Rising Healthcare Expenditure

The erythropoietin drug market is likely to benefit from the increasing healthcare expenditure in the US. With healthcare spending projected to reach approximately $6 trillion by 2027, there is a growing focus on improving patient outcomes and investing in effective treatments. This trend is particularly relevant for conditions like anemia, where erythropoietin drugs play a vital role. As healthcare providers allocate more resources towards innovative therapies, the demand for erythropoietin is expected to rise. Additionally, the emphasis on value-based care may encourage the adoption of erythropoietin therapies, as they can lead to better health outcomes and reduced hospitalizations. Consequently, the erythropoietin drug market stands to gain from this upward trajectory in healthcare investment.

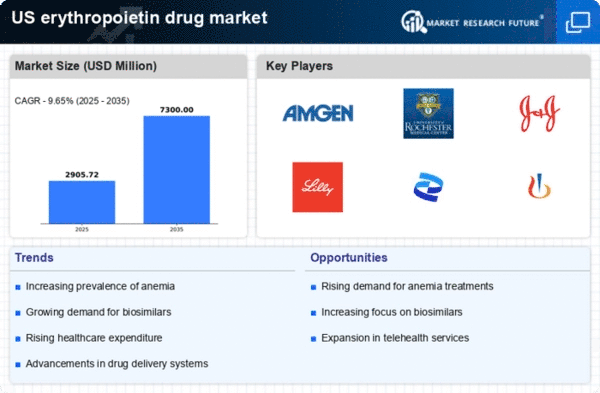

Increasing Prevalence of Anemia

The erythropoietin drug market is experiencing growth due to the rising prevalence of anemia, particularly in patients with chronic diseases. Anemia affects millions in the US, with estimates suggesting that around 3 million individuals are diagnosed annually. This condition is often linked to chronic kidney disease, cancer, and other health issues, necessitating effective treatment options. Erythropoietin, a hormone that stimulates red blood cell production, is crucial for managing anemia in these patients. As healthcare providers increasingly recognize the importance of addressing anemia, the demand for erythropoietin drugs is likely to rise, thereby driving market expansion. Furthermore, the increasing awareness among patients and healthcare professionals about the implications of untreated anemia may further bolster the erythropoietin drug market, as timely intervention becomes a priority.

Growing Awareness of Chronic Conditions

The erythropoietin drug market is poised for growth due to the increasing awareness of chronic conditions that lead to anemia. As healthcare education improves, patients and providers are becoming more cognizant of the link between chronic diseases and anemia, particularly in conditions such as chronic kidney disease and cancer. This heightened awareness is likely to drive demand for erythropoietin therapies, as patients seek effective management options. Additionally, public health campaigns aimed at educating the population about the symptoms and risks associated with anemia may further stimulate interest in erythropoietin treatments. Consequently, the erythropoietin drug market could see a significant uptick in demand as more individuals seek diagnosis and treatment.

Technological Advancements in Drug Delivery

Technological innovations in drug delivery systems are significantly impacting the erythropoietin drug market. Recent advancements, such as sustained-release formulations and targeted delivery mechanisms, enhance the efficacy and safety of erythropoietin therapies. These innovations not only improve patient compliance but also optimize therapeutic outcomes, which is particularly important for chronic conditions requiring long-term management. The market is witnessing a shift towards more sophisticated delivery methods, which could potentially increase the market size. For instance, the introduction of needle-free delivery systems may appeal to patients who are averse to injections, thereby expanding the user base. As these technologies continue to evolve, they are expected to play a pivotal role in shaping the future landscape of the erythropoietin drug market.

Regulatory Support for Erythropoietin Therapies

Regulatory bodies in the US are increasingly supportive of erythropoietin therapies, which is likely to foster growth in the erythropoietin drug market. The Food and Drug Administration (FDA) has streamlined the approval process for biosimilars, making it easier for new entrants to offer competitive products. This regulatory environment encourages innovation and competition, which can lead to more affordable options for patients. Furthermore, the FDA's focus on ensuring the safety and efficacy of erythropoietin drugs enhances public trust in these therapies. As more biosimilars enter the market, the overall accessibility of erythropoietin treatments may improve, potentially expanding the patient population and driving market growth.