Emergence of Advanced Analytics

The enterprise data-management market is being propelled by the emergence of advanced analytics capabilities. Organizations are increasingly leveraging data analytics to derive actionable insights from vast datasets. In 2025, the analytics market is anticipated to grow by 25%, indicating a strong inclination towards data-driven decision-making. This trend is particularly evident in sectors such as finance and healthcare, where data insights can lead to improved operational efficiency and customer satisfaction. As businesses seek to harness the power of their data, the demand for sophisticated data management solutions that facilitate advanced analytics is expected to rise. This shift underscores the critical role of data management in enabling organizations to remain competitive in a rapidly evolving landscape.

Regulatory Compliance Pressures

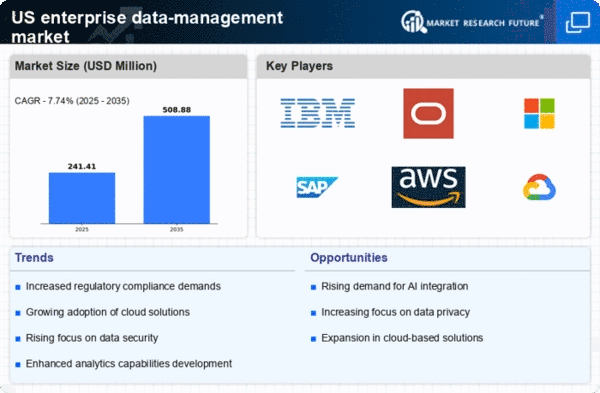

The enterprise data-management market is significantly influenced by the pressures of regulatory compliance. With the introduction of stringent data protection laws, such as the California Consumer Privacy Act (CCPA), organizations are compelled to adopt comprehensive data management practices. Compliance with these regulations is not merely a legal obligation; it is also a strategic imperative that can enhance customer trust and brand reputation. In 2025, it is estimated that compliance-related expenditures will account for nearly 15% of total IT budgets in the US. This trend indicates that businesses are increasingly investing in data management solutions that ensure adherence to regulatory standards, thereby driving growth in the enterprise data-management market.

Shift Towards Data-Driven Cultures

The enterprise data-management market is being shaped by a significant shift towards data-driven cultures within organizations. As companies recognize the strategic value of data, there is a concerted effort to embed data-driven decision-making into their core operations. This cultural transformation is expected to drive a 30% increase in investments in data management technologies by 2025. Organizations are increasingly prioritizing data literacy and training programs to empower employees to leverage data effectively. This shift not only enhances operational efficiency but also fosters innovation and agility. As a result, the enterprise data-management market is likely to experience robust growth as businesses embrace data as a critical asset.

Growing Importance of Data Integration

The enterprise data-management market is witnessing a growing emphasis on data integration as organizations strive to create a unified view of their data assets. As businesses accumulate data from diverse sources, the need for seamless integration becomes paramount. In 2025, the data integration market is projected to expand by 20%, reflecting the increasing recognition of its value in enhancing operational efficiency. Effective data integration enables organizations to break down silos, improve collaboration, and facilitate better decision-making. Consequently, the enterprise data-management market is likely to benefit from this trend, as companies seek solutions that enable them to integrate and manage their data more effectively.

Rising Demand for Data Security Solutions

The enterprise data-management market is experiencing a notable surge in demand for robust data security solutions. As organizations increasingly recognize the importance of safeguarding sensitive information, investments in security technologies are projected to rise. In 2025, the market for data security solutions is expected to reach approximately $30 billion in the US alone. This heightened focus on data protection is driven by regulatory requirements and the growing threat of cyberattacks. Companies are compelled to implement comprehensive data management strategies that not only ensure compliance but also enhance their overall security posture. Consequently, the enterprise data-management market is likely to witness significant growth as businesses prioritize data security in their operational frameworks.