Demand for Customizable Solutions

The enterprise software market is witnessing a growing demand for customizable solutions that cater to specific business needs. Organizations are increasingly seeking software that can be tailored to their unique processes and workflows. In 2025, it is estimated that 50% of enterprises in the US will prioritize customization in their software selection. This trend reflects a shift away from one-size-fits-all solutions, as businesses recognize the importance of aligning software with their operational requirements. Customizable software not only enhances efficiency but also improves user satisfaction, as employees can work with tools that fit their preferences. Consequently, the enterprise software market is likely to expand, with vendors focusing on providing flexible and adaptable solutions.

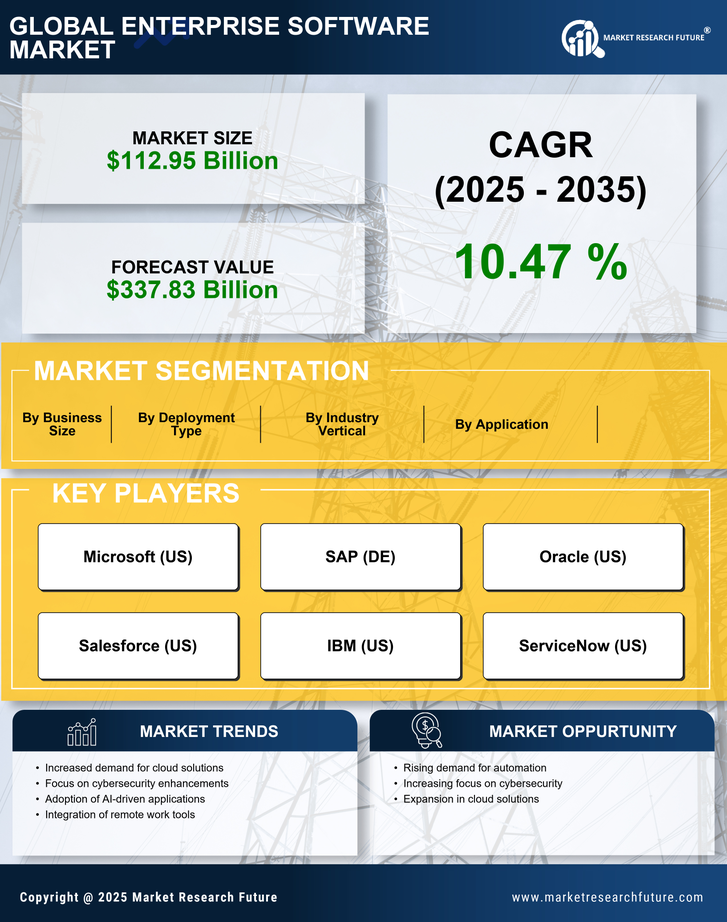

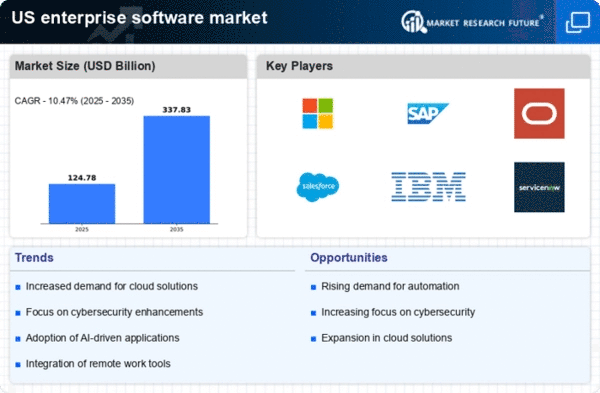

Growing Emphasis on Data Analytics

Data analytics emerges as a critical driver in the enterprise software market, as organizations strive to leverage data for informed decision-making. In 2025, the market for data analytics software is projected to reach $30 billion in the US, reflecting a growing recognition of its value. Companies are increasingly adopting analytics tools to gain insights into customer behavior, operational efficiency, and market trends. This trend is likely to enhance the competitive edge of businesses, as they utilize data-driven strategies to optimize performance. The enterprise software market is thus positioned to expand, with vendors offering advanced analytics solutions that cater to diverse industry needs. As organizations prioritize data literacy, the demand for software that simplifies data interpretation and visualization is expected to rise.

Rise of Subscription-Based Pricing Models

The enterprise software market is experiencing a transformation in pricing strategies, with a notable shift towards subscription-based models. This approach offers organizations flexibility and scalability, allowing them to pay for software based on usage rather than upfront costs. In 2025, it is projected that subscription-based software will account for over 60% of the enterprise software market in the US. This trend is appealing to businesses seeking to manage budgets effectively while accessing the latest features and updates. Additionally, subscription models often include customer support and training, enhancing user experience. As companies increasingly favor this model, the enterprise software market is likely to adapt, with vendors offering tailored subscription plans to meet diverse customer needs.

Increased Demand for Remote Work Solutions

The enterprise software market experiences a notable surge in demand for remote work solutions. As organizations adapt to flexible work environments, the need for software that facilitates collaboration and communication becomes paramount. In 2025, it is estimated that approximately 70% of enterprises in the US will implement remote work solutions, driving growth in the enterprise software market. This shift necessitates tools that support virtual meetings, project management, and document sharing, thereby enhancing productivity. Companies are increasingly investing in cloud-based platforms that allow seamless access to resources from any location. The enterprise software market is likely to benefit from this trend. Businesses seek to optimize their operations and maintain employee engagement in a remote setting.

Integration of Advanced Cybersecurity Features

The enterprise software market is experiencing increased focus on cybersecurity due to the rising frequency of cyber threats. In 2025, it is anticipated that cybersecurity spending in the US will exceed $200 billion, prompting software vendors to integrate advanced security features into their offerings. Organizations are prioritizing solutions that not only protect sensitive data but also ensure compliance with regulatory standards. This trend indicates a shift towards software that incorporates real-time threat detection, encryption, and user authentication. As businesses recognize the importance of safeguarding their digital assets, the enterprise software market is likely to evolve, with a growing emphasis on security as a core component of software development.