Expansion of 5G Networks

The rollout of 5G networks is poised to have a transformative effect on the video encoder market. With significantly higher data transfer speeds and lower latency, 5G technology enables seamless streaming of high-definition and 4K content. As of 2025, it is projected that 5G subscriptions in the US will surpass 100 million, creating a substantial opportunity for the video encoder market. This expansion allows for more sophisticated encoding techniques that can leverage the capabilities of 5G, such as real-time encoding and enhanced interactivity. Consequently, service providers are likely to invest in advanced encoding solutions that can fully utilize the benefits of 5G, thereby improving the overall user experience and driving further growth in the market.

Growth of Mobile Video Consumption

The proliferation of mobile devices has significantly impacted the video encoder market, as more consumers are accessing video content on smartphones and tablets. In 2025, mobile video consumption is anticipated to account for over 70% of total video views in the US. This shift necessitates the development of encoding solutions that are optimized for mobile platforms, ensuring that video quality remains high while minimizing data usage. As a result, companies in the video encoder market are focusing on creating adaptive bitrate streaming technologies that can adjust video quality based on the user's network conditions. This trend not only enhances user satisfaction but also drives the demand for more sophisticated encoding solutions tailored for mobile environments.

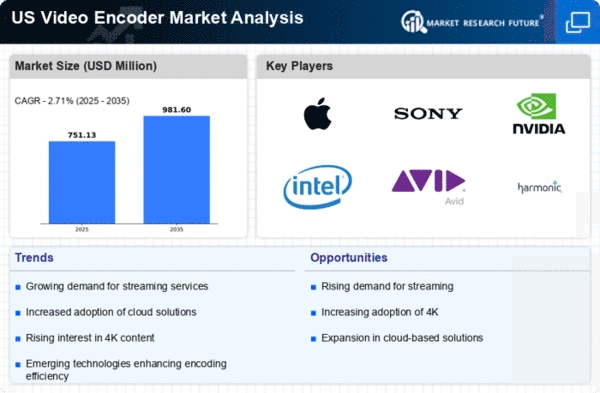

Rising Demand for Streaming Services

The video encoder market is experiencing a notable surge in demand due to the increasing popularity of streaming services in the US. As consumers gravitate towards platforms like Netflix, Hulu, and Amazon Prime, the need for efficient video encoding solutions becomes paramount. In 2025, the streaming industry is projected to generate revenues exceeding $30 billion, which directly influences the video encoder market. This growth necessitates advanced encoding technologies that can handle high-definition content while ensuring minimal latency. Consequently, companies are investing in innovative encoding solutions to meet the evolving needs of content providers and consumers alike. The video encoder market is thus positioned to benefit significantly from this trend, as service providers seek to enhance user experience through superior video quality and reliability.

Increased Focus on Security and Privacy

As the video encoder market continues to expand, there is a growing emphasis on security and privacy concerns associated with video content. With the rise of digital piracy and unauthorized access to streaming services, content providers are increasingly seeking robust encoding solutions that incorporate encryption and watermarking technologies. In 2025, it is estimated that around 30% of video content will be protected by advanced security measures, reflecting the industry's commitment to safeguarding intellectual property. This trend is likely to drive innovation within the video encoder market, as companies strive to develop secure encoding methods that not only protect content but also comply with regulatory standards. The focus on security is expected to become a key differentiator among service providers in the competitive landscape.

Technological Advancements in Encoding Techniques

Technological advancements are playing a crucial role in shaping the video encoder market. Innovations such as HEVC (High Efficiency Video Coding) and AV1 (AOMedia Video 1) are revolutionizing the way video content is compressed and transmitted. These advanced encoding techniques allow for higher quality video at lower bitrates, which is essential for streaming applications. As of 2025, the adoption of HEVC is expected to reach approximately 40% among streaming platforms, indicating a strong shift towards more efficient encoding methods. This evolution in technology not only enhances the viewing experience but also reduces bandwidth costs for service providers. The video encoder market is thus likely to see increased investment in research and development to further refine these technologies and maintain competitive advantages.