US Enterprise Video Market Overview

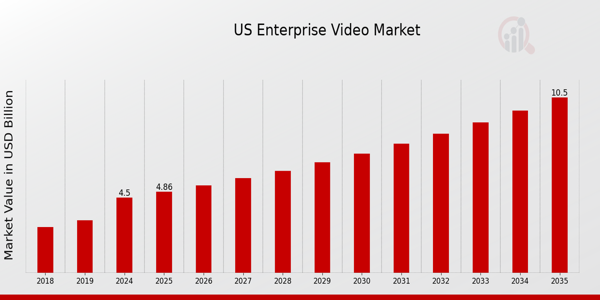

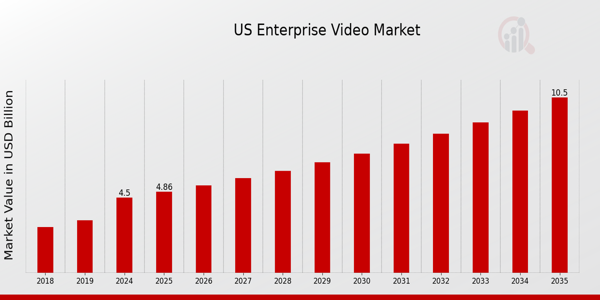

As per MRFR analysis, the US Enterprise Video Market Size was estimated at 4.11 (USD Billion) in 2023. The US Enterprise Video Market is expected to grow from 4.5 (USD Billion) in 2024 to 10.5 (USD Billion) by 2035. The US Enterprise Video Market CAGR (growth rate) is expected to be around 8.007% during the forecast period (2025 - 2035)

Key US Enterprise Video Market Trends Highlighted

The growing need for video communication tools among enterprises is driving notable developments in the US enterprise video market. Companies are using video conferencing solutions to sustain communication and cooperation as a result of the growing popularity of remote work arrangements.

High-quality video solutions are more important than ever as businesses seek to increase employee engagement and productivity in a hybrid work environment. Businesses must invest in video technology as the incorporation of video material into educational programs is being driven by the increased emphasis on corporate training and employee onboarding procedures.

Advanced video analytics, which may offer insights into viewer engagement and content efficacy, is one of the opportunities in the US industry. Platforms that provide data-driven analytics are becoming more and more in demand as businesses look for methods to enhance their video content strategy.

Furthermore, cloud-based video services and mobile compatibility are becoming increasingly popular, enabling teams to collaborate from different devices and places. For American businesses hoping to accommodate a diverse staff, this flexibility is essential.Artificial intelligence technologies that improve user experience through real-time transcription, background noise reduction, and automatic scheduling have also been increasingly popular in the US enterprise video market in recent years.

Demand for platforms that put data protection and compliance first has grown as a result of the growing emphasis on safeguarding video communications, especially in light of US data privacy regulations. Together, these patterns highlight how enterprise video solutions are changing as businesses try to adjust to the contemporary workplace.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

US Enterprise Video Market Drivers

Increase in Remote Work and Collaboration

The rise of remote work has significantly influenced the US Enterprise Video Market. With the shift in workforce dynamics, companies have increasingly adopted video conferencing and collaboration tools to facilitate effective communication among remote teams.According to the U.S. Bureau of Labor Statistics, in 2021, nearly 30% of employees were working remotely or in a hybrid capacity, a 35% increase since 2019.

Major organizations, such as Zoom Video Communications, have reported tremendous growth, with a user base that has expanded exponentially due to remote work practices.This has created a robust demand for video communication solutions, driving the growth of the enterprise video market in the US as companies look to foster collaboration and maintain productivity in a virtual environment.

Growing Demand for Video Content

The increasing consumption of video content across various platforms is another driving force for the US Enterprise Video Market. A report from Cisco projects that by 2023, video will account for over 82% of all internet traffic.As businesses continue to leverage video for marketing, training, and internal communications, companies such as Microsoft and Google have enhanced their video platforms to meet this demand, recognizing the importance of visual engagement.

