Rising Data Complexity

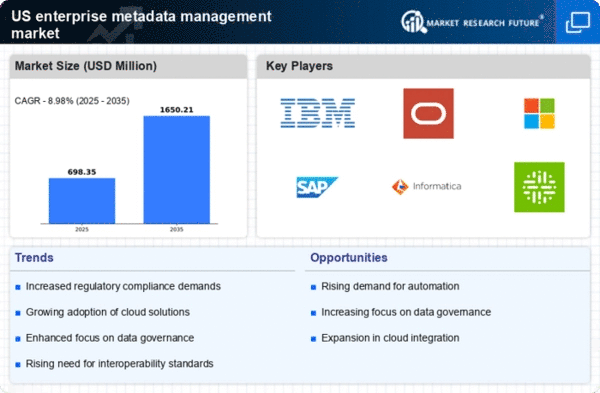

The enterprise metadata-management market is experiencing a surge in demand due to the increasing complexity of data generated by organizations. As businesses adopt more sophisticated technologies, the volume and variety of data have escalated, necessitating robust metadata management solutions. According to recent estimates, organizations are generating data at a rate of approximately 2.5 quintillion bytes daily. This complexity requires effective metadata management to ensure data quality, accessibility, and compliance. Companies are investing in metadata management tools to streamline data governance and enhance decision-making processes. The enterprise metadata management market is projected to grow significantly. Organizations are seeking to harness the power of their data while navigating the challenges posed by its complexity.

Increased Focus on Data Quality

The enterprise metadata-management market is experiencing heightened attention on data quality as organizations strive to improve their data assets. High-quality data is essential for accurate reporting, analysis, and decision-making. Companies are increasingly aware that poor data quality can lead to significant financial losses and reputational damage. As a result, there is a growing emphasis on implementing metadata management practices that ensure data integrity and reliability. The enterprise metadata-management market is expected to grow as organizations prioritize investments in solutions that enhance data quality and support their overall data governance strategies.

Growing Demand for Data Analytics

The enterprise metadata-management market is benefiting from the growing demand for data analytics across various sectors. Organizations are increasingly leveraging data analytics to gain insights and drive strategic decision-making. Effective metadata management is essential for ensuring that data is properly cataloged and accessible for analysis. As businesses invest in analytics tools, the need for robust metadata management solutions becomes apparent. The enterprise metadata-management market is projected to expand as organizations seek to enhance their analytical capabilities and improve data-driven decision-making processes. This trend indicates a strong correlation between the rise of data analytics and the demand for effective metadata management.

Regulatory Compliance Requirements

The enterprise metadata-management market is significantly influenced by the need for regulatory compliance across various industries. Organizations are increasingly required to adhere to stringent regulations regarding data privacy and security, such as the CCPA and GDPR. These regulations necessitate comprehensive metadata management practices to ensure that data is accurately classified, tracked, and reported. Failure to comply can result in substantial fines, which can reach millions of dollars. As a result, businesses are prioritizing investments in metadata management solutions to mitigate risks and ensure compliance. The enterprise metadata-management market is likely to see continued growth as organizations recognize the importance of maintaining compliance in an evolving regulatory landscape.

Shift Towards Cloud-Based Solutions

The enterprise metadata management market is witnessing a notable shift towards cloud-based solutions. Organizations seek flexibility and scalability. Cloud computing offers numerous advantages, including cost savings and enhanced collaboration. As more businesses migrate their data to the cloud, the need for effective metadata management becomes increasingly critical. Cloud-based metadata management solutions enable organizations to manage their data assets efficiently, regardless of location. This trend is likely to drive growth in the enterprise metadata-management market as companies recognize the benefits of cloud technology in managing their metadata effectively.