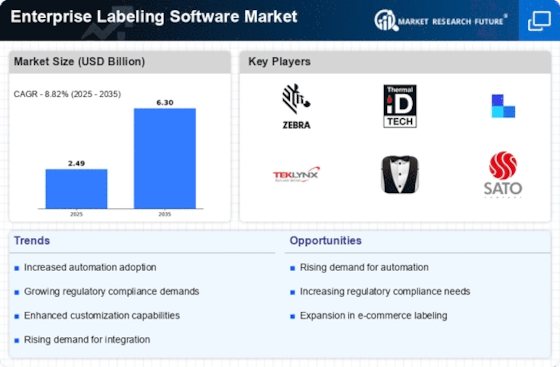

Rising Demand for Automation

The increasing demand for automation in various industries is a primary driver for the Enterprise Labeling Software Market. Organizations are seeking to streamline their operations and reduce manual errors, which can be costly. Automation in labeling processes not only enhances efficiency but also ensures consistency and accuracy in product labeling. According to recent data, the automation market is projected to grow significantly, with a compound annual growth rate of over 9%. This trend indicates that businesses are investing in technologies that facilitate automated labeling solutions, thereby propelling the growth of the Enterprise Labeling Software Market. As companies strive to improve productivity and reduce operational costs, the adoption of automated labeling solutions is likely to become more prevalent.

Regulatory Compliance and Standards

The stringent regulatory environment surrounding product labeling is a crucial driver for the Enterprise Labeling Software Market. Companies are increasingly required to adhere to various labeling standards and regulations, which can vary by region and product type. This complexity necessitates the use of sophisticated labeling software that can ensure compliance and reduce the risk of penalties. The market for labeling solutions is projected to grow as businesses invest in technologies that facilitate compliance with evolving regulations. Data indicates that the compliance software market is expected to witness a growth rate of around 7%, reflecting the increasing importance of regulatory adherence. As organizations prioritize compliance, the demand for Enterprise Labeling Software Market that simplifies the labeling process while ensuring regulatory conformity is likely to rise.

Customization and Personalization Trends

The growing trend towards customization and personalization in products is driving the Enterprise Labeling Software Market. Consumers are increasingly seeking tailored products that meet their specific preferences, which necessitates flexible labeling solutions. Companies are adopting labeling software that allows for easy customization of labels to reflect individual customer needs. This trend is supported by market data indicating that personalized products can lead to higher customer satisfaction and loyalty. As businesses strive to differentiate themselves in a competitive landscape, the demand for labeling solutions that enable customization is expected to increase. The Enterprise Labeling Software Market is likely to benefit from this trend, as companies invest in technologies that facilitate personalized labeling options, thereby enhancing their market appeal.

Expansion of E-commerce and Online Retail

The rapid expansion of e-commerce and online retail is significantly influencing the Enterprise Labeling Software Market. As more businesses transition to online platforms, the need for efficient labeling solutions becomes paramount. E-commerce companies require accurate and compliant labels for a diverse range of products, which necessitates the adoption of advanced labeling software. Recent statistics suggest that e-commerce sales are expected to reach trillions of dollars, indicating a robust market for labeling solutions tailored to online retail. This growth presents opportunities for software providers to develop innovative labeling solutions that cater to the unique needs of e-commerce businesses. Consequently, the expansion of online retail is likely to drive the demand for Enterprise Labeling Software Market, as companies seek to enhance their operational efficiency and customer satisfaction.

Increased Focus on Supply Chain Transparency

The heightened emphasis on supply chain transparency is driving the Enterprise Labeling Software Market. Consumers and regulatory bodies are demanding more information about product origins, ingredients, and manufacturing processes. This trend compels companies to adopt labeling solutions that provide clear and accurate information. The market for labeling software is expected to expand as businesses seek to comply with these transparency requirements. In fact, a recent report indicates that the demand for labeling solutions that enhance traceability and compliance is on the rise, with a projected growth rate of approximately 8% over the next few years. This focus on transparency not only meets consumer expectations but also mitigates risks associated with non-compliance, further fueling the growth of the Enterprise Labeling Software Market.

.png)