This trend is supported by the findings of the Pew Research Center, which revealed that 86% of American adults regularly watch online videos, indicating a strong preference for video content over traditional textual formats. The growing reliance on video for communication and marketing will likely propel the expansion of the US Enterprise Video Market.

Advancements in Video Technology

Technological advancements in video streaming quality, artificial intelligence, and cloud services are significantly propelling the growth of the US Enterprise Video Market. The introduction of 5G technology is expected to facilitate faster internet speeds, leading to enhanced video streaming experiences.Industry leaders like Amazon, through their AWS Media Services, are simplifying the backend operations for video content delivery.

A study by the Consumer Technology Association indicated that nearly 30% of all US households have adopted 4K technology, which has raised the bar for quality expectations in video content. As organizations prioritize high-quality content delivery and invest in innovative solutions, this technological evolution will drive the growth of the enterprise video market in the US.

US Enterprise Video Market Segment Insights

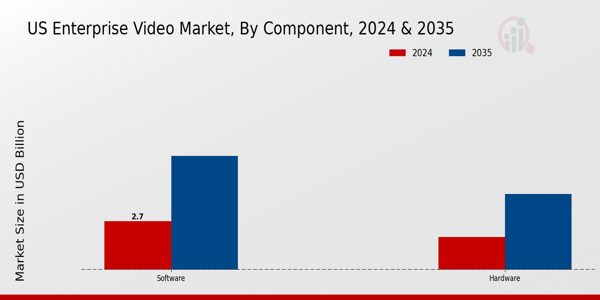

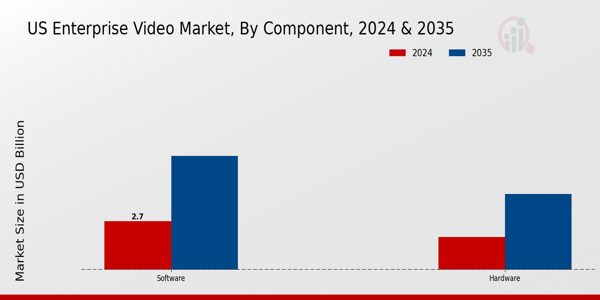

Enterprise Video Market Component Insights

The Component segment of the US Enterprise Video Market encompasses critical elements that contribute significantly to the effectiveness and functionality of enterprise video solutions. This segment can be broadly categorized into two key areas: Hardware and Software, both of which play pivotal roles in shaping the current landscape and future developments within the industry.In recent years, with the expansion of remote work practices and increasing demands for effective communication tools, there has been a notable surge in the adoption of hardware components such as video conferencing systems and cameras.

This trend underscores the growing need for high-quality video transmission and interactive capabilities in business environments. On the software front, applications facilitating video streaming, recording, and editing have become essential for organizations aiming to enhance their internal and external communication strategies.Software solutions that incorporate artificial intelligence for features like transcription and real-time translation are gaining traction, as they allow businesses to foster better collaboration across diverse teams.

When examining the US Enterprise Video Market segmentation, the importance of software cannot be overstated, as it shapes user experiences and facilitates the integration of video solutions within existing corporate infrastructures. In particular, advancements in cloud-based platforms have made it easier for businesses to deploy video solutions at scale while maintaining flexibility and cost-effectiveness.

The innovative features provided by modern software applications contribute to driving user engagement and fostering a collaborative culture among employees. As organizations increasingly leverage video for training, marketing, and customer engagement, both hardware and software components hold a significant share in enhancing operational efficiency and reaching growth objectives.The rise of hybrid work models further illuminates the relevance of this Component segment as enterprises strive to maintain connectivity, drive productivity, and foster seamless communication in a dynamically evolving work landscape.

Moreover, emerging trends in virtual reality and augmented reality are poised to revolutionize the way organizations utilize video technologies, presenting both challenges and opportunities in the US Enterprise Video Market. Companies are continuously seeking robust hardware solutions that can support these advanced technologies while enhancing the overall user experience.

The significance of the Component segment in this context cannot be overlooked, as organizations prioritize investments into integrated hardware and software systems that cater to diverse business needs.The evolution of video solutions in enterprise settings is becoming increasingly reliant on the convergence of these components, effectively setting the stage for sustained market growth amidst evolving consumer preferences and technological advancements.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Enterprise Video Market Application Insights

The Application segment of the US Enterprise Video Market plays a crucial role in driving the adoption of video-based solutions across various industries. As organizations increasingly seek to enhance employee engagement and communication efficiency, training and development has emerged as a prominent focus area within this segment.

This sub-segment is vital as it offers scalable and flexible solutions for remote learning and skills enhancement, addressing the growing workforce demands in the US. Corporate learning, on the other hand, emphasizes knowledge transfer and retention, which are critical in maintaining competitive advantage in the rapidly evolving business landscape.

The ability to deliver interactive and personalized video content not only fosters a culture of continuous learning but also aligns with the trend of digital transformation in workplaces. As more companies invest in video technology, the implications for operational efficiency and employee productivity become more significant, creating abundant opportunities for growth in the US Enterprise Video Market.

Furthermore, challenges such as integrating these solutions with existing IT infrastructures and ensuring high-quality user experiences remain central to strategies in overcoming barriers to adoption within these applications. Overall, the Application segment is poised for notable advancements with ongoing technological innovations and the increasing importance placed on effective training methodologies.

Enterprise Video Market Delivery Mode Insights

The Delivery Mode segment of the US Enterprise Video Market plays a pivotal role in facilitating effective communication and collaboration among organizations. This segment can be primarily categorized into Video Conferencing and Web Conferencing, both of which have shown significant growth in recent years.Video Conferencing has become essential for remote teams and businesses, offering a more personal connection compared to traditional communication methods, thereby enhancing productivity and employee engagement.

On the other hand, Web Conferencing is widely utilized for virtual meetings, webinars, and training sessions, allowing organizations to leverage real-time sharing of information and resources. The ongoing trend toward remote work and the increasing need for seamless digital communication solutions have propelled the demand for these delivery modes, leading to a more connected and efficient workforce.

With advancements in technology and heightened user expectations, these modes are likely to dominate the market landscape, contributing significantly to the overall evolution of the US Enterprise Video Market. Enhanced features, ease of access, and compatibility with various devices are further driving the adoption of these solutions, presenting numerous opportunities for growth in the segment.

Enterprise Video Market Industries Insights

The US Enterprise Video Market, particularly within the Industries segment, showcases significant diversity and growth potential. Sectors like Banking, Financial Services and Insurance (BFSI) utilize video solutions to streamline operations, enhance customer communication, and bolster security protocols through video conferencing.In the Manufacturing industry, enterprises increasingly adopt video tools for training, operational efficiency, and remote monitoring, which leads to improved productivity and reduced downtime.

The Media and Entertainment sector continues to dominate by leveraging video technologies for content creation, streaming services, and viewer engagement, reflecting the growing consumer demand for high-quality visual content. In Healthcare, video has become essential for telemedicine, allowing providers to reach more patients while optimizing care delivery.

The evolving landscape in these sectors indicates a robust appetite for innovative video solutions that drive market growth. Each of these industries contributes uniquely to the overall dynamics of the US Enterprise Video Market, highlighting the importance of tailored video applications that cater to specific operational requirements and user needs.The diverse requirements and applications foster opportunities for growth and expansion across various sectors, making the market a critical focal point for emerging technologies.

US Enterprise Video Market Key Players and Competitive Insights

The US Enterprise Video Market is a dynamic environment marked by rapid evolution as organizations increasingly adopt video communication tools for remote work, training, and collaboration. The competition in this sector is intense, with numerous players vying for market share by offering diverse solutions ranging from video conferencing software to video hosting platforms.

Factors such as technological advancements, changing user preferences, and a growing focus on enhanced user experiences drive competition. The market features an array of capabilities, including high-definition video, ease of integration with existing systems, and robust security features to address the demands of businesses.As enterprises navigate their video communication strategies, understanding the competitive landscape becomes essential for identifying opportunities and threats.

Key Companies in the US Enterprise Video Market Include

- Cisco

- BlueJeans

- Zoom Video Communications

- Slack

- Adobe

- Google

- Microsoft

- RingCentral

- IBM

- Amazon Web Services

US Enterprise Video Market Developments

Zoom Video Communications unveiled a significant update to its AI Companion platform in March 2025, adding intelligent prompt-based collaboration capabilities, multilingual transcription, and real-time meeting summaries to its video package.Targeting business clients looking for greater hybrid work integration, Cisco introduced a next-generation collaboration experience in January 2025 with new Webex AI capabilities, such as real-time audio intelligence, AI-powered conference summaries, and smart whiteboarding.

Through Copilot in Microsoft Teams, which brings AI-powered insights, meeting recap automation, and business-specific action ideas to workplace collaboration, Microsoft extended its enterprise video services in April 2024.In May 2024, Google followed suit by integrating Gemini AI capabilities into Google Meet and Workspace. This enhanced the efficiency of video meetings by offering contextual meeting summaries, smart canvas features, and sophisticated note-taking.

Developers may now immediately incorporate real-time video, screen sharing, and session analytics into bespoke enterprise apps, particularly in regulated sectors like healthcare and finance, thanks to new capabilities added to the Amazon Chime SDK by Amazon Web Services in February 2025.Leading enterprise video players' strategic improvements demonstrate the rising significance of AI, personalization, and safe integration in assisting American companies' digital transformation and hybrid work goals.

Enterprise Video Market Segmentation Insights

Enterprise Video Market Component Outlook

Enterprise Video Market Application Outlook

- Training & Development

- Corporate Learning

Enterprise Video Market Delivery Mode Outlook

- Video Conferencing

- Web Conferencing

Enterprise Video Market Industries Outlook

- BFSI

- Manufacturing

- Media & Entertainment

- Healthcare

| Report Attribute/Metric |

Details |

| Market Size 2023 |

4.11(USD Billion) |

| Market Size 2024 |

4.5(USD Billion) |

| Market Size 2035 |

10.5(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

8.007% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Cisco, BlueJeans, Zoom Video Communications, Slack, Adobe, Google, Microsoft, RingCentral, IBM, Amazon Web Services |

| Segments Covered |

Component, Application, Delivery Mode, Industries |

| Key Market Opportunities |

Remote collaboration tools expansion, AI-driven video analytics integration, Enhanced security features demand, Customizable video solutions growth, Virtual events and webinars surge |

| Key Market Dynamics |

growing remote workforce, demand for engaging content, increased cloud adoption, enhanced collaboration tools, focus on cybersecurity |

| Countries Covered |

US |

Frequently Asked Questions (FAQ):

The US Enterprise Video Market was valued at 4.5 billion USD in 2024.

In 2035, the market is forecasted to reach a value of 10.5 billion USD.

The expected CAGR for the US Enterprise Video Market from 2025 to 2035 is 8.007%.

In 2024, the software component of the market was valued at 2.7 billion USD.

The hardware component is projected to be valued at 4.2 billion USD in 2035.

Major players in the market include Cisco and Zoom Video Communications.

Emerging trends indicate significant opportunities in video collaboration and remote communication technologies.

Technological advancements have driven increased adoption of video solutions, contributing to the market's growth trajectory.

The demand for video software solutions is expected to grow significantly, complementing hardware sales in the market.

Challenges may include intense competition and the need for continuous innovation in video technologies.