Focus on Cost Efficiency

Cost efficiency remains a primary concern for businesses, driving the adoption of ERP software solutions. Organizations are increasingly looking for ways to optimize their operations and reduce overhead costs. ERP systems can provide comprehensive insights into financial performance, enabling companies to identify areas for cost reduction. The ERP software market is responding to this demand by offering solutions that not only streamline processes but also enhance financial visibility. As businesses strive to improve their bottom line, the emphasis on cost-effective ERP solutions is likely to continue, fostering growth in the market.

Growing Demand for Automation

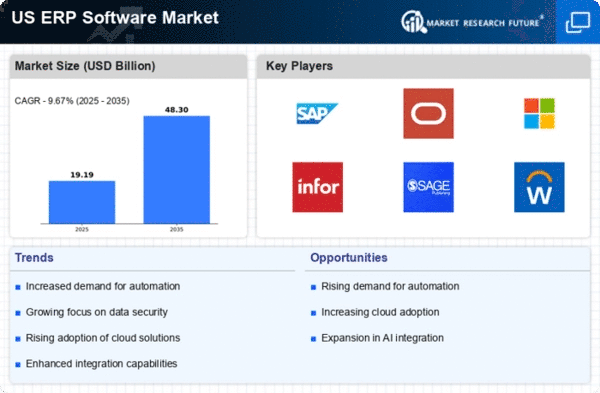

The increasing demand for automation in business processes is a key driver in the ERP software market. Organizations are seeking to streamline operations, reduce manual errors, and enhance productivity. Automation can lead to significant cost savings, with studies indicating that companies can save up to 30% in operational costs by implementing ERP solutions. This trend is particularly evident in manufacturing and retail sectors, where efficiency is paramount. As businesses recognize the potential of ERP systems to automate tasks such as inventory management and order processing, the adoption rate continues to rise. The ERP software market is thus experiencing a surge in demand as companies strive to remain competitive in a rapidly evolving landscape.

Regulatory Compliance Requirements

Regulatory compliance is becoming increasingly stringent across various industries, driving the demand for ERP software solutions. Organizations must adhere to numerous regulations, including financial reporting standards and data protection laws. ERP systems provide the necessary tools to ensure compliance by automating reporting processes and maintaining accurate records. The ERP software market is responding to this need, with many vendors enhancing their offerings to include compliance features. As businesses face potential penalties for non-compliance, the adoption of ERP solutions that facilitate adherence to regulations is likely to increase, further propelling market growth.

Shift Towards Remote Work Solutions

The shift towards remote work is reshaping the landscape of the ERP software market. As organizations adapt to flexible work arrangements, there is a growing need for cloud-based ERP solutions that support remote access and collaboration. This trend is particularly pronounced in sectors such as technology and services, where teams are often distributed across various locations. The ERP software market is witnessing a surge in demand for solutions that enable seamless communication and project management among remote teams. This shift is expected to drive innovation in ERP offerings, with a focus on enhancing user experience and accessibility.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is transforming the ERP software market. These technologies enable organizations to gain deeper insights from their data, optimize decision-making processes, and enhance customer experiences. For instance, AI-driven analytics can predict trends and customer behavior, allowing businesses to tailor their strategies accordingly. The ERP software market is witnessing a shift towards solutions that incorporate these technologies, with a projected growth rate of 15% annually in the next five years. This integration not only improves operational efficiency but also positions companies to leverage data for strategic advantages.