proliferation of Internet of Things (IoT) devices is significantly impacting the edge data-center market. With billions of devices connected globally, the need for efficient data processing and storage at the edge has become paramount. IoT applications, ranging from smart cities to industrial automation, generate vast amounts of data that require immediate analysis. Edge data centers facilitate this by processing data closer to the source, reducing bandwidth costs and enhancing response times. The edge data-center market is expected to capture a substantial share of the overall data center market, with estimates suggesting it could account for over 30% of total data center investments by 2026. This growth underscores the critical role of edge data centers in supporting the expanding IoT ecosystem.

Emergence of Hybrid Cloud Solutions

The edge data-center market is being propelled by the emergence of hybrid cloud solutions. These solutions combine the benefits of both on-premises and cloud-based infrastructures. Organizations are increasingly adopting hybrid models to achieve greater flexibility, scalability, and cost-effectiveness. Edge data centers play a crucial role in this ecosystem by providing localized processing power and storage, enabling businesses to optimize their cloud strategies. As companies seek to balance their workloads between edge and cloud environments, the edge data-center market is expected to see substantial growth. Recent projections indicate that hybrid cloud adoption could lead to a 40% increase in edge data-center investments over the next few years, highlighting the market's potential as organizations navigate their digital transformation journeys.

Increased Focus on Data Sovereignty

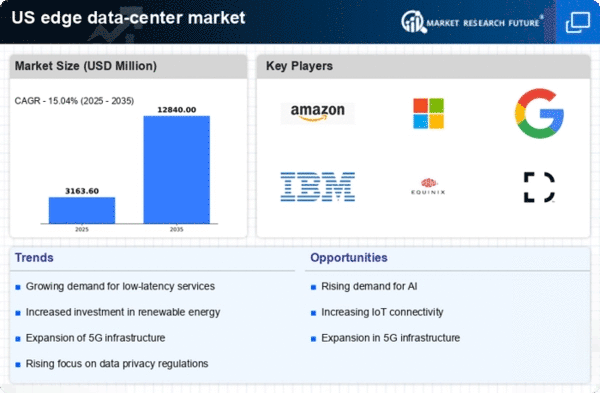

As data privacy regulations become more stringent, the edge data-center market is witnessing a heightened focus on data sovereignty. Organizations are increasingly required to store and process data within specific geographical boundaries to comply with local laws. This trend is particularly relevant in the US, where regulations such as the California Consumer Privacy Act (CCPA) mandate strict data handling practices. Consequently, businesses are turning to edge data centers to ensure compliance while maintaining operational efficiency. The edge data-center market is likely to benefit from this shift. Companies are seeking to establish localized data processing capabilities that align with regulatory requirements. This emphasis on data sovereignty may drive further investments in edge infrastructure, enhancing its significance in the broader data management landscape.

Advancements in Network Infrastructure

The edge data-center market is significantly influenced by advancements in network infrastructure. This is particularly true with the rollout of high-speed connectivity options. Technologies such as 5G and fiber-optic networks are enhancing data transmission speeds and reliability, making edge data centers more viable for various applications. As network capabilities improve, businesses are increasingly leveraging edge data centers to support bandwidth-intensive applications, such as video streaming and augmented reality. This trend is expected to drive substantial growth in the edge data-center market, with estimates suggesting that investments in network infrastructure could lead to a 35% increase in edge data-center deployments by 2027. The synergy between advanced networks and edge data centers is likely to reshape the digital landscape, fostering innovation and efficiency.

Rising Demand for Low Latency Solutions

The edge data-center market is experiencing a notable surge in demand for low latency solutions, driven by the increasing reliance on real-time data processing. Industries such as finance, gaming, and autonomous vehicles require instantaneous data transmission to function effectively. As a result, organizations are investing heavily in edge data centers to minimize latency and enhance user experience. According to recent estimates, the edge data-center market is projected to grow at a CAGR of approximately 25% over the next five years, indicating a robust shift towards localized data processing. This trend is likely to continue as businesses seek to optimize their operations and improve service delivery, thereby reinforcing the importance of edge data centers in the overall digital infrastructure landscape